Bitcoin Updates Today: Institutional Bitcoin Buzz vs. Arbitrage Facts: Hayes Reveals the Strategy

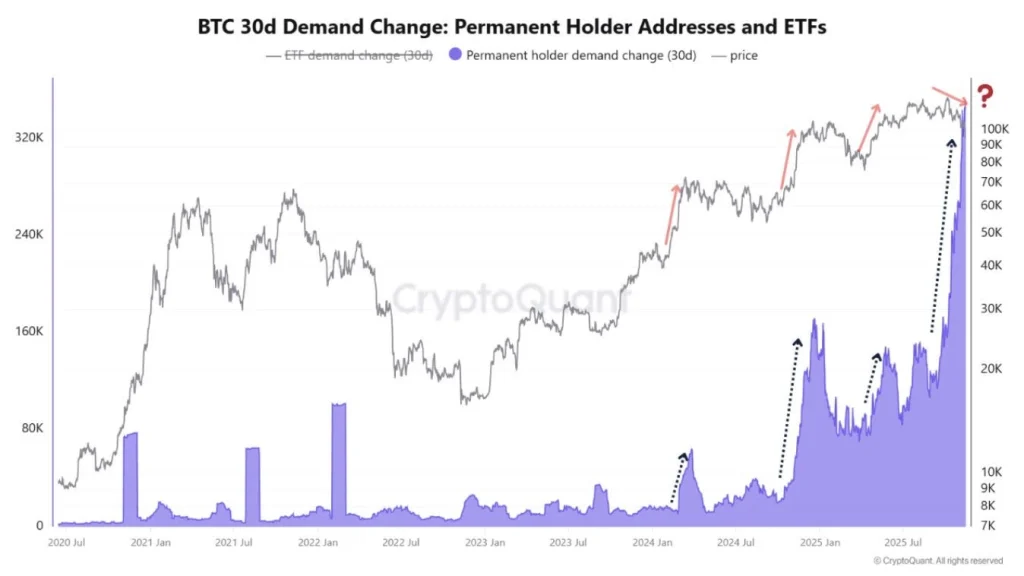

- Arthur Hayes challenges institutional Bitcoin bullishness, arguing major players exploit arbitrage strategies rather than hold long-term conviction. - Harvard University's $442.8M IBIT stake and 15% Q3 surge in BlackRock's ETF holders highlight growing institutional adoption. - Hayes reveals "basis trade" tactics where large holders buy IBIT shares while shorting Bitcoin futures to capture yield differentials. - ETF flows show $2.3B November outflows and Wisconsin's $300M IBIT liquidation, reflecting vol

The narrative of institutional enthusiasm for Bitcoin is being questioned, as BitMEX co-founder Arthur Hayes disputes the idea that influential firms like

Harvard University’s latest disclosure to the U.S. Securities and Exchange Commission showed

Yet, Hayes maintains that this apparent institutional interest is misleading. He points out that major players—hedge funds, bank trading desks, and BlackRock itself—are engaging in a “basis trade,” simultaneously purchasing IBIT shares and shorting Bitcoin futures to profit from yield differences

Recent figures back up this trend.

Hayes’ recent moves stand in contrast to his outspoken support for privacy-oriented

The ongoing debate between institutional involvement and arbitrage strategies highlights Bitcoin’s shifting place in the financial world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights