XRP Price Is One Step From a Breakdown — Or a Cycle Bottom?

The XRP price sits on one level that decides everything. Momentum has weakened, but a major support band and a fresh yearly low in NUPL suggest a bottom may be forming. If buyers defend $2.154, XRP can attempt a rebound. If not, the chart opens to $2.065 and deeper levels.

The XRP price is down almost 9% this week, showing clear weakness after failing to hold its recent rebound. Sellers remain in control for now, but one support level continues to hold.

Whether this level survives decides if XRP forms a cycle bottom or slides into a deeper correction.

Weakness Shows Up In Momentum, But Support Still Holds

The first sign of pressure comes from momentum. Between October 13 and November 10, the XRP price made a lower high while the Relative Strength Index (RSI) made a higher high. RSI tracks buying pressure, and this pattern is called a hidden bearish divergence. It shows buying strength was rising, but not enough to push the price up.

That explains the week’s decline.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Flashes Bearish Divergence:

TradingView

XRP Flashes Bearish Divergence:

TradingView

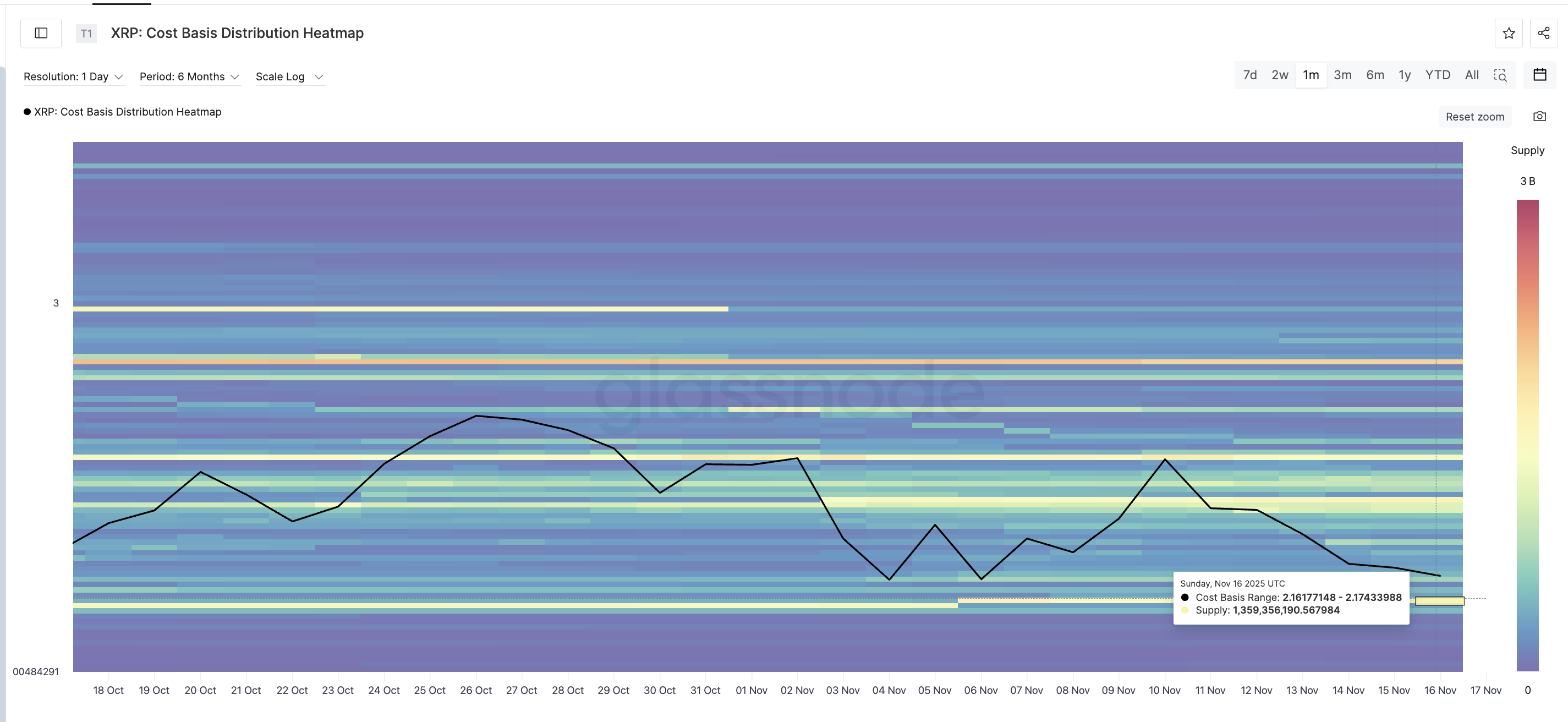

Even with that weakness, the $2.154 zone still holds. This is not just a chart level. The cost-basis heatmap confirms it. Between $2.161 and $2.174, XRP has a huge supply cluster of 1.359 billion tokens.

That makes this band the strongest support in the near term. The $2.154 level on the chart sits immediately under this cluster and could be the only thing standing between a bounce and a breakdown.

Support Cluster Could Limit Downside:

Glassnode

Support Cluster Could Limit Downside:

Glassnode

If this band holds, the divergence can be considered “played out,” opening the door for a recovery attempt.

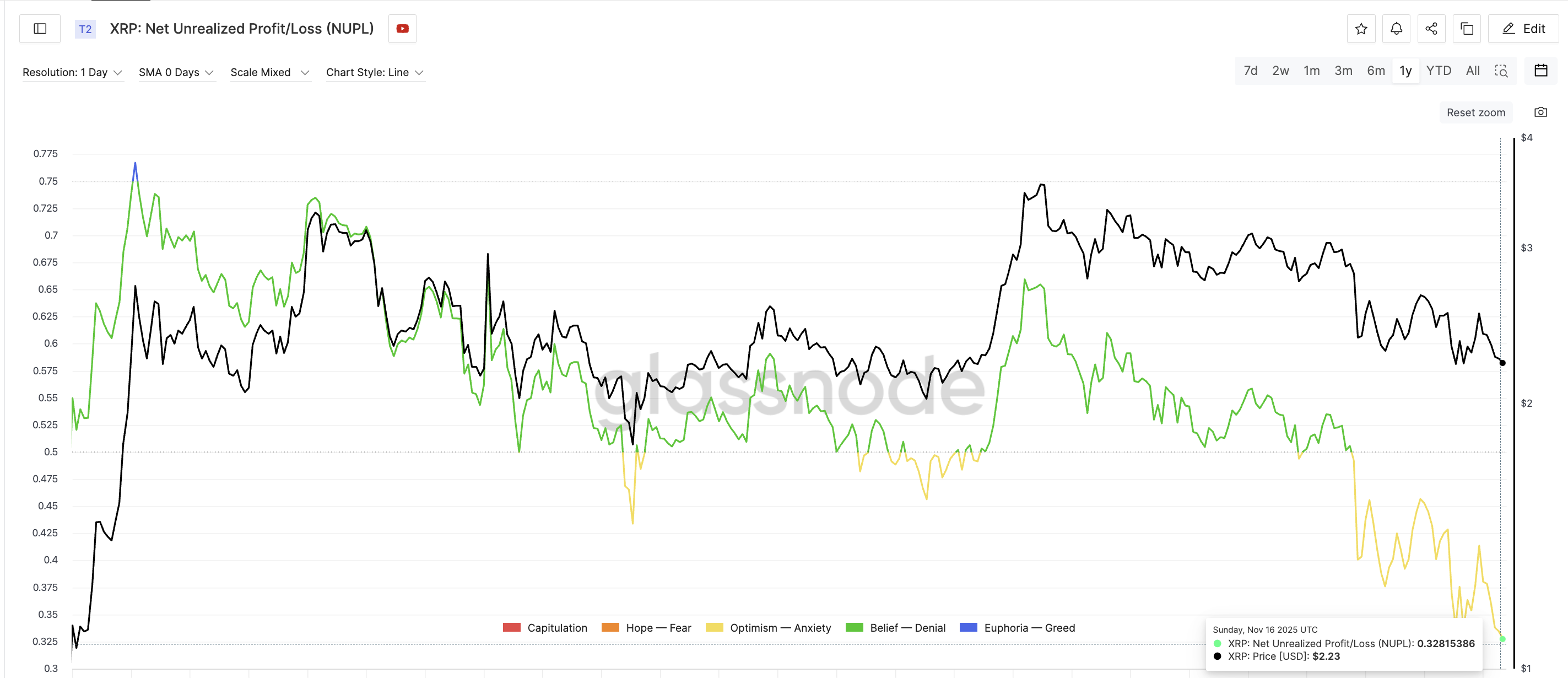

Sentiment Shows A Bottom May Be Forming

The second signal is psychological. XRP’s Net Unrealized Profit and Loss (NUPL) fell to 0.32 on November 16, its lowest reading in a year. NUPL measures investor sentiment—whether wallets hold paper profit or loss.

The last time NUPL hit a yearly low (0.43 on April 8), the XRP price rallied from $1.80 to $3.54 by July 22. That was a 96% rise.

XRP Flashes A Bottoming Signal:

Glassnode

XRP Flashes A Bottoming Signal:

Glassnode

This time, the NUPL is even lower, which means sentiment has reset more deeply. If the $2.154 support holds, the same type of bottoming behavior could form here, too.

XRP Price Levels To Watch Next

If the XRP price loses $2.154, the support zone breaks. In that case, there is little strong demand until $2.065, and falling under $2.06 opens a path toward even lower levels.

If buyers defend support instead, the first upside test sits at $2.394, a level with several prior rejections. A move above $2.394 starts a real rebound attempt.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If momentum improves further, XRP can push toward $2.696, and breaking that level brings a much stronger recovery into view.

For now, everything comes down to one question: Can the $2.154 support band survive long enough for sentiment to flip? If yes, the XRP price may be forming the same kind of bottom that drove its last major rally.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Retail vs. whales: Who actually drives the Santa rally?

Ethereum News Update: Crypto Market Divides: Stability or Speculation Amid BlockDAG’s Rapid Growth

- Dogecoin (DOGE) maintained top-ten crypto status in early November 2025 amid market volatility, contrasting with Chainlink's (LINK) uncertain whale activity ahead of delayed U.S. CPI data. - BlockDAG (BDAG) raised $435M in its presale using hybrid Proof-of-Work/DAG architecture, with analysts projecting $0.3–$0.4 launch price and potential 3,000% returns. - Chainlink's price divergence from RSI and whale accumulation of 150,000 LINK ($2.36M) signaled possible trend reversal above $18.76 or bearish confir

Crypto Presale Comparison November 2025: Hyper, BlockDAG, Remittix, Little Pepe, and Layer Brett

Revolut and Polygon Connect Conventional and Digital Finance with $690 Million Stablecoin Initiative

- Revolut partners with Polygon to enable stablecoin payments, processing $690M in transactions via blockchain infrastructure. - 65 million users across 38 countries can now send/receive USDC/USDT with low fees and instant settlements through the integration. - The collaboration supports crypto trading, staking (up to 4% APY), and fiat-to-crypto on-ramps, aligning with Polygon's global payments strategy. - Revolut's MiCA license in Cyprus and Polygon's $3.6B stablecoin network highlight regulatory progress