Bitcoin Slump Deepens as Small-Cap Cryptos Sink to Four-Year Lows

Global crypto markets are under heavy pressure following a sharp decline in Bitcoin’s value, which has damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

In brief

- Bitcoin’s drop below $94K and thin liquidity are driving sharp volatility across major and minor crypto assets.

- ETF outflows intensify pressure on Bitcoin as hopes for a rate cut fade and market uncertainty grows.

- Small-cap tokens hit their lowest levels since 2020, with weak sentiment limiting ETF prospects.

- Analysts warn of further declines but note that conditions differ from those in 2022, expecting long-term recovery potential.

Bitcoin’s Drop Deepens After October Liquidations Erase Billions in Leverage

Bitcoin fell below $94,000 on Friday, just days after dropping under $100,000 , erasing nearly all progress made since January. Unsurprisingly, the slide sent a wave of concern through traders who often rely on momentum when making decisions.

Market watchers say the downturn began when many investors rushed to sell as economic worries spread. Forced selling then added to the pressure as traders closed positions that could no longer withstand the losses.

According to Alessio Quaglini of Hex Trust, the chain reaction traces back to October 10. Rising geopolitical tensions between the United States and China drove investors out of risk assets. Shortly afterwards, cascading liquidations wiped out billions in leveraged trades. Quaglini described the selloff as a “liquidity reset,” noting that sentiment toward Bitcoin itself had not collapsed.

Even so, the fallout spread quickly. Ether has fallen more than 35% from its August peak of $4,954, and the broader market weakened alongside it.

Although tensions between Washington and Beijing have eased, Bitcoin remains stuck in a fragile environment. Peter Chung of Presto Research said liquidity has remained thin since the October crash, causing even modest trades to move prices sharply. He also raised the possibility that Bitcoin’s four-year cycle pattern may be losing its impact as broader economic pressures take hold.

ETF Reversal and Geopolitical Tension Push Bitcoin Toward Higher Volatility

Economic concerns persist, thus weighing on investors’ sentiment regarding the overall market outlook. Expectations for a Federal Reserve rate cut in December have waned, and uncertainty has grown following a recent U.S. government shutdown that delayed key data releases. Tim Sun from HashKey said the tighter backdrop has hit Bitcoin exchange-traded funds especially hard.

These products drew more than $100 billion shortly after their approval, but inflows have slowed significantly. In recent weeks, money has started to move out of the ETFs rather than into them.

Growing caution is influencing the behavior of both retail and institutional traders. Analysts predict that more volatility is likely as markets contend with the combined effects of weak liquidity, rising rate concerns, and sensitive geopolitical conditions.

Several forces continue to shape the downturn:

- Investors are selling risk assets following U.S.–China tensions.

- Forced liquidations are increasing losses as leveraged positions are unwound.

- Low trading volumes allow small orders to move prices sharply.

- Market sentiment is weakening as expectations for rate cuts have faded.

- ETF inflows are reversing, adding further pressure to Bitcoin.

Quaglini warned that Bitcoin could still fall as low as $70,000 if stock markets weaken further. Jeff Mei from BTSE echoed that view, noting that Bitcoin continues to behave like a high-risk asset. He added that doubts over valuations in fast-growing tech sectors and uncertainty around interest rate policy leave the crypto market exposed to deeper pullbacks.

Even with these risks, several analysts emphasize that the current downturn does not resemble the 2022 crisis. Quaglini said there is no wave of bankruptcies or major lending failures spreading through the system. He expects Bitcoin to recover and potentially reach new highs within the next 12 to 18 months once broader conditions improve.

Retail Traders Shift Toward Quality Coins as Small-Cap Market Extends its Slide

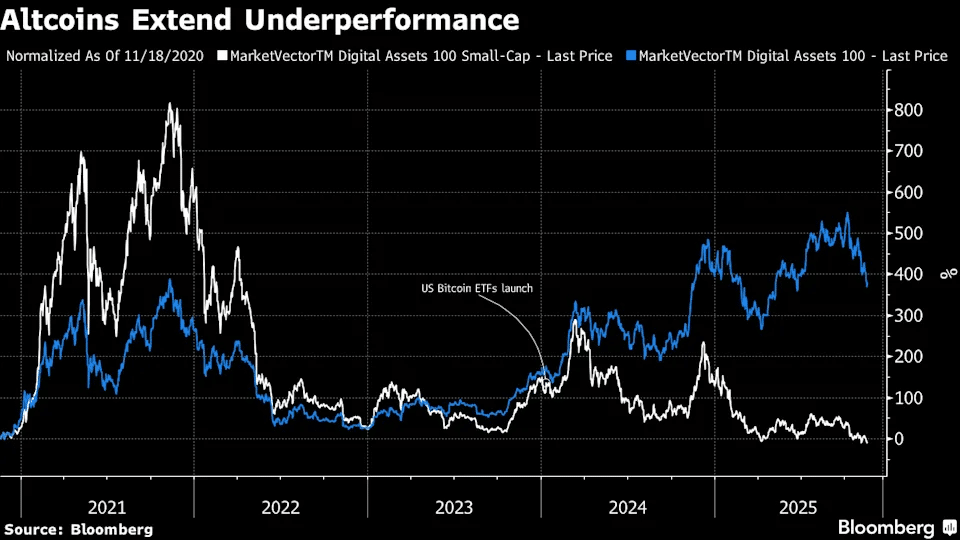

While Bitcoin and Ether dominate most discussions, smaller tokens are under even heavier strain. MarketVector’s index tracking 50 small-cap crypto assets has fallen to its lowest level since 2020 . Many of these coins once surged during bullish phases, attracting traders seeking quick gains. That momentum faded last year when U.S. regulators approved ETFs for Bitcoin and Ether, drawing institutional attention toward larger tokens instead.

The weakness in small-cap tokens is now creating challenges for ETF issuers. Roughly 130 applications tied to smaller crypto coins remain pending with the Securities and Exchange Commission.

Current market conditions make it less likely for approval to translate into meaningful inflows. A Dogecoin-linked ETF, listed in September under the ticker DOJE, has recorded no inflows since mid-October. Dogecoin itself has fallen 13% over the past month.

Over the past five years, the small-cap index has slipped nearly 8% , while major coins have surged roughly 380%. Pratik Kala of Apollo Crypto said retail traders are beginning to recognize that not all tokens rebound during recoveries. “A rising tide doesn’t lift all boats—it only lifts the quality ones,” he said.

The October crash erased more than $1 trillion in market value and triggered approximately $19 billion in forced selling. Appetite for risk has yet to recover, and many traders are avoiding the most speculative coins while waiting for clearer economic signals.

Looking ahead, Chung advised retail investors to avoid trying to predict short-term moves and instead consider buying in small amounts over time. Sun said long-term buyers should monitor global monetary conditions rather than chart patterns, arguing that Bitcoin’s next recovery will depend on easier liquidity worldwide.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Vitalik's "Can't Be Evil" Roadmap: The New Role of Privacy in the Ethereum Narrative

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.