Warren, Reed: Loopholes in Trump-Endorsed Crypto Pose Risks for Illegal Financial Activities

- U.S. Senators Warren and Reed demand federal investigation into Trump-linked crypto firm WLF over alleged ties to North Korean hackers and Russian sanctions evasion tools. - WLF's $WLFI token sales to entities like Lazarus Group and Tornado Cash raise risks of "supercharging illicit finance" and governance manipulation by foreign adversaries. - Trump family's 22.5B $WLFI token stake valued at $3B creates conflict of interest, with officials potentially prioritizing profit over compliance during Trump adm

U.S. Senators Elizabeth Warren and Jack Reed have called for a federal probe into

According to a letter obtained by CNBC, the senators referenced a September report by the nonprofit Accountable.US, which

WLF, which names Eric Trump, Donald Trump Jr., and Barron Trump as co-founders, has issued $WLFI tokens to fund ventures such as a debit card and tokenized commodities. However, the senators pointed out that DT Marks DEFI LLC, a Trump family-linked entity, owns 22.5 billion $WLFI tokens—worth over $3 billion—and receives 75% of the revenue from token sales. They argue this situation presents a conflict of interest for Trump administration officials, who could put financial gain ahead of regulatory compliance

This request for an investigation comes as lawmakers consider new cryptocurrency rules that might exclude governance tokens like $WLFI from current regulatory frameworks. Warren and Reed

Meanwhile, North Korea has intensified its criticism of U.S. and South Korean military collaboration,

World Liberty Financial has come under scrutiny from various directions, including its stablecoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

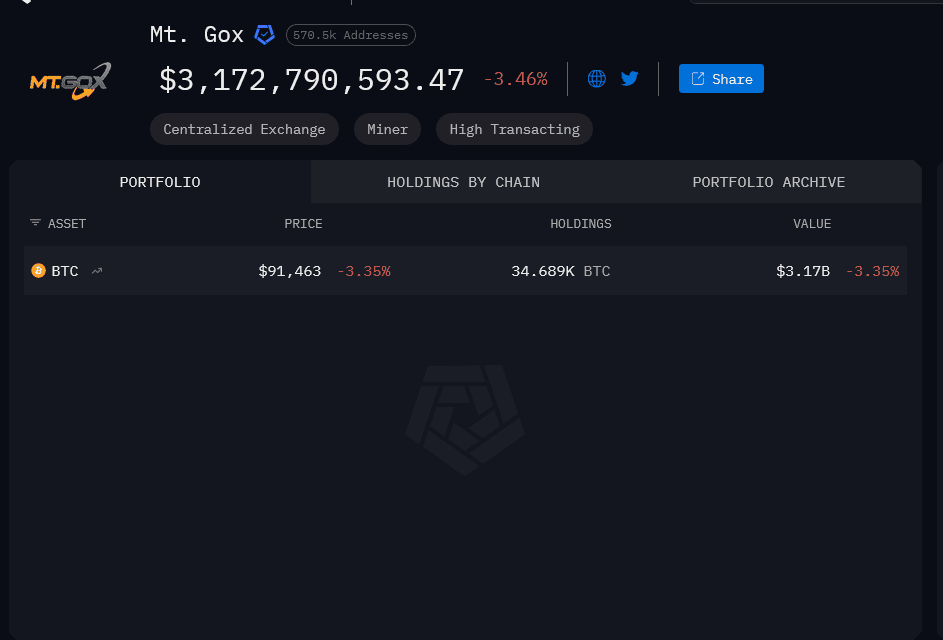

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).