Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Despite recent volatility in the cryptocurrency sector, investor interest in new exchange-traded funds (ETFs) remains strong. Grayscale and VanEck are both preparing to introduce

These product launches are occurring during a difficult period for digital assets. U.S.-listed spot

The current ETF landscape also demonstrates Ethereum's continued strength. BitMine Immersion (BMNR) disclosed holdings of 3.6 million

As the market works through this bearish cycle, the introduction of new ETFs highlights the evolving place of cryptocurrencies in mainstream finance. Although outflows continue, the steady rollout of products such as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

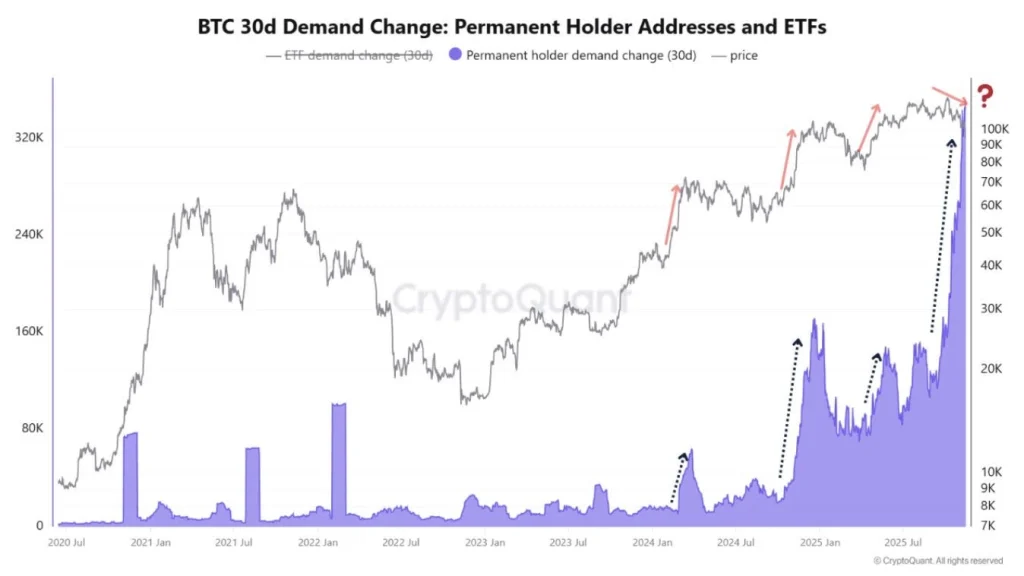

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights