El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Quick Breakdown:

- El Salvador marked the fourth anniversary of adopting Bitcoin as legal tender with a significant purchase of 420 BTC worth $25.6 million.

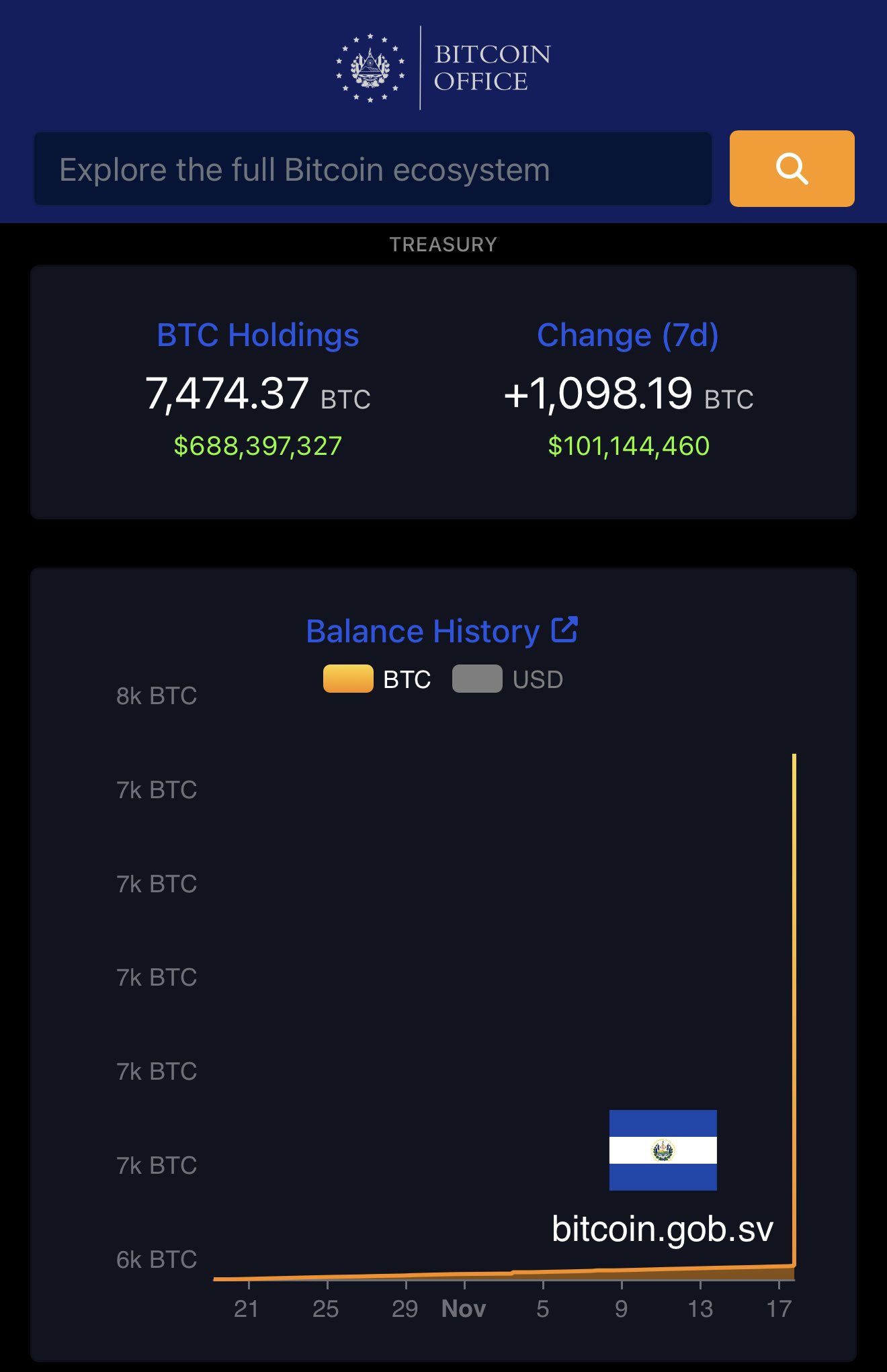

- This move increased its Bitcoin reserves to over 7,474.37 BTC, valued at approximately $700 million, despite the International Monetary Fund’s (IMF) advice to halt acquisitions.

- The government’s proactive buying strategy highlights its commitment to Bitcoin despite market volatility and IMF constraints.

Nation makes record Bitcoin purchase

El Salvador’s Bitcoin Office announced the acquisition of 1,090 BTC, valued at approximately $100 million, marking the country’s largest single-day purchase since adopting Bitcoin as legal tender in 2021. The transaction, occurring during a sharp market dip, signals the administration’s ongoing faith in Bitcoin as a strategic national asset. President Bukele shared the purchase details on social media, reiterating his government’s intention to continue buying the cryptocurrency regardless of prevailing market conditions.

Source:

President Nayib Bukele

Source:

President Nayib Bukele

With this investment, El Salvador’s holdings have increased to 7,474 BTC, valued at nearly $676 million at current market rates. This purchase comes even as the IMF reportedly maintains restrictions on new public-sector Bitcoin purchases due to existing loan agreements, leading to questions about the source and structure of the latest buy. The gap between public statements and blockchain data has prompted debate about transparency in the nation’s reporting and reserves management.

Implications and global reactions

The purchase highlights the Bukele administration’s commitment to positioning El Salvador as a leader in state-level digital asset adoption. While proponents argue this move could boost financial inclusion and reduce remittance costs, critics, including the IMF, point to risks such as market volatility and potential fiscal instability. The IMF had cautioned against further accumulation, and recent discrepancies between official wallet activities and public announcements have intensified calls for greater transparency around El Salvador’s strategy.

El Salvador’s continued accumulation of Bitcoin has attracted both attention and scrutiny. International observers question the long-term impacts on national finances, given the volatile nature of the crypto market, even as the country posts significant unrealized gains amid Bitcoin’s upward price cycles.

Notably, Bolivia’s central bank now views cryptocurrency as a “viable and reliable alternative,” following the formalization of a collaboration with El Salvador, which has made Bitcoin legal tender. Through a memorandum of understanding, the nations will continue to work together on crypto policy and regulation. This partnership aims to modernize Bolivia’s financial system, utilizing El Salvador’s expertise to enhance financial inclusion and establish a regulated digital asset ecosystem, thereby integrating blockchain technology into its long-term economic strategy.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Takes a Hit, ARK Invest Seizes Opportunity with $10M Optimistic Investment

- ARK Invest bought $10.2M in Bullish shares on Nov 17, defying its 4.5% stock drop and six-month 46% decline. - Bullish reported $57M Q2 revenue (vs $67M prior) but turned $108. 3M profit after a $116.4M 2024 loss, ahead of its Nov 19 earnings. - The purchase aligns with ARK's strategy to accumulate crypto assets during downturns, following recent buys in Circle and BitMine. - Analysts debate crypto market bottoming, with Bitcoin's ETF outflows and Fed rate-cut uncertainty (52% chance in Dec) seen as key

The ICP Bull Run: Assessing the Role of Infrastructure in the Web3 Age

- ICP Network expands as a decentralized cloud leader via strategic alliances, AI-driven infrastructure, and institutional partnerships with Microsoft/Google Cloud. - TVL surged to $237B in Q3 2025, but DApp engagement fell 22.4%, highlighting reliance on speculative capital over organic user growth. - Industrial IoT innovations (PMC controllers, IoTstar platform) and on-chain AI execution position ICP as a hybrid blockchain-industry 4.0 solution leader. - Institutional adoption in healthcare/finance and d

Zcash (ZEC) Sees Price Rally in November 2025: Network Enhancements and Growing Institutional Interest Drive Upward Trend

- Zcash (ZEC) surged 472% to $420 in late 2025, driven by protocol upgrades and institutional adoption. - ECC enhanced privacy/usability via sapling address expansion, P2SH multi-signature support, and Zashi wallet improvements. - Grayscale's $137M investment and U.S. regulatory clarity (Clarity/Genius Acts) boosted institutional confidence in Zcash's compliance-friendly privacy model. - Zcash's market cap surpassed $7B as shielded pools held 30% of supply, reflecting growing demand for privacy-compliant c

Is Zcash (ZEC) Poised for Bullish Move? This Emerging Fractal Setup Suggest So!