Bitcoin Falls Harder Than Tech as Nasdaq Link Tightens and Skew Turns Negative

Bitcoin’s correlation with the Nasdaq has surged while its relationship with gold has nearly vanished, pushing the asset deeper into tech-stock territory. Analysts warn that thin liquidity and bearish skew now define its market behavior.

Bitcoin’s 30-day correlation with the Nasdaq 100 Index has surged to its highest level in 3 years. Meanwhile, its link to traditional safe-haven assets, such as gold, has dropped to nearly zero.

This significant shift raises questions about Bitcoin’s digital gold narrative as it now acts more like a high-beta technology asset than a stable store of value.

Bitcoin Mirrors Tech Stock Volatility as Market Dynamics Shift

In a recent post on X (formerly Twitter), The Kobeissi Letter highlighted that the cryptocurrency’s 30-day correlation with the Nasdaq 100 Index has reached roughly 0.80. This was the highest reading since 2022 and the second-strongest level in the past decade.

Bitcoin’s correlation with equities turned positive in 2020. Over the last five years, the largest cryptocurrency has generally moved in the same direction as the tech-heavy index. It only broke that pattern for short stretches in 2023.

This long-running trend has now pushed Bitcoin’s five-year correlation with the Nasdaq to 0.54. Meanwhile, The Kobeissi Letter noted that Bitcoin shows almost no statistical relationship with assets traditionally viewed as safe havens, including gold.

“Bitcoin is increasingly behaving like a leveraged tech stock,” the post read.

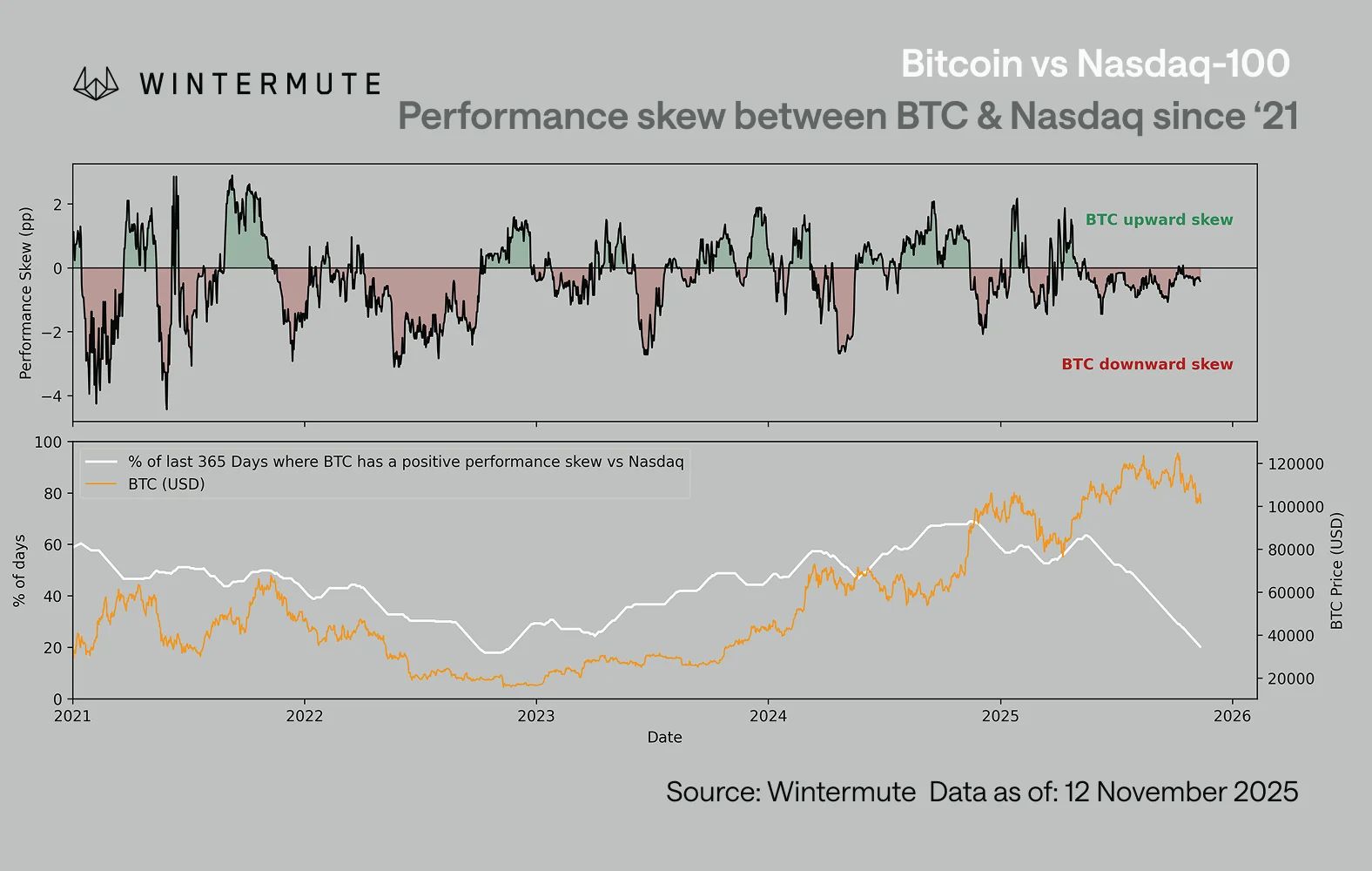

Furthermore, in its latest report, Wintermute pointed to a more pressing dynamic: the quality of the correlation has shifted. The firm explained that while the directional correlation with the Nasdaq remains elevated, its quality has deteriorated into a bearish skew. This means that,

- When equities fall, BTC falls harder.

- When equities rise, BTC participates weakly.

“Right now, that skew is firmly negative, showing that BTC still trades as a high-beta expression of risk sentiment, but only when it cuts the wrong way,” the analysis reveals.

Bitcoin and Nasdaq Correlation. Source:

Wintermute

Bitcoin and Nasdaq Correlation. Source:

Wintermute

Notably, the “pain gap,” has surged to levels not seen since late 2022. This results in a structural performance disadvantage, where Bitcoin underperforms in risk-on environments—characterized by investor optimism—and overreacts in risk-off scenarios, amplifying downside moves.

Wintermute’s Jasper De Maere revealed that two forces explain why this skew is appearing now. First, investor mindshare has shifted toward equities, especially mega-cap tech. It has absorbed most of the risk-on flows that previously rotated into crypto.

“This crowding of mindshare means BTC remains correlated when global risk sentiment turns, but doesn’t benefit proportionally when optimism returns. It reacts as a ‘high-beta tail’ of macro risk rather than a standalone narrative, the downside beta remains, the upside narrative premium does not,” De Maere stated.

Second, structural liquidity in crypto remains thin. Stablecoin supply has stalled, ETF inflows have slowed, and exchange depth has not recovered to early-2024 levels. This fragile liquidity amplifies downside moves, reinforcing the negative skew.

“Historically, this kind of negative asymmetry doesn’t appear near tops but rather shows up near bottoms. When BTC falls harder on bad equity days than it rises on good ones, it usually signals exhaustion, not strength,” the report added.

Market data further corroborates this. Over the past 41 days, the crypto sector has shed $1.1 trillion in market capitalization, equating to $27 billion daily. Bitcoin itself has dropped 25% in the last month, moving below $95,000 amid a broader sell-off.

“US stock market futures just opened and they are completely unfazed by the crypto decline this weekend. Even as crypto has lost -$100 billion since Friday, US stock market futures are GREEN,” The Kobeissi Letter reported.

Furthermore, gold has surpassed $4,100 per ounce, outperforming Bitcoin by 25 percentage points since early October. According to The Kobeissi Letter,

“The isolated nature of the -25% crypto downturn further supports our view: This is a leverage and liquidation-based crypto ‘bear market.'”

Taken together, these developments raise a crucial question for investors: can Bitcoin still be viewed as a safe-haven asset? With correlations elevated, liquidity thin, and downside reactions outweighing upside participation, the current data points to a market where Bitcoin behaves more like a high-beta speculative asset than a defensive hedge.

Whether this dynamic proves temporary or structural will depend on how risk sentiment, liquidity conditions, and investor positioning evolve in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Institutional Exhaustion and Broader Economic Concerns Push Bitcoin Down to Lowest Point in 7 Months

- Bitcoin fell to a 7-month low below $95,000 amid profit-taking, institutional outflows, and macroeconomic uncertainty, mirroring a 5.8% drop in the CoinDesk 20 index. - Market fear intensified as the Fear & Greed Index hit 10 (lowest since Feb 2025), while MicroStrategy's rumored Bitcoin sales sparked panic despite CEO Saylor's denial. - Institutional fatigue and liquidity declines ($766M→$535.2M) raised correction risks, though Harvard's $443M IBIT investment signaled growing crypto acceptance amid vola

Bitcoin Updates Today: Bitcoin's $80,000 Support Falters as Regulatory Changes and Increased Selling Pressure Emerge

- Bitcoin drops to $89,900, with weak $89,600–$79,500 support raising fears of a breakdown below $90,300 amid heavy selling pressure. - Binance short positions dominate 6.4:1 ratio, while exchange reserves surge $1.43B, signaling panic exit preparations and reduced buyer leverage. - Japan reclassifies 105 cryptos as financial products, and Brazil considers stablecoin tax, adding regulatory uncertainty to crypto markets. - Institutional activity diverges: BitMine expands ETH holdings, while Mt. Gox’s $953M

Vitalik Buterin Backs ZKsync: Driving Ethereum's Layer 2 Transformation and Boosting Altcoin Growth

- Vitalik Buterin endorses ZKsync's Atlas upgrade, signaling a strategic shift in Ethereum's Layer 2 scaling. - The upgrade enables 15,000 TPS, near-zero fees, and boosts ZK token price by 50% post-announcement. - Institutional partnerships with Deutsche Bank and Citi highlight ZKsync's privacy-driven appeal in financial services . - ZK ecosystem grows with $3.5B TVL, driven by ZK rollups and hybrid TradFi-DeFi systems projected to reach $90B by 2031. - Regulatory risks and gas volatility persist, but ZK t

ZK Atlas Enhancement: Driving Ethereum’s Growth in Scalability and Energy Conservation

- ZK Atlas Upgrade (Oct 2025) tackles Ethereum's scalability and energy efficiency via Airbender prover, sequencer, and ZKsync OS, redefining Layer 2 performance. - Achieves 15,000 TPS with $0.0001 fees, boosting ZK rollups' TVL to $3.5B and enabling real-world asset tokenization through Prividiums architecture. - GKR protocol reduces ZK verification costs by 10-15x, slashing Ethereum gas fees by 90% and accelerating institutional adoption of energy-efficient blockchain solutions. - Upcoming Fusaka upgrade