Bitcoin Bottom Could Form Under $80,000 If Price Fails To Reclaim This Level

Bitcoin price has slipped below $90,300 with selling pressure rising and support turning thin. A bounce only survives if buyers reclaim the breakdown level soon.

Bitcoin price has slipped under $90,300, now trading near $89,900 after a sharp drop that pushed its 30-day losses to 16%. Traders are split between expecting another bounce or preparing for deeper losses.

But the charts and on-chain data point to one simple idea: if Bitcoin price does not reclaim a key level soon, the next bottom could form lower, possibly under $80,000.

Spot Selling Takes As Exchange Reserves Surge

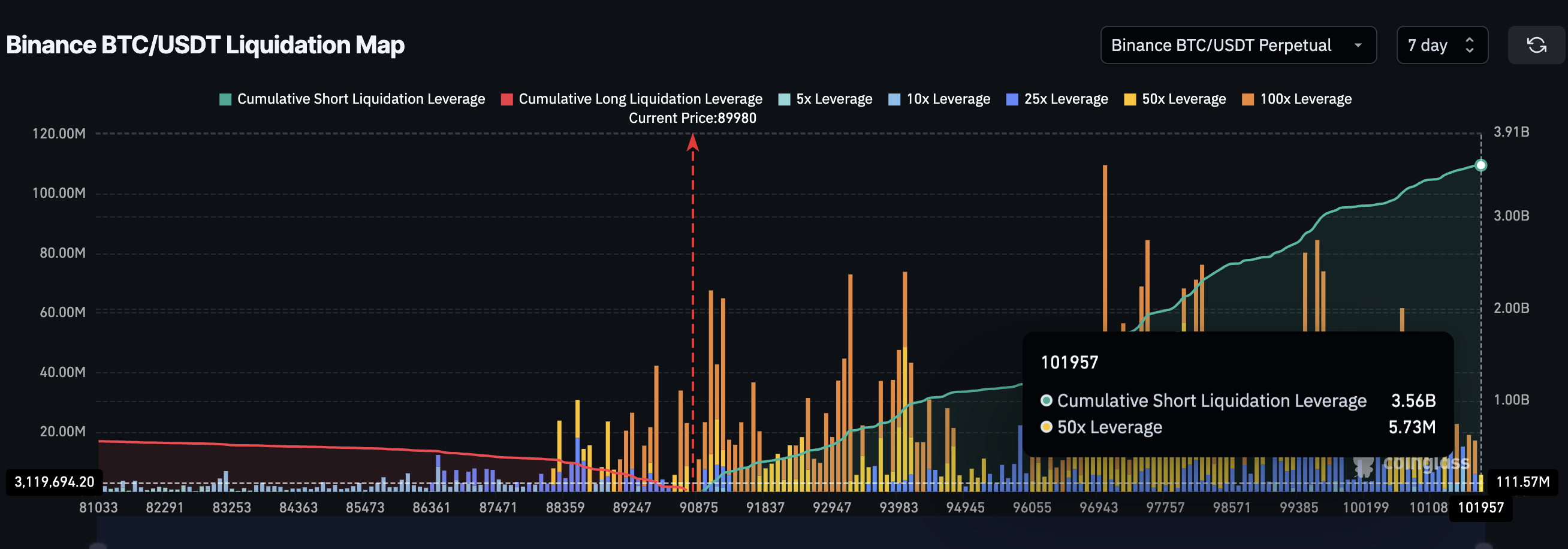

Selling pressure has changed in character. Earlier BTC dips were driven mainly by long liquidations, but that force has faded. On Binance alone, BTC/USDT long liquidations sit near $558 million, while shorts are around $3.56 billion. That is more than six times higher, showing that long-side leverage has already been flushed out. When liquidations fade, price drops begin to show real selling instead of forced selling.

Liquidation Map:

Liquidation Map:

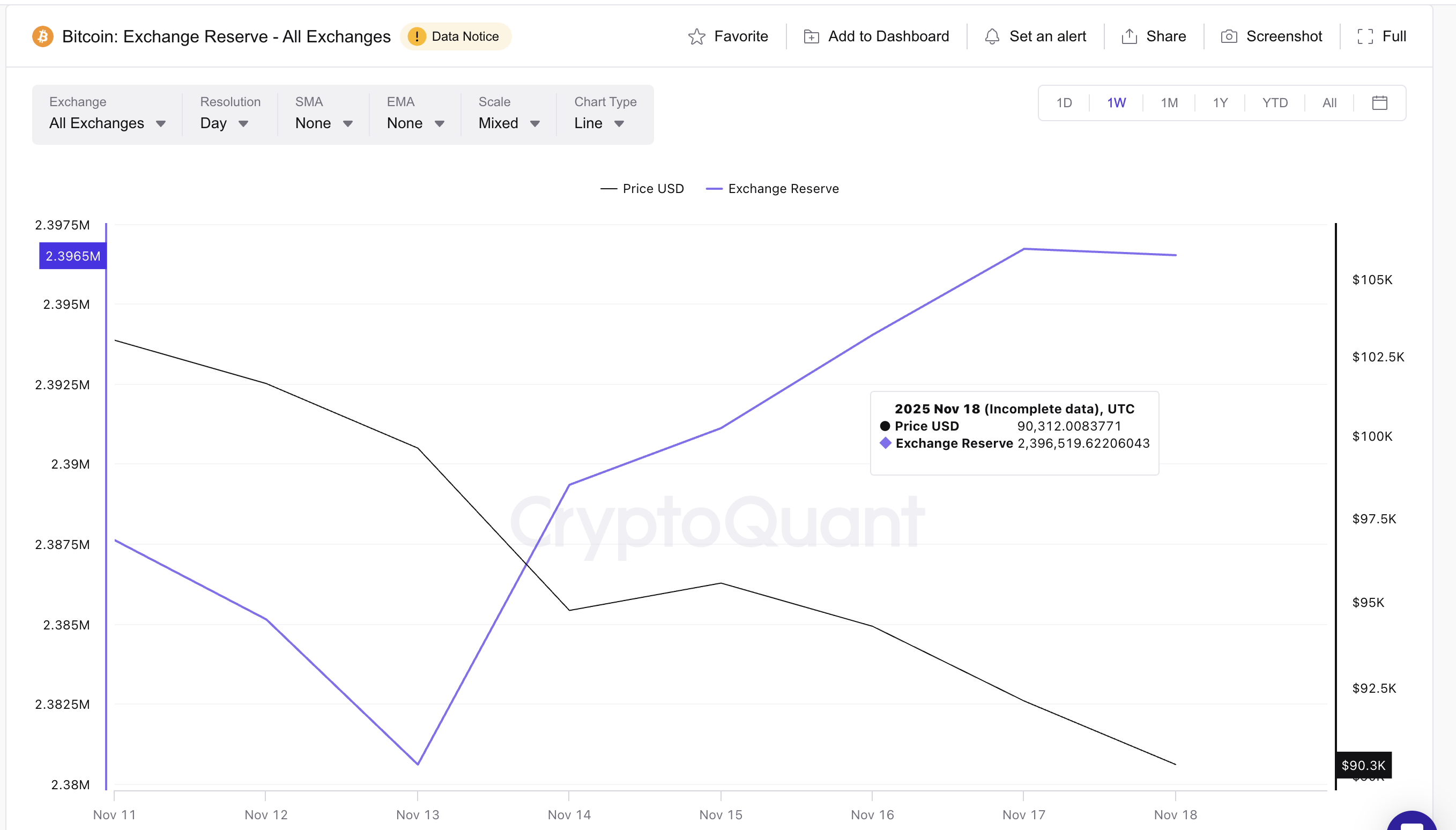

This is exactly what the exchange reserves are confirming.

Between November 13 and November 18, Bitcoin reserves on all exchanges rose from 2,380,595 BTC to 2,396,519 BTC. That means 15,924 BTC moved onto exchanges in five days. That’s roughly $1.43 billion at the current BTC price.

This is the highest inflow in weeks and a sign of deliberate spot selling, possibly panic exits. Holders are moving coins to exchanges to sell or prepare to sell.

Rising BTC Exchange Reserves:

Rising BTC Exchange Reserves:

The shift from liquidation-driven drops to spot-driven drops is important because it usually makes declines more controlled, but also more persistent. It also explains why the Bitcoin price continues to face pressure even after leverage has cooled.

Weak Support Pockets Leave Bitcoin Price Exposed

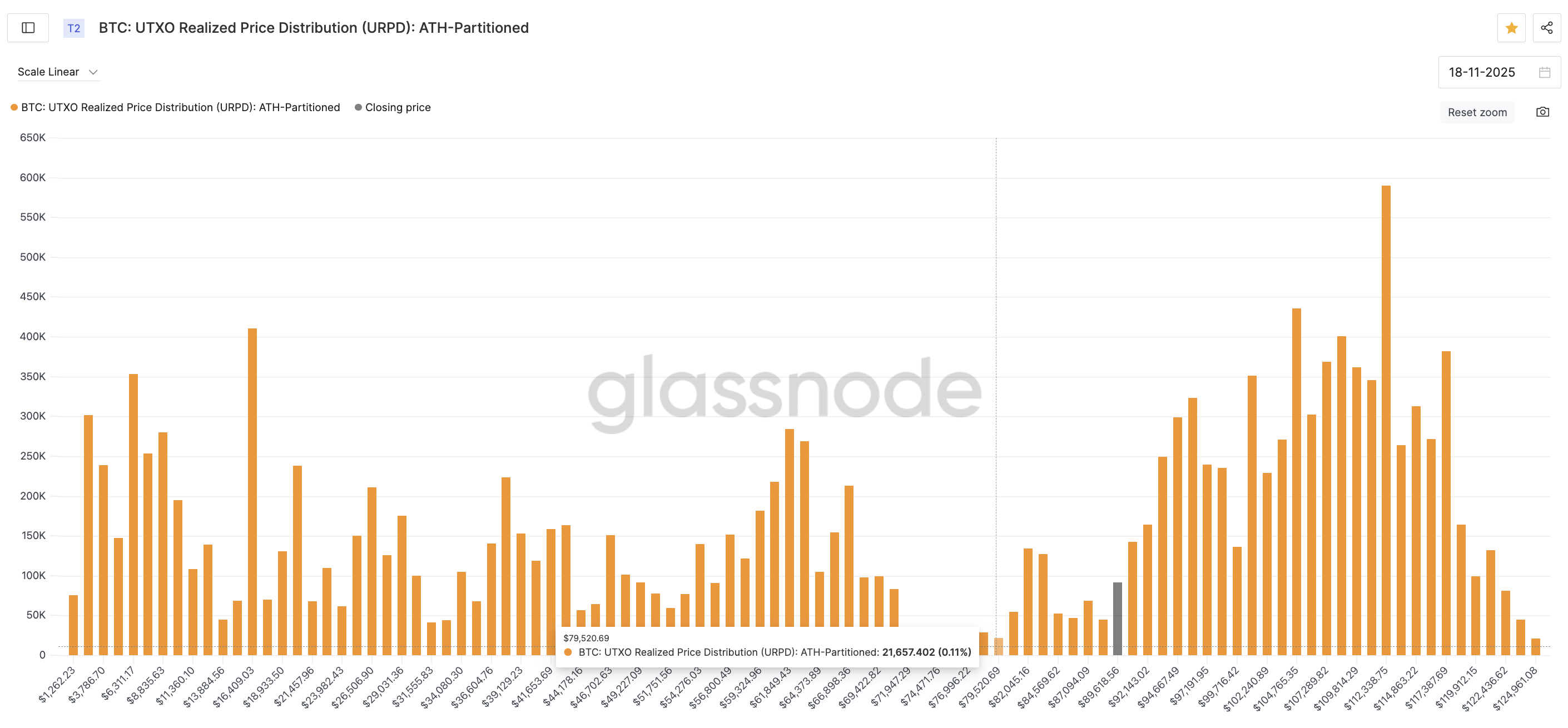

To understand where the Bitcoin price can stabilize, we look at the UTXO Realized Price Distribution (URPD). URPD shows where holders last bought their coins. These regions act like support clusters because people tend to defend the prices they entered at.

However, the area between $89,600 and $79,500 has very thin support. Few coins last moved in this band, meaning fewer holders are motivated to defend it.

Key Bitcoin Price Support Clusters:

Key Bitcoin Price Support Clusters:

This explains why losing $90,300 is dangerous. If Bitcoin cannot reclaim this level, the chart and URPD map leave the price exposed to a wide, weak zone that extends to the high under $80,000.

The trend-based Fibonacci structure supports the same idea. Bitcoin has been falling inside a wedge since October 6. The lower trend line is weak because it has only two clean touches. Price is drifting toward that line again, and a break would leave the Fibonacci extension at $79,600 as the next real target, breaking down the trendline. This level lines up almost perfectly with the URPD gap.

The short-term supports near $82,000–$84,500 are the last buffers before this zone, according to the URPD clusters. If Bitcoin continues closing under $90,300, these supports become the next logical tests.

Bitcoin Price Analysis:

Bitcoin Price Analysis:

The reversal case is still possible, but it requires the Bitcoin price to reclaim several levels in order. First comes $90,300, which would signal the market is rejecting the breakdown. After that, $96,800 becomes the next hurdle. And finally, a move above $100,900 would flip the short-term sentiment bullish.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Retail vs. whales: Who actually drives the Santa rally?

Ethereum News Update: Crypto Market Divides: Stability or Speculation Amid BlockDAG’s Rapid Growth

- Dogecoin (DOGE) maintained top-ten crypto status in early November 2025 amid market volatility, contrasting with Chainlink's (LINK) uncertain whale activity ahead of delayed U.S. CPI data. - BlockDAG (BDAG) raised $435M in its presale using hybrid Proof-of-Work/DAG architecture, with analysts projecting $0.3–$0.4 launch price and potential 3,000% returns. - Chainlink's price divergence from RSI and whale accumulation of 150,000 LINK ($2.36M) signaled possible trend reversal above $18.76 or bearish confir

Crypto Presale Comparison November 2025: Hyper, BlockDAG, Remittix, Little Pepe, and Layer Brett

Revolut and Polygon Connect Conventional and Digital Finance with $690 Million Stablecoin Initiative

- Revolut partners with Polygon to enable stablecoin payments, processing $690M in transactions via blockchain infrastructure. - 65 million users across 38 countries can now send/receive USDC/USDT with low fees and instant settlements through the integration. - The collaboration supports crypto trading, staking (up to 4% APY), and fiat-to-crypto on-ramps, aligning with Polygon's global payments strategy. - Revolut's MiCA license in Cyprus and Polygon's $3.6B stablecoin network highlight regulatory progress