3 Altcoins That Can Survive The Bear Market

Bitcoin slipping under $92,000 and Ethereum losing $3,000 has pushed traders toward assets that can handle deeper volatility. This piece looks at three bear market coins that show different strengths: OKB’s hedge-like resilience, Filecoin’s inverse correlation, and Zcash’s strong momentum. Each offers a distinct way to survive if the downtrend becomes a full market cycle.

The bear market hypothesis is getting stronger each day. Bitcoin slipping under $92,000 and Ethereum briefly losing $3,000 have pulled the market into a clear fear phase. With sentiment turning this fast, traders are now looking at bear market coins that can hold up if this downtrend becomes a confirmed cycle.

The coins in this list are not chosen at random. Each one fits a different style of survival: past outperformance against Bitcoin during weak periods, signs of inverse correlation when Bitcoin falls, or strong momentum that shows buyers are still active even in a stressful market. These filters give a simple way to judge which assets can handle deeper volatility if the market corrects further.

OKB (OKB)

OKB might feel like a surprise bet for anyone searching for bear market coins, but hear us out. This token has a history of holding its ground when the market gets heavy. One of the cleanest signals comes from the OKB/BTC weekly chart. From February 28, 2022, to February 13, 2023, the OKB–BTC ratio jumped by almost 493% over 350 days.

OKB-BTC Chart:

TradingView

OKB-BTC Chart:

TradingView

That period covered the heart of the bear market. When most assets struggled, OKB gained value relative to Bitcoin. This is why traders see it as a hedge-style pick, even if its short-term structure looks soft.

Right now, OKB is down about 14% in the past week and nearly 35% in the past month. The daily chart shows a small but important shift. Between November 4 and November 14, the price made a lower low, but the RSI made a higher low. RSI measures momentum, and this pattern often hints at early reversal pressure.

If buyers step in, OKB needs to stay above $108. A move above $173 would show real strength. Clearing $237 would confirm a full trend reversal. If the price falls below $108, and especially under $88.5, the setup breaks.

OKB Price Analysis:

TradingView

OKB Price Analysis:

TradingView

OKB also has a strong base case. It is tied to OKX, one of the largest exchanges, and exchange tokens often stay relevant even when the wider market slides.

Filecoin (FIL)

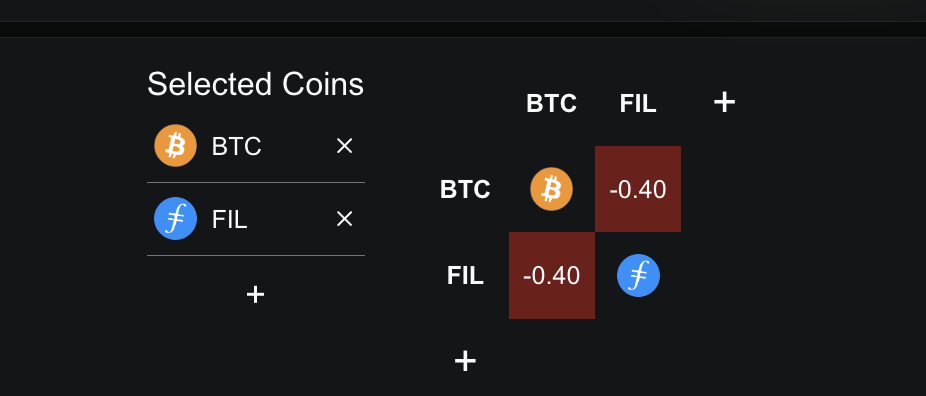

Filecoin sits in the correlation category of bear market coins, and the past month makes that clear. While the total crypto market cap fell about 5.2% in the last 24 hours, FIL moved higher by roughly the same amount. Over the past month, it has been up about 37.6%, and that strength has built a clean –0.40 monthly correlation with Bitcoin.

FIL-BTC Monthly Correlation:

Defillama

FIL-BTC Monthly Correlation:

Defillama

As Bitcoin drives almost 60% of the market, that inverse link matters if the bear market hypothesis gets confirmed.

This monthly correlation is based on the Pearson coefficient, a metric that ranges from +1 to –1, where +1 means two assets move together, –1 means they move in opposite directions, and 0 shows no clear relationship.

The longer window shows the same behaviour. Over the past year, FIL has held a –0.27 inverse correlation with Bitcoin. This suggests that if Bitcoin keeps losing support, FIL may not follow the same path. That is why traders often keep it on their list of bear market coins during stress phases.

FIL-BTC Yearly Correlation:

Defillama

FIL-BTC Yearly Correlation:

Defillama

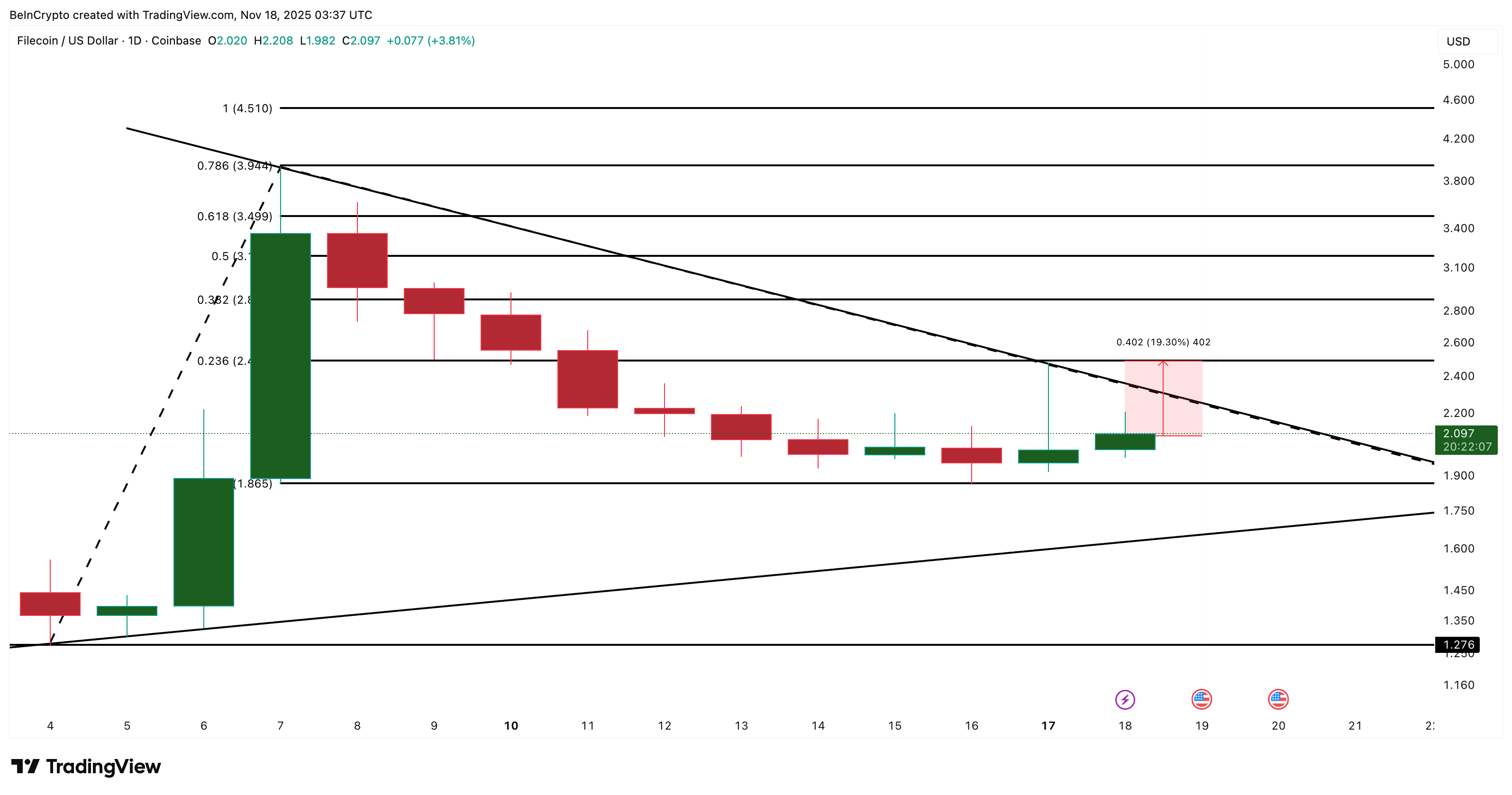

The price chart also adds to the story. FIL continues to trade inside a pennant pattern and is pushing against the upper trend line. If the recent positive momentum holds, the key level to clear is $2.48. Breaking that line would show new strength and open the path toward $3.49, with $4.50 as the higher target.

The upper trendline is weaker, with only two clear touchpoints. Therefore, any move on the upside can cascade into something bigger if the trendline breaks.

FIL Price Analysis:

TradingView

FIL Price Analysis:

TradingView

The downside remains simple. FIL must stay above $1.86 to protect the structure. Losing that level can pull it back toward $1.27, especially if the market bounces and the inverse correlation works against it.

Zcash (ZEC)

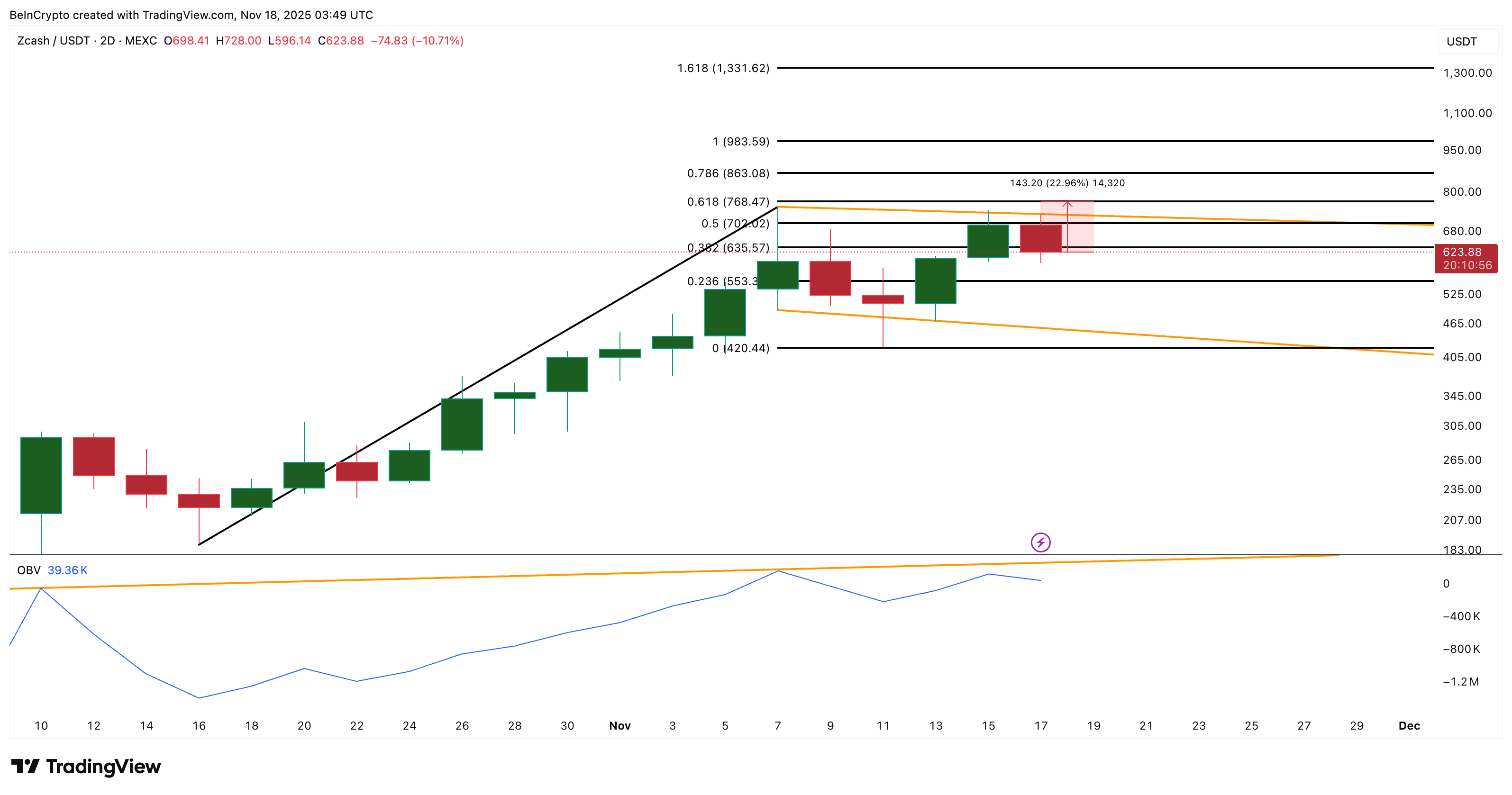

Zcash is the momentum pick in this list of bear market coins, mainly because it has moved in the exact opposite direction of Bitcoin. Over the past three months, Bitcoin has been down about 20%, while ZEC has been up more than 1,600%. That is a cycle-level divergence. The trend has continued in shorter windows, too.

Over the past month, ZEC has increased by 175%, and even in the past seven days, it has remained in the green with nearly 15% gains. This makes ZEC a clean example of a coin that grows stronger when the broader market weakens.

The privacy-coin narrative is also building fast. Ethereum’s new privacy layer, Kohaku, has lifted interest across the entire category. Most privacy coins like XMR, Dash, and Firo have moved well, but Zcash remains the clear leader.

Maria Carola, CEO of StealthEx, told BeInCrypto that this shift is part of a bigger trend:

“ZEC’s performance gap over major assets shows market leadership moving away from large caps toward narrative-driven sectors,” she mentioned.

The two-day chart shows ZEC pressing against a flag pattern. A breakout above $768 would need about a 23% move and could open the path toward $983 and even $1,331. The only missing confirmation is volume. OBV, which tracks buy-sell pressure, is still sitting under an ascending trend line. If OBV breaks out, it would validate the move and show that buyers are fully behind the breakout.

Zcash Price Analysis:

TradingView

Zcash Price Analysis:

TradingView

If the wider market falls deeper into a confirmed downtrend, this kind of momentum could keep ZEC at the front of the bear market coins category.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Highlights Falling Prices, Opponents Argue Tariffs Are Raising Expenses

- Trump promotes affordability agenda via McDonald's $5 meals, claiming inflation control success despite 3% CPI rise. - Critics argue tariffs on Brazil/Argentina beef and 200+ food imports worsen supply chains and price surges. - Political tensions escalate as New York mayor-elect condemns Trump's policies, threatening federal funding cuts. - Administration balances tariff protectionism with affordability goals amid 75-year low cattle herds and droughts.

Google Integrates Gemini 3 Into Search, Aims for AI Leadership Over OpenAI

- Google launched Gemini 3, its most advanced AI model, directly integrated into Search to strengthen AI competitiveness. - The model emphasizes coding efficiency, multimedia generation, and nuanced responses, with $40B+ invested in global data centers for infrastructure support. - Mobile testing reveals superior performance compared to web versions, showcasing real-world iteration strategies and "vibe coding" capabilities for developers. - Facing OpenAI's GPT-5 challenges, Gemini 3 targets enterprise appl

Solana News Update: Crypto Authorities Pursue Shadows While Libra Channels $4M to Solana

- Argentina and U.S. regulators investigate Libra meme token's $4M liquidity siphoned to Solana amid fraud probes. - Token collapsed hours after Milei's endorsement, wiping $250M from 40,000 investors as prosecutors froze $100-120M in assets. - On-chain data reveals Libra-linked wallets converting $3.94M to SOL during price dips, raising transparency concerns. - Political tensions escalate as Milei's administration faces "Cryptogate" allegations despite anti-corruption clearance. - Cross-jurisdictional leg

Revolut Transforms Blockchain Transactions, Leading Effortless International Money Transfers

- Revolut partners with Polygon to enable instant stablecoin remittances via USDC , USDT, and POL for UK and non-EU EEA users. - This expansion, following $690M in 2024 transactions, aims to streamline cross-border payments using Layer 2 solutions. - Polygon’s collaboration with Revolut highlights blockchain’s integration into traditional finance, supported by scalable infrastructure and regulatory alignment. - Mastercard’s Crypto Credential program on Polygon further enhances trust in digital transactions