XRPL Foundation Board Director Explains Why XRP Price Is Down Despite ETF Launch

The XRP community continues to discuss why XRP’s price failed to rally following the launch of the highly anticipated Canary Capital XRP ETF (XRPC).

While the fund posted one of the strongest ETF debuts of 2025, pulling in $245 million on day one, XRP’s price continued drifting lower.

Now, Fabio Marzella, Founding and Board Director of the XRPL Foundation, has stepped in to explain what’s really happening beneath the surface.

“ETF Trading Happens on the Stock Market, Not Crypto Exchanges”

In a post on X, Marzella noted that many people expected the price to shoot up as soon as XRPC began trading. But the structure of ETF settlement explains why that didn’t happen.

According to him, ETF trades occur on the stock market, not on crypto exchanges, where spot XRP is bought and sold.

Due to the T+1 settlement system, when someone buys an XRP ETF share, the issuer does not receive the cash immediately. The money settles the next business day, and only then can the provider begin purchasing the actual XRP needed to back the fund.

This delay means early inflows don’t immediately translate into spot market demand. Essentially, Marzella stressed that an ETF does not pump the price on day one. The real impact comes later, sometimes quietly at first, then all at once.

Strong ETF Debut, Weak Price Reaction

After XRPC’s debut , the ETF recorded $26 million in trading volume in its first 30 minutes and $58.5 million by market close. Additionally, it logged $245 million in net inflows on the first day.

These numbers made XRPC the top ETF debut of the year, surpassing even the Bitwise Solana ETF. It also placed the XRP fund among the best-performing ETF launches out of more than 900 issued in 2025.

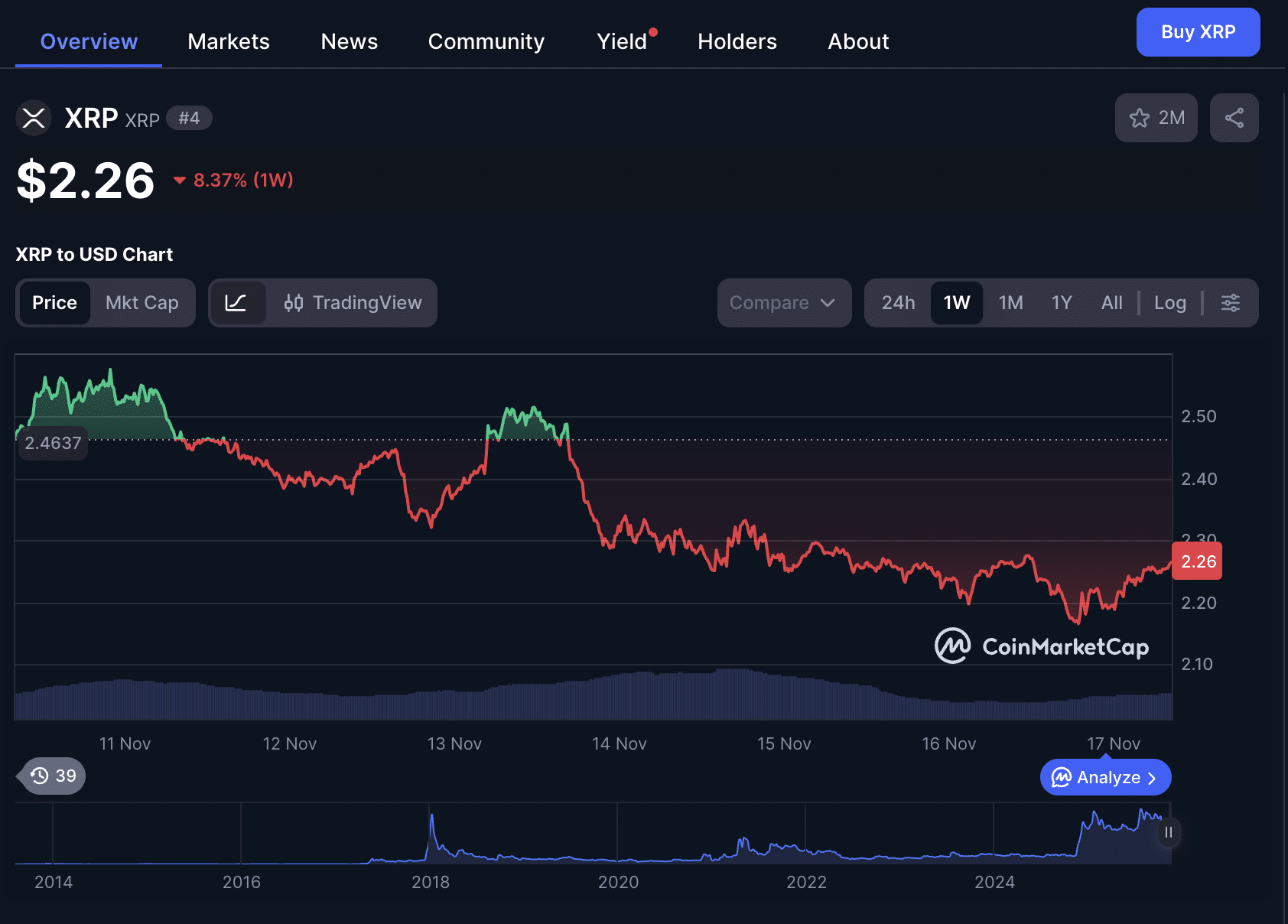

Yet despite this momentum, XRP fell from $2.52 to around $2.28. Since the ETF launch, XRP’s price has dropped to $2.16 before slightly recovering to $2.25 at press time. At this price, the coin is down 8.63% over the past week.

XRP chart CoinMarketCap

XRP chart CoinMarketCap

Bearish Market Dampened the Effect

Marzella also highlighted a second factor behind XRP’s decline: the entire crypto market is bearish.

Bitcoin lost the $100,000 support last Friday and has since fallen to $92,900. This bearish Bitcoin performance dragged the rest of the market down with it. In other words, as major altcoins corrected, XRP followed the trend.

Nick from The Web Alert pointed out that inflows worth tens or even hundreds of millions are still too small to overpower market selling pressure—especially considering XRP’s large supply. Any selling by major holders can offset upward pressure.

OTC Purchases May Hide the Real Buying Activity

Another reason the price impact hasn’t appeared yet is the way ETFs acquire their underlying assets. Even after settlement, issuers rarely buy directly from public exchanges. Large funds like Canary Capital often source assets from over-the-counter liquidity providers, meaning the purchases are not visible on spot price charts.

Marzella ended his explanation with a message of patience. ETF-driven price effects typically lag behind launch-day hype, as seen with Bitcoin’s own ETF debut in January 2024, which initially showed little price reaction before kicking off a major rally weeks later.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Cboe's Perpetual Futures Narrow the Gap Between Offshore and U.S. Crypto Markets

- Cboe will launch U.S.-regulated Bitcoin/Ether perpetual futures on Dec 15, 2025, offering 10-year contracts with daily cash adjustments. - The cash-settled products, cleared via Cboe Clear U.S., bridge offshore flexibility with domestic oversight, addressing institutional demand for long-term crypto exposure. - Trading 23/5 with cross-margining capabilities and educational sessions, the move aligns with growing ETF interest and Cboe's innovation strategy within U.S. regulatory frameworks.

Crypto Slide Driven by Leverage, Bottom May Be Near

DOGE drops 15.12% over the past month as Trump’s tariff pledges remain unmet

- DOGE fell 15.12% in 1 month amid unfulfilled Trump tariff dividend promises and political uncertainty. - Trump's Truth Social AI chatbot acknowledged no tangible economic benefits from his DOGE-linked policies. - Treasury Secretary Bessent highlighted legislative hurdles for $2,000/person tariff payments, facing legal skepticism. - Technical indicators show DOGE remains bearish, lacking catalysts for market optimism despite sector trends.

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut