Ethereum News Update: Ethereum Whale Makes $1.33B Leveraged Move—Sign of Confidence or Risky Overextension?

- Ethereum whale "66kETHBorrow" injected $1.33B into ETH via leveraged Aave borrowing, stabilizing prices near $3,500. - Whale's 385k ETH holdings and $270M Aave-funded purchases signal institutional confidence despite market volatility. - Analysts note leveraged accumulation often precedes recoveries, though risks include amplified losses if prices correct further. - Market remains divided as whale's strategy contrasts with $183M Ethereum ETF outflows and key support/resistance levels.

Ethereum's market landscape is evolving as a prominent whale steps up its accumulation efforts,

The whale's moves have

Although the whale's actions reflect institutional-level confidence, they also carry risks. Using borrowed capital increases potential losses if prices drop further, and

Ethereum's ability to stay above $3,500 is also supported by

The whale's impact goes beyond price stabilization,

Opinions remain mixed regarding Ethereum's short-term direction.

As Ethereum moves through this consolidation period, the balance between whale-driven buying and institutional outflows will play a crucial role. With over $1.33 billion already invested and more capital available through borrowed USDT,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

While broader markets fluctuate, specialized crypto-gaming projects are steadily gaining momentum

- Kamirai bridges DeFi and gaming via Kamirex Exchange, a high-speed DEX for Asia's crypto demand, and a PlayStation/Xbox RPG using its token for transactions and governance. - $HUGS meme coin leverages Milk Mocha IP with 60% APY staking, deflationary token burns, and charity-linked revenue, combining viral branding with blockchain utility. - Mutuum Finance's Ethereum-based lending protocol raised $18.7M in presale, offering institutional-grade DeFi solutions with 250% token price growth and 18,000+ holder

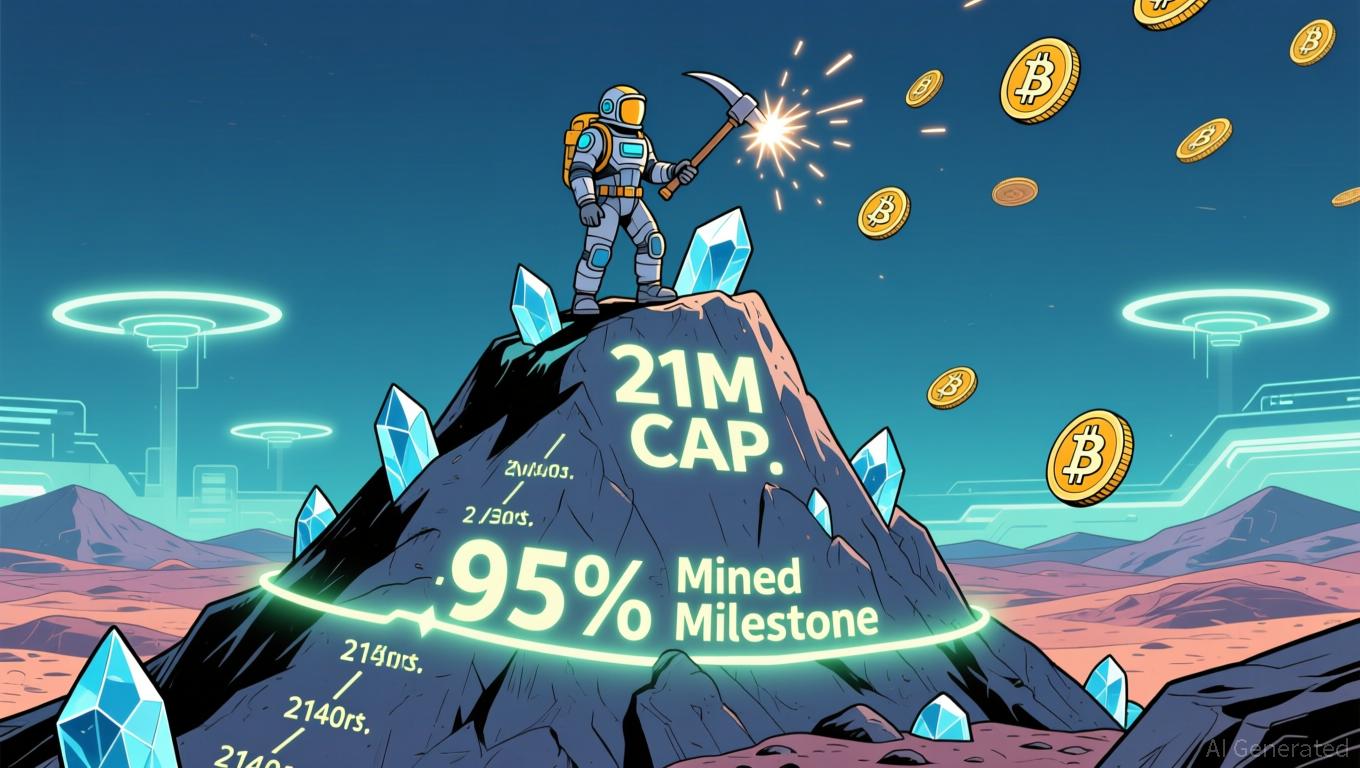

Bitcoin News Today: 95% of Bitcoin's Supply Reached—A Powerful Symbol of Scarcity Triumphing Over Fiat Currency Devaluation

- Bitcoin's supply now exceeds 95% of its 21 million cap, with 2.05 million remaining to be mined by 2140 via halving mechanisms. - The 2024 halving reduced block rewards to 3.125 BTC, intensifying miner reliance on fees as output halves every four years. - Experts highlight Bitcoin's scarcity as a hedge against fiat debasement, though price impacts remain limited as adoption and regulation gain priority. - New projects like Bitcoin Munari aim to replicate Bitcoin's capped supply model while adding program

AI Industry's Contrasting Approaches: C3.ai Faces Downturn While SoundHound Rises on Strong Cash Flow

- C3.ai faces declining revenue (-20% YoY) and widening net losses ($117M Q1 FY2026), driven by margin compression from IPD sales and operational reorganization risks. - SoundHound AI leverages $269M cash reserves to expand conversational AI, achieving 68% YoY revenue growth and strategic acquisitions like Interactions. - Citigroup's strong Q4 earnings ($2.24/share) and dividend hike attract institutional investors, contrasting with AI sector's fragmented performance and valuation challenges. - Divergent A

Visa Introduces a Global Stablecoin Platform to Broaden Worldwide Payment Opportunities

- Visa launches stablecoin payout pilot via Visa Direct, enabling real-time USDC transfers to crypto wallets for emerging market gig workers. - Program allows fiat-funded transactions with stablecoin receipts, addressing currency volatility and limited banking infrastructure in regions like Bolivia. - Partnerships with Nium and Wirex expand cross-border solutions, while regulatory compliance via KYC/AML requirements ensures broader accessibility. - Initiative reflects Visa's strategy to bridge traditional