3 Altcoins Facing Major Liquidation Risk in the Third Week of November

ETH, SOL, and ZEC are entering the third week of November with elevated liquidation risk as leveraged positions pile up. Key levels now threaten sharp volatility across all three assets.

The market has moved past the halfway point of November, and the total altcoin market cap has fallen below $1 trillion. The ability of altcoins to rebound while sentiment hits rock bottom may trigger volatility and large-scale liquidations in several assets.

Which altcoins face this risk, and what special factors deserve close attention? Details follow below.

1. Ethereum (ETH)

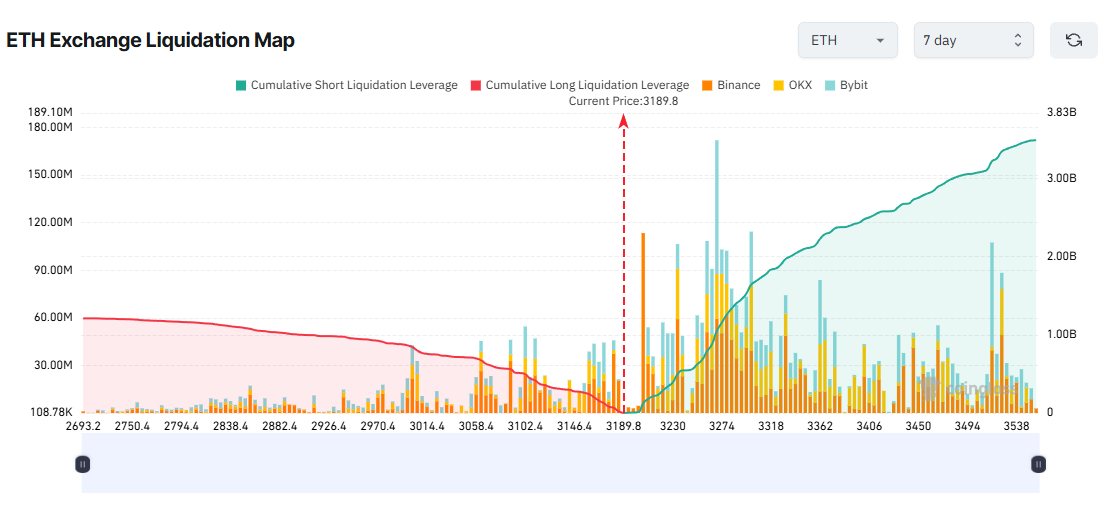

Ethereum’s liquidation map shows a clear imbalance between potential liquidation volumes on the Long and Short sides.

Traders are allocating more capital and leverage to Short positions. As a result, they would suffer heavier losses if ETH rebounds this week.

ETH Exchange Liquidation Map. Source:

Coinglass

ETH Exchange Liquidation Map. Source:

Coinglass

If ETH rises above $3,500, more than $3 billion worth of Short positions could be liquidated. In contrast, if ETH drops below $2,700, Long liquidations would total only about $1.2 billion.

Short sellers have reasons to maintain their positions. ETH ETFs recorded $728.3 million in outflows last week. Additionally, crypto billionaire Arthur Hayes has recently sold ETH.

However, on the technical side, ETH remains at a major support zone around $3,100. This level has the potential to trigger a strong recovery.

$ETH: BUY signal just flashedEthereum just hit max fear levels.Historically, we bounced EVERY SINGLE TIME from here.I buy fear now – I sell greed in early 2026. pic.twitter.com/ewXc3GEXaD

— Wimar.X (@DefiWimar) November 16, 2025

The sentiment indicator for ETH has also fallen into extreme fear. Historically, ETH has often rebounded sharply from similar conditions.

Because of this, an ETH recovery has a solid basis and could trigger significant losses for Short traders.

2. Solana (SOL)

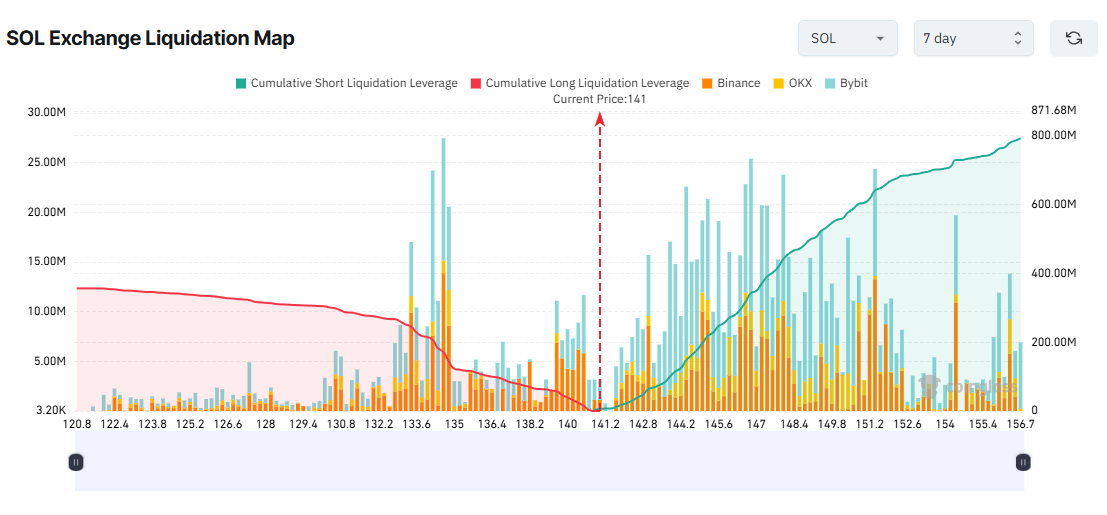

Similar to ETH, Solana’s liquidation map also shows a strong imbalance, with Short liquidation volume dominating.

SOL’s drop below $150 in November has led many short-term traders to expect a further decline toward $100. Not only retail traders, but whales have also shown short-selling behavior this month.

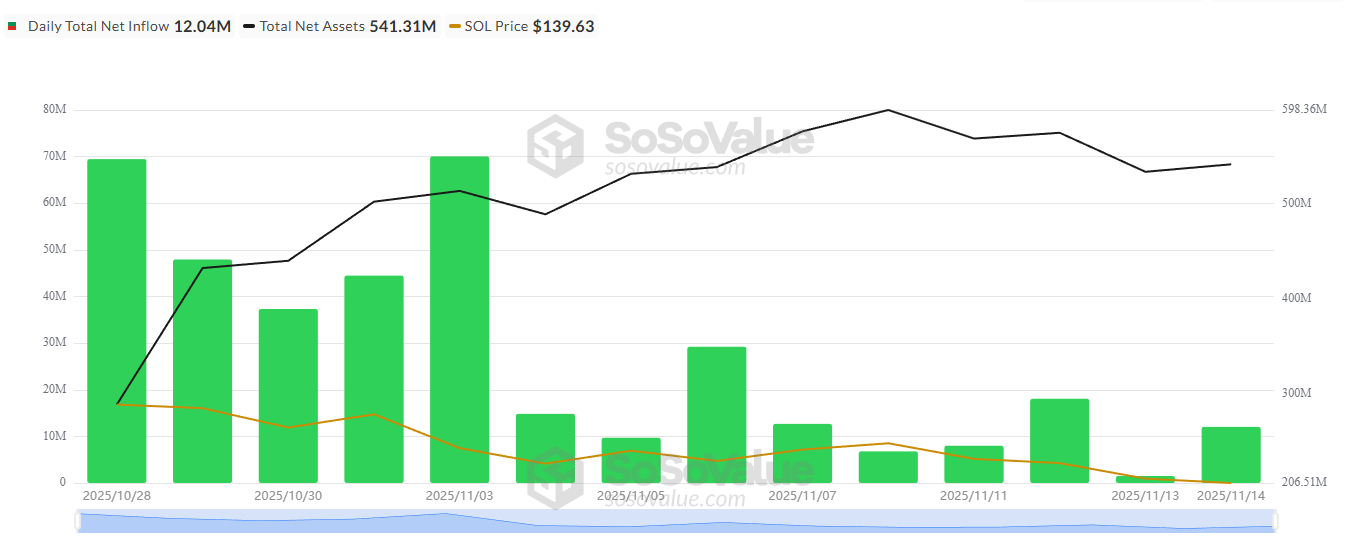

However, SOL ETF data paints a more positive picture. According to SoSoValue, U.S. SOL ETFs recorded a net inflow of more than $12 million on November 14 and over $46 million for the past week. Meanwhile, both BTC ETFs and ETH ETFs saw negative net flows.

SOL ETF Daily Total Net Inflow. Source:

SoSoValue

SOL ETF Daily Total Net Inflow. Source:

SoSoValue

This gives SOL a reason to rebound, as investors still see strong ETF demand. The liquidation map shows that if SOL climbs to $156, Short liquidations may reach nearly $800 million.

SOL Exchange Liquidation Map. Source:

Coinglass

SOL Exchange Liquidation Map. Source:

Coinglass

Conversely, if SOL falls to $120 this week, Long liquidations could reach around $350 million.

3. Zcash (ZEC)

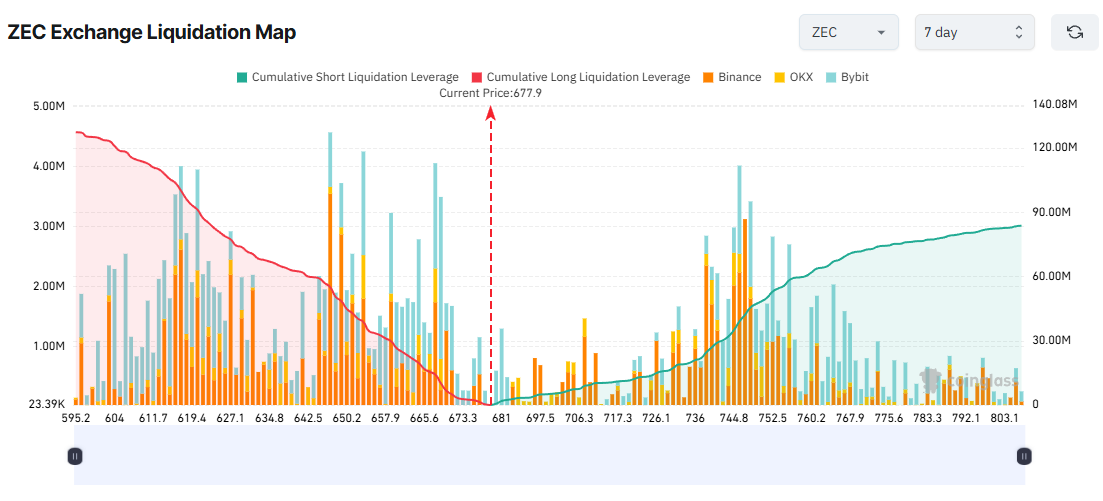

In contrast to ETH and SOL, ZEC’s liquidation map shows that Long traders face the bulk of potential liquidation risk.

Short-term traders appear confident that ZEC will continue forming higher highs in November. They have reasons for this outlook. ZEC locked in the Zcash Shielded Pool has increased sharply this month, and several experts still expect ZEC to reach as high as $10,000 potentially.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

However, ZEC has faced repeated rejections near the $700 level. Many analysts, therefore, worry about a correction this week.

If a correction occurs and ZEC drops below $600, Long liquidations could exceed $123 million.

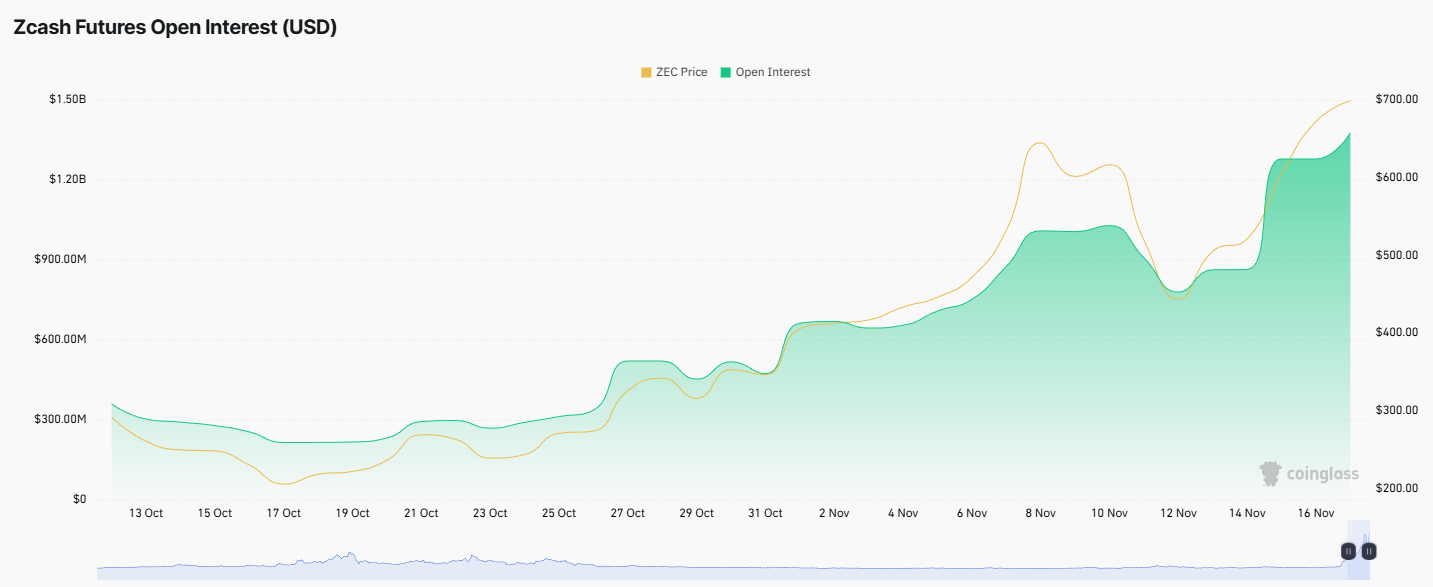

Moreover, Coinglass data shows that ZEC’s total open interest reached an all-time high of $1.38 billion in November. This reflects a high level of leveraged exposure, which increases the risk of volatile moves and large-scale liquidations.

ZCash Futures Open Interest. Source:

Coinglass

ZCash Futures Open Interest. Source:

Coinglass

Because of this, holding Long positions in ZEC could offer short-term gains. But without clear take-profit or stop-loss plans, these positions could quickly face liquidation pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Adversaries Reportedly Received Voting Rights in Crypto Company Supported by Trump

- U.S. Senators Warren and Reed demand federal investigation into Trump-linked crypto firm WLF over alleged sales to sanctioned entities including North Korea, Russia, and Iran. - WLF denies claims, asserting "rigorous AML/KYC checks," but faces scrutiny for granting adversaries voting rights over its governance and Trump family's $3B stake in tokens. - Critics highlight conflicts of interest as Trump family members lead WLF while prioritizing token sales over compliance, alongside expansion plans involvin

XRP News Today: XRP Price Showdown: Downward Pressure Faces Off Against Institutional Confidence

- XRP faces a 25% price drop to $1.55 as technical breakdowns and weak sentiment indicators signal bearish momentum. - Analysts highlight conflicting forecasts: short-term bearish patterns vs. long-term institutional optimism driven by Ripple's regulatory progress and ODL adoption. - Derivatives market weakness (futures open interest down 62%) contrasts with strategic gains like SEC lawsuit resolution and cross-border payment utility expansion. - Key battlegrounds at $2.00 and $1.50 will determine whether

DOJ Intensifies Actions Against Crypto Tools Emphasizing Privacy

- William Hill and Keonne Rodriguez received 4-5 year prison sentences for operating Samourai Wallet, a Bitcoin mixer that processed $237M in criminal proceeds. - The case reflects intensified U.S. efforts to prosecute privacy-focused crypto tools, with prosecutors labeling mixing technology as "money laundering for Bitcoin." - Developers actively marketed the service to criminal users on darknet forums, acknowledging its core purpose was obscuring illegal transaction trails. - The conviction sparks debate

Bitcoin News Update: New Hampshire Introduces Bitcoin-Backed Bond in a Bid to Pioneer Digital Finance

- New Hampshire becomes first U.S. state to approve $100M Bitcoin-backed municipal bond, enabling private borrowing against over-collateralized crypto. - Bond structure includes 160% Bitcoin collateral and liquidation triggers if crypto drops below 130% of bond value, ensuring investor protection amid price volatility. - Proceeds fund state's Bitcoin Economic Development Fund, with Governor Kelly Ayotte calling it a "historic" step to position New Hampshire as digital finance leader. - Initiative bridges t