End of an Era: ‘CryptoKitty Age Star’ DappRadar Shuts Down, Token Tanks 38%

DappRadar, the leading blockchain analytics platform tracking decentralized applications since 2018, will permanently shut down due to ongoing financial challenges that made continued operations unsustainable. Founded during the CryptoKitties boom, DappRadar became essential for millions of users and thousands of developers seeking blockchain insights. The company will address matters regarding its DAO and RADAR token

DappRadar, the leading blockchain analytics platform tracking decentralized applications since 2018, will permanently shut down due to ongoing financial challenges that made continued operations unsustainable.

Founded during the CryptoKitties boom, DappRadar became essential for millions of users and thousands of developers seeking blockchain insights. The company will address matters regarding its DAO and RADAR token separately, as stated in its closure notice.

Seven-Year Journey Ends Amid Financial Pressures

The closure of DappRadar marks the end of an influential era for blockchain data analytics. Starting in 2018, DappRadar capitalized on the momentum of CryptoKitties, showcasing the versatility of blockchain applications. At its peak, it delivered analytics for hundreds of blockchains, covering key data points such as transaction volumes, trades, and user activity.

The platform became a go-to resource for developers, investors, and analysts. DappRadar aggregated real-time data across more than 50 blockchains, spanning decentralized finance, gaming, and NFTs. Its analytics empowered users to track trends and assess the performance of blockchain networks.

DappRadar’s official shutdown announcement after seven years of operations. Source: DappRadar

DappRadar’s official shutdown announcement after seven years of operations. Source: DappRadar

Despite these successes, financial realities outpaced DappRadar’s expansion. In their official announcement, the co-founders, Skirmantas and Dragos, highlighted financial unsustainability as the key factor behind the shutdown. Their decision spotlights broader challenges for blockchain analytics platforms in 2025, amid increased market volatility and shifting user interests.

The European Central Bank reported a drop in crypto market capitalization to $2.8 trillion by March 2025, emphasizing the volatility affecting crypto businesses. Blockchain analytics services also face mounting technical hurdles, including data accessibility, scalability, and tracking the rapidly increasing number of blockchain networks.

Wind-Down Process and Token Considerations

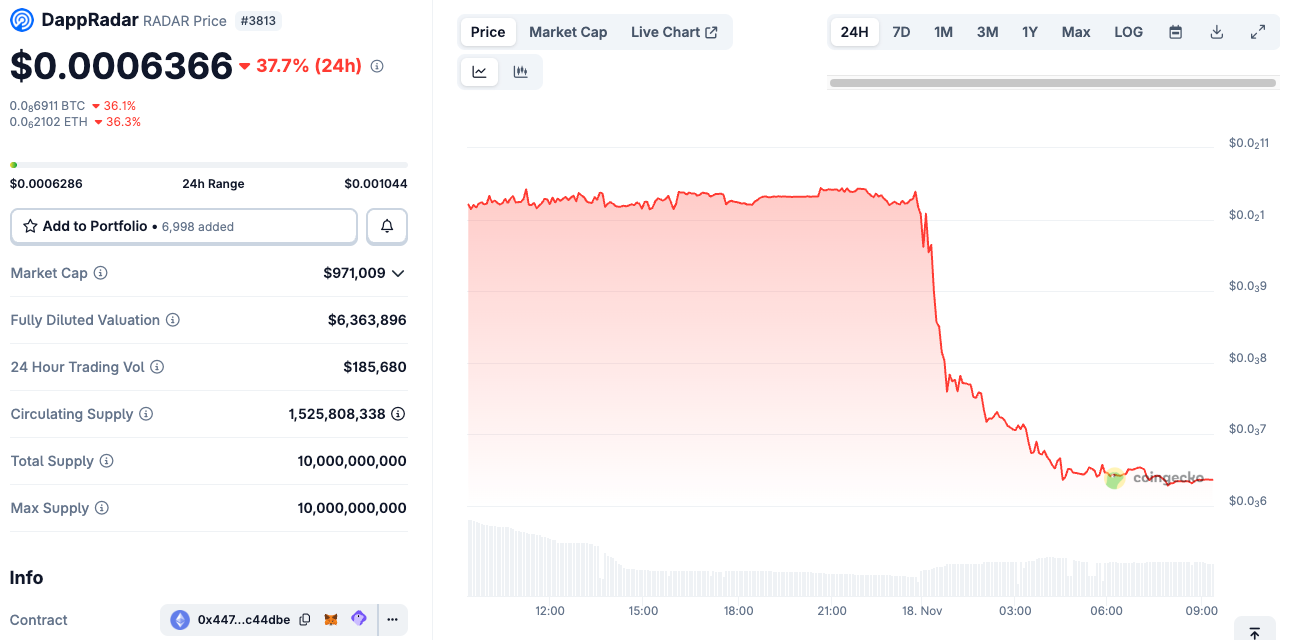

DappRadar’s shutdown affects multiple stakeholders: users, developers dependent on its data feeds, and RADAR token holders. RADAR price plunged 38% after the company’s announcement, which clarified that DAO and token matters will be communicated separately. While specifics remain unclear, this careful approach suggests a commitment to responsible management.

The founders reiterated their dedication to transparency throughout the wind-down process. By inviting community feedback, they recognized DappRadar’s influence among millions of users seeking dependable blockchain analytics. The shutdown may prompt developers and analysts to seek alternative solutions, potentially disrupting data workflows.

DappRadar’s exit leaves a gap among analytics providers. While competitors like Chainalysis and blockchain-specific explorers remain, DappRadar was unique in offering a cross-chain view of decentralized applications and markets.

Industry Context and Future Outlook

The closure comes at a time of rapid transformation in the cryptocurrency sector. Despite the broader digital asset market exceeding $4 trillion in 2025, individual firms confronted persistent profitability concerns. Analytics companies in particular struggle with rising infrastructure costs and with generating sustainable revenue.

Research from Global Market Insights estimates the crypto trading platform market at $27 billion in 2024, with an annual growth rate of 12.6% through 2034. Notably, most of this growth centers around trading, not analytics, underscoring the revenue challenges analytics providers face. Monetization models favor trading and financial services, making sustainability difficult for analytics-driven firms.

DappRadar’s shutdown affects multiple stakeholders, including RADAR token holders. Source: Coingecko

DappRadar’s shutdown affects multiple stakeholders, including RADAR token holders. Source: Coingecko

Blockchain analytics platforms also navigate technical complexities. Issues with data quality arise from chain forks and stale blocks, while interoperability between blockchains complicates unified analytics. As a result, operational costs remain high, with few revenue offsets, especially as more free tools become available.

DappRadar’s closure raises questions about the long-term viability of multi-chain analytics platforms. Will new competitors fill this gap, or will the market fragment into smaller, niche services? Although uncertain, DappRadar’s seven-year run demonstrates both the promise and difficulty of building foundational blockchain infrastructure in a rapidly evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gundlach Cautions That Inflated Markets and Unstable Loans Could Trigger a Financial Crisis

- Jeffrey Gundlach warns U.S. equity market is "least healthy" and predicts private credit crisis due to "garbage loans" and weak underwriting. - He advises 20% cash allocation, reduced AI/data-center speculation, and compares private credit growth to 2006 subprime crisis, citing recent firm failures. - Recommends rebalancing portfolios: 40% global equities, 25% non-dollar bonds, and 15% gold as hedge amid dollar weakness and inflation. - Criticizes AI mania as "dot-com bubble" repeat, with NYU's Damodaran

Mexico Thwarts U.S. Cartel Raids, Cites 1848 Lesson on National Sovereignty

- Mexico's President Sheinbaum rejects Trump's cartel strike proposal, invoking 1848 sovereignty lesson to defend national autonomy. - Tensions escalate as Mexico removes U.S. contractors' "Restricted Area" signs near Rio Grande, citing border disputes and environmental concerns. - Trump's hardline drug rhetoric clashes with Mexico's sovereignty stance, highlighting strained U.S.-Mexico relations over border security and governance. - Sheinbaum balances U.S. cooperation with sovereignty defense, while Trum

Bitcoin News Update: New Hampshire Connects Cryptocurrency and Conventional Finance Through Innovative $100M Bond

- New Hampshire becomes first U.S. state to issue $100M Bitcoin-backed municipal bond, setting global precedent. - Bond uses 160% Bitcoin over-collateralization with automated liquidation, shielding taxpayers while enabling crypto-backed lending. - Governor Ayotte emphasizes risk-free innovation, directing proceeds to a Bitcoin Economic Development Fund for entrepreneurship. - Structured by Wave Digital Assets and Orrick, the bond bridges traditional finance and crypto, avoiding taxable events for borrower

COAI Experiences Significant Drop in November 2025: Investor Hesitation Grows Amid Regulatory Ambiguity and Profitability Challenges

- COAI Index's 88% YTD drop in Nov 2025 sparks investor panic due to CLARITY Act ambiguity and C3.ai's operational turmoil. - C3.ai's $116.8M Q1 loss, leadership shakeup, and sale speculation amplify sector instability amid overlapping regulatory guidelines. - Global crypto scams and institutional risk aversion worsen market sentiment, though AI infrastructure fundamentals remain resilient. - Analysts debate selloff as temporary correction vs. terminal decline, emphasizing need for regulatory clarity and c