Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

As crypto entered extreme fear this week, a new claim began circulating online:

“McDonald’s sees a record surge in job applicants amid the crypto crash.”

It’s catchy, it’s meme-friendly, and it taps into the long-running joke that traders turn to fast-food jobs whenever Bitcoin drops.

But is it true?

The Claim: McDonald’s Hiring Surges Because Bitcoin Fell

The narrative popped up on social media shortly after $Bitcoin slipped below $100K and sentiment hit extreme fear levels .

The implication:

Crypto traders lost money and rushed to apply for jobs at McDonald’s .

It’s a meme the community has used for years, often resurfacing whenever prices drop sharply. But memes are not facts — and this specific claim is unsupported.

The Reality: Zero Data, Zero Reports, Zero Evidence

Here’s what we can confirm:

- McDonald’s has not released any official hiring report tied to crypto markets.

- There are no announcements from the company about increased applications.

- There is no labor data showing unusual spikes in fast-food job interest this week.

- No credible media outlet, HR firm, or labor research group has published anything linking crypto’s decline to McDonald’s hiring trends.

Simply put:

The claim is internet satire, not breaking news.

Bitcoin Did Drop — But That Doesn’t Prove the Claim

Bitcoin indeed dipped below $100K, briefly touching levels that pushed fear and liquidity risk higher.

But financial volatility does not automatically translate into employment trends — especially not in a specific company like McDonald’s.

Labor shifts take time, are tracked through national data, and are reported quarterly — not instantly after a market dip.

Why the Meme Keeps Coming Back

The “McDonald’s job” joke is a long-standing part of crypto culture. Every major crash — from 2018 to 2020 to 2022 and now — triggers the same meme cycle:

- Bitcoin dips

- Traders panic

- Memes about working at McDonald’s flood the timeline

While entertaining, they’re exaggerated and not grounded in real-world labor analytics.

Conclusion – It’s Satire, Not a Statistic

There is no factual basis for claims that McDonald’s is experiencing a record surge in job applications linked to the crypto crash.

It’s simply a viral meme that has been mistaken for real news.

Crypto markets may be shaky this week, but employment reports — especially from major corporations — are based on verified data, not social media jokes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum price outlook: bears pierce $3,000 as sell-off pressure mounts

Aster News Today: Aster Sets New Standard for DEXs by Introducing CEX-Level Liquidity Hybrid

- Aster launches Stage 4 "Harvest" airdrop and $10M "Double Harvest" trading competition to boost ecosystem growth. - Dual-reward system allows users to earn airdrop and competition tokens simultaneously through trading activity. - Platform develops on-chain order-book protocol for CEX-like speeds and expands gold/index perpetual contracts. - Global expansion includes Binance events and wallet integrations, while token utility expands to staking and governance. - Hybrid model combines decentralized infrast

The Federal Reserve's Change in Policy and Its Unexpected Effect on Solana's Price Rally

- The Fed's 2025 shift to easing policy, ending QT and cutting rates, injected liquidity, boosting Solana and other cryptos as risk assets. - Historical parallels show Fed liquidity expansions correlate with crypto rallies, though Solana's December 2025 price data remains unclear. - Cryptocurrencies now exhibit macroeconomic sensitivity, with Fed easing potentially increasing demand for high-volatility assets like Solana. - Investors must balance Fed-driven liquidity benefits against crypto's volatility an

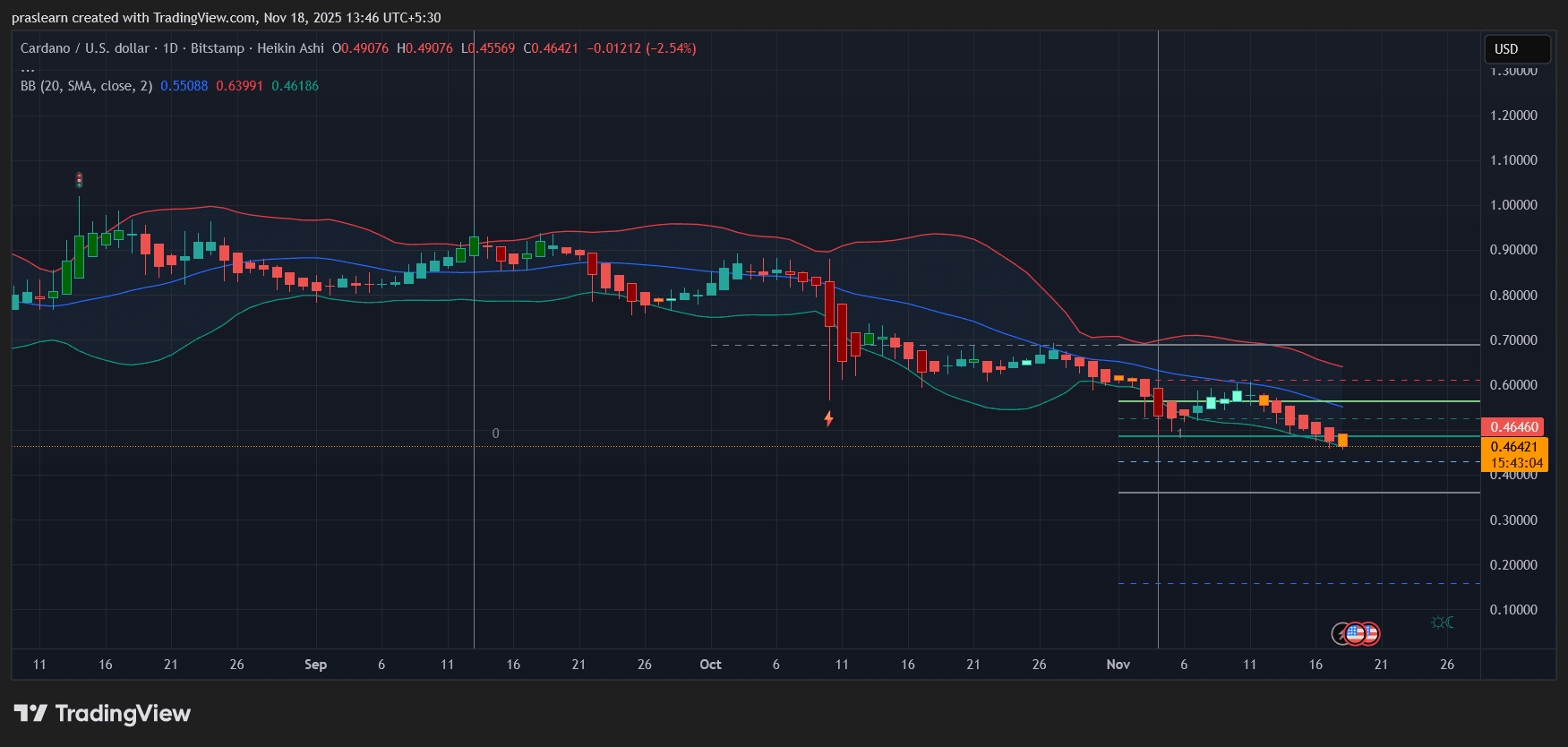

Cardano Price Crashes: Is $0.40 Next?