- Aave Labs launches a consumer-focused savings app in Europe with yields up to 9% on deposits.

- The app simplifies DeFi access by removing crypto jargon while relying on Aave’s audited, five-year-exploit-free protocol.

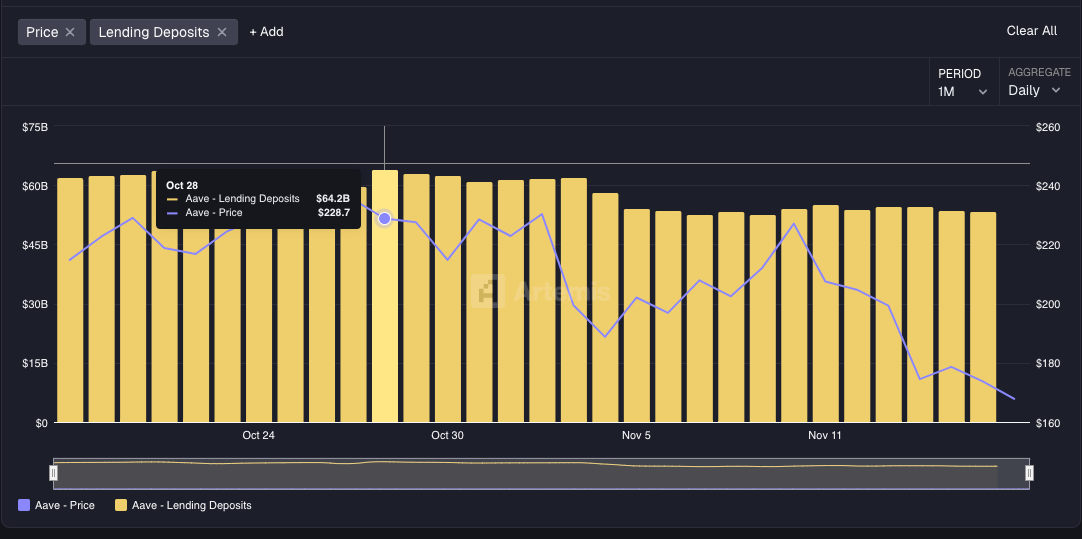

- Aave deposits fall from $63.2B to $53.6B this month as market sentiment weakens ahead of key U.S. political events.

Aave Labs, the developer behind one of crypto’s largest decentralized lending protocols, announced Monday that its new consumer app has officially launched on Apple’s European App Store. The firm also opened a global waitlist, signaling its first major push toward broad retail adoption.

The app reframes DeFi as a simple savings product, offering a minimum 5% yield and up to 9% on select stablecoin deposits. Users can onboard through traditional bank accounts or debit cards, bypassing typical crypto interfaces and terminology. Aave Labs said the goal is to remove the “protocol,” “stablecoin,” and “liquidity pool” vocabulary that often deters mainstream savers.

As reported by Fortune , Founder and CEO Stani Kulechov emphasized that Aave’s five-year exploit-free history reinforces the app’s safety profile. He noted that both the protocol’s economics and software have undergone extensive third-party audits. “There is security on the market mechanics and security on the code base,” Kulechov said.

Aave on-chain deposits decline from $64.2 billion to $53.6 billion between Oct 28 and Nov 17 | Artemis

Aave on-chain deposits decline from $64.2 billion to $53.6 billion between Oct 28 and Nov 17 | Artemis

Despite the launch, Aave’s on-chain deposits have fallen sharply this month, mirroring broader risk aversion as U.S. political tensions unsettle global markets. According to Artemis data, Aave’s total supplied liquidity slid from $64.2 billion on Oct. 28 to $53.6 billion, marking one of its steepest monthly drawdowns in 2025.

Aave expects its new yield product to counteract this decline by attracting longer-term savers. With Ethereum staking yields hovering between 3.5% and 4%, the protocol’s advertised 9% rate positions it competitively for risk-aware investors seeking a high-yield income. DeFi yields historically outpace traditional savings rates, concerns persist around smart-contract vulnerabilities and the lack of government insurance.

Aave price is trading around $166 at press time, down 4% intraday. AAVE traders are now assessing whether the new app can reverse the protocol’s declining deposits. While macro headwinds remain dominant, sustained inflows into the new savings product could bolster confidence and stabilize AAVE’s medium-term price trajectory.