ICP Token Jumps 30% Over the Past Week: Is This Rally Built to Last or Just a Brief Hype?

- ICP token surged 30% in seven days, driven by DeFi revival and protocol upgrades like Caffeine AI. - Strategic partnerships with Microsoft and Google Cloud, plus energy-efficient 0.003 Wh transactions, strengthen enterprise adoption. - Deflationary token burns and hybrid cloud integrations support long-term viability despite SEC regulatory risks. - Sustainability hinges on balancing innovation momentum with regulatory navigation and maintaining technological edge.

Market Sentiment: DeFi Resurgence and Protocol Breakthroughs

The latest price increase coincides with renewed activity across the decentralized finance (DeFi) sector.

At the same time, major token launches such as

On-Chain Fundamentals: Protocol Enhancements and Corporate Integration

Recent advancements on the ICP network in Q3 2025 have laid a more solid groundwork for ongoing expansion.

Collaborations with industry leaders like

Nonetheless, regulatory challenges remain.

Sustainability Analysis: Green Technology and Deflationary Design

ICP’s low-energy infrastructure makes a strong case for its future sustainability.

The platform’s

Conclusion: Bullish Momentum with Reservations

The 30% rise in ICP’s value is driven by a combination of DeFi revival and unique protocol strengths. While innovations like Uniswap’s CCA and AI-powered dApps have fueled recent interest, the network’s energy efficiency and enterprise alliances provide a more robust base. Still, regulatory uncertainties and the cyclical nature of crypto markets mean that caution is warranted.

At present, ICP is benefiting from a surge in innovation and adoption. Whether this marks the start of a lasting uptrend or a temporary spike will depend on how effectively the protocol manages regulatory hurdles and sustains its technological leadership.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

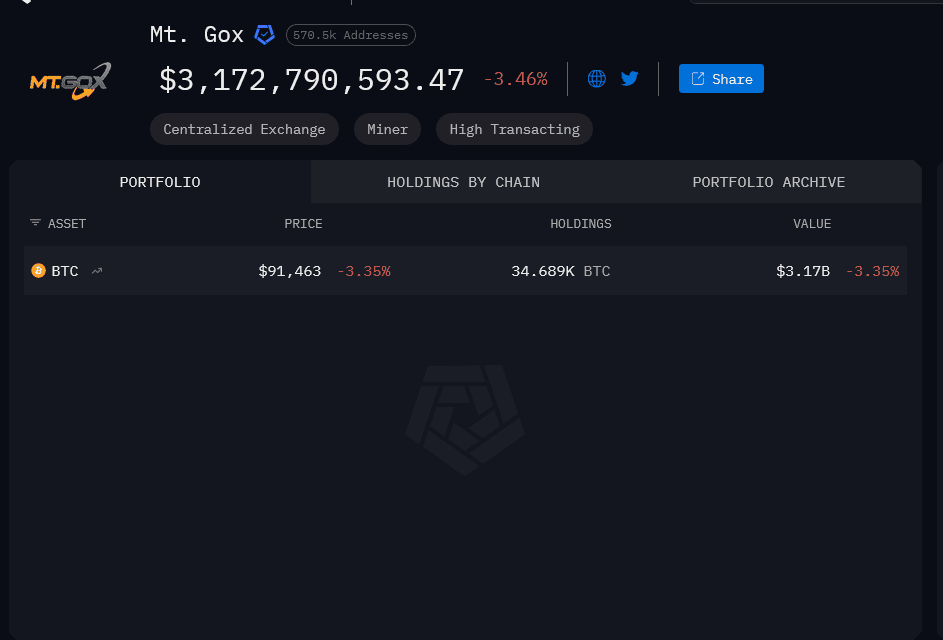

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).