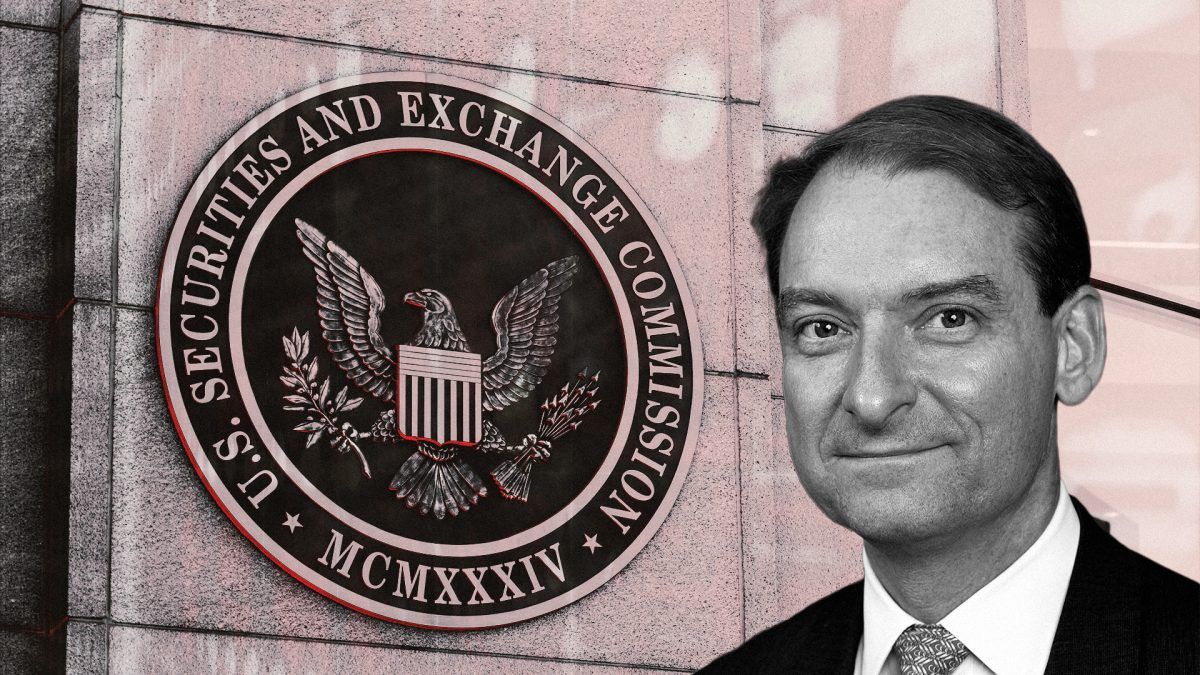

SEC Chair Atkins enters crucial 12-month crypto and regulatory push post shutdown, says TD Cowen

Quick Take Following the longest government shutdown ending last week, the focus is now on SEC Chair Paul Atkins’ agenda, TD Cowen’s Washington Research Group said in a note. Atkins is expected to focus on a range of issues, including crypto and allowing retail investors to have access to alternative investments.

The next 12 months will be pivotal for the U.S. Securities and Exchange Commission following the reopening of the federal government, as the agency looks to write rules to regulate the cryptocurrency industry, said an analyst at investment bank TD Cowen.

Following the longest government shutdown ending last week, the focus is now on SEC Chair Paul Atkins' agenda, said TD Cowen’s Washington Research Group, led by Jaret Seiberg, in a note.

"The SEC is reopening after the shutdown for what we view as the most important 12 months in the tenure of SEC Chair Paul Atkins and his deregulatory agenda," Seiberg said on Monday.

Since the beginning of the year under the new Trump administration, the SEC has made several moves to clarify its crypto stance, including releasing guidance on staking, holding roundtables and launching an initiative called " Project Crypto " to modernize the SEC's rules. Last week, Atkins also unveiled plans for a token taxonomy that looks to delineate between what and when digital assets would be securities.

"The agency needs to start issuing proposals in the coming months in order to be able to finalize them in 2027," Seiberg said, noting the SEC can take up to two years to propose and finish rules. "That then provides time to defend the rules in court to ensure they become implemented before the end of 2028."

Seiberg noted that Atkins is focused on a range of issues outside of crypto, like semi-annual reporting and allowing retail investors to have access to alternative investments.

As for crypto, it's expected that Atkins will focus on tokenized equities, Seiberg said. Tokenized securities, such as stocks converted into tokens on a blockchain, have garnered popularity as crypto firms look to launch those assets, potentially putting them in direct competition with traditional brokerages.

"Our expectation is that SEC Chair Paul Atkins will grant online brokers and crypto platforms the exemptive relief needed for them to proceed with tokenized equities," Seiberg said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve meeting minutes reveal sharp divisions: many believe a December rate cut is inappropriate, while some are concerned about disorderly declines in the stock market

All participants agreed that monetary policy is not fixed, but is influenced by the latest data, the evolving economic outlook, and the balance of risks.

Despite Losses, Strategy’s S&P 500 Entry In Sight