Bitcoin Holders Panic Sell 148K BTC at a Loss

- Market experienced substantial sell pressure, impacting short-term BTC holders.

- Panic selling led to a price drop below $93K.

- Analysts foresee possible further decline and eventual stabilization.

Short-term Bitcoin holders recently sold 148,000 BTC at a loss as prices dropped to $93K, intensifying market volatility. Analysts like Michaël van de Poppe highlight potential recovery opportunities, predicting new support levels around $94,000.

A significant sell-off of 148,000 Bitcoin by short-term holders occurred recently, dropping prices below $93,000. This event involved rapid sell activity by recent investors amidst falling prices.

The sell-off is pivotal because it highlights market fragility and speculative pressures. As prices dipped, it sparked selling under duress and market analysts predicted potential for further downturns.

Short-term Bitcoin holders, particularly those with addresses under three months old, engaged in significant panic selling. 148,000 BTC were sold at a loss, marking a significant event in recent crypto cycles. Analysts like Michaël van de Poppe note this as an opportunity for market realignment.

“While it signifies intense short-term pain, this transfer of coins from panicked sellers to steadfast buyers at a discounted price can solidify a stronger long-term base.” — Crazzyblockk, Analyst, CryptoQuant

The event’s impact on BTC prices was immediate, causing a price fall below $93,000. Notably, 4.9 million BTC now sit at a loss for short-term holders. Analysts observed this may set up long-term stabilization.

Market reactions included institutional observation rather than intervention. Broader market volatility may affect correlated assets like ETH. Analysts suggest this marks a potential bottoming phase with long-term investors possibly stepping in.

Financially, retail investors facing losses could reshape market dynamics. On-chain metrics show increased exchange inflows, signaling sellers’ exit. Historically, such phases produce market bottoms, possibly attracting capital consolidation.

A potential outcome includes market stabilization as strong hands acquire from distressed sellers. Analysts see this as a corrective phase, potentially resetting a broader uptrend. Historical patterns indicate eventual market recovery, consistent with past cycles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

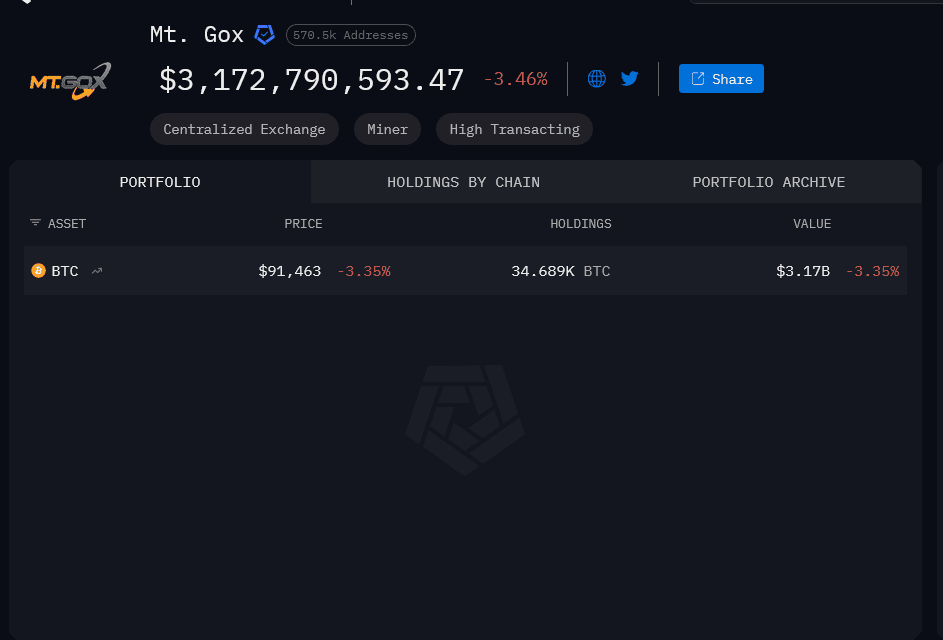

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).