Written by: Murphy

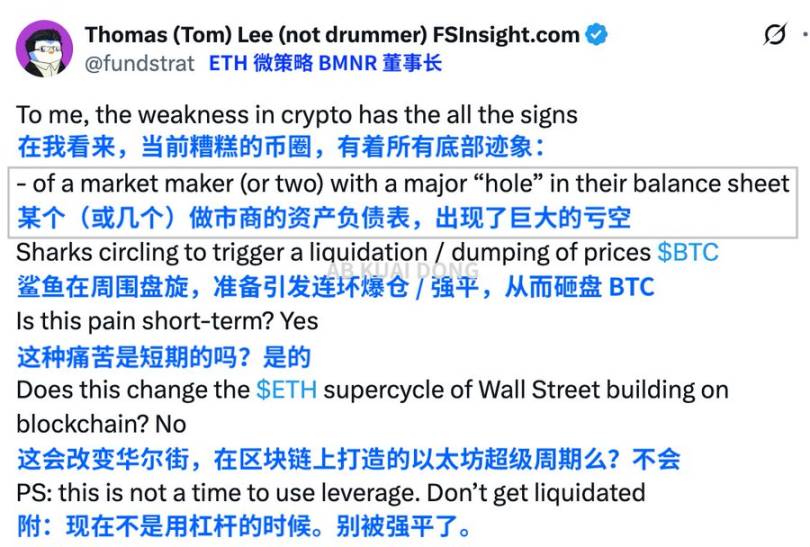

Bitcoin fell below $100,000, and Ethereum dropped by 10% in a week. The crypto market once again experienced a "bullish death spiral" in mid-November. Tom Lee, Chairman of BitMine, the largest Ethereum reserve institution, and a Wall Street analyst, believes that the real pressure comes from shrinking market maker liquidity and arbitrage sell-offs by large traders.

Source: X

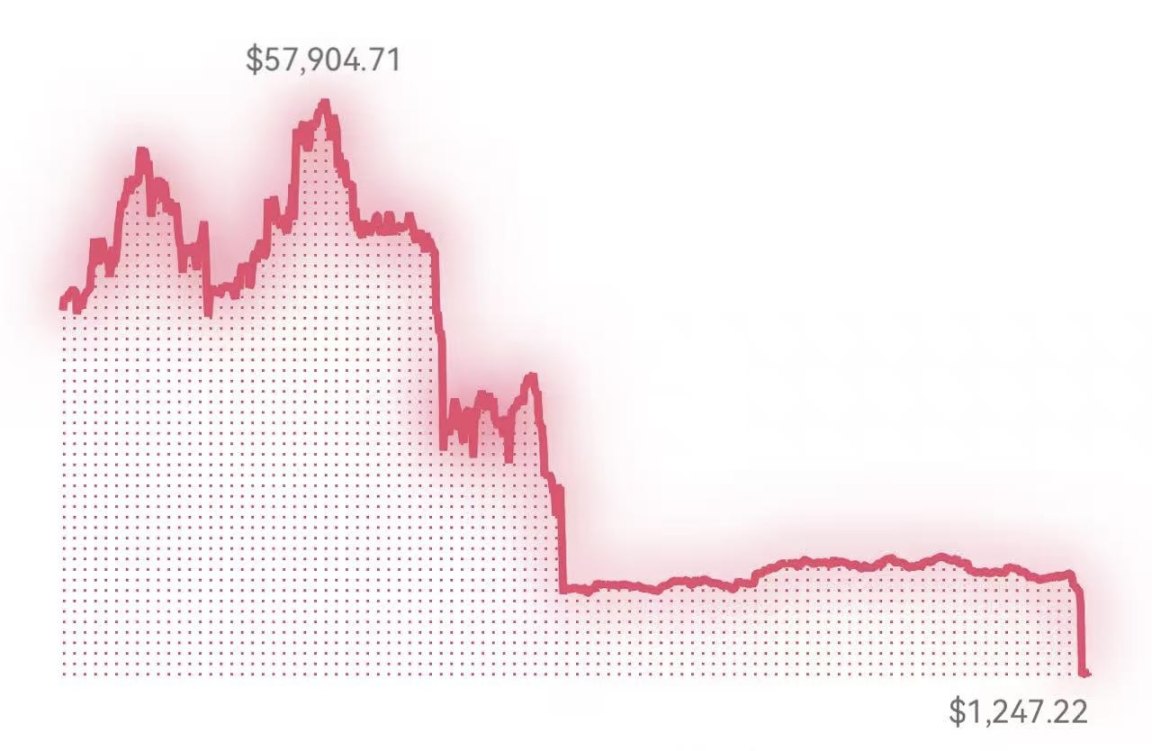

The price of Bitcoin (BTC) plummeted from its early October high of $126,000, falling below the $100,000 mark in just three days. Bulls and market makers were liquidated in succession, with the price once dropping to $97,000, a weekly decline of over 5%. After a $524 million inflow into Bitcoin spot ETFs on the 11th, there were outflows of $278 million and $866.7 million on the 12th and 13th, respectively, accelerating the spread of selling pressure.

Some attribute this market movement to "whale sell-offs," "reversal of Fed expectations," "market maker withdrawal," and so on. However, if you only look at the present, it's easy to overlook a more fundamental historical pattern: bull markets never end abruptly at the top, but rather, after reaching a peak, they automatically digest themselves through a "liquidation chain."

And the order of the liquidation chain never changes.

The first to fall are the "bullish believers"

Source: Binance

Those who were still shouting "see you at $140,000" and "ETF bull market taking off" at $120,000 are the first to be buried. They increased their positions and went all in at high levels, with high leverage ratios. Any slight price movement would trigger a chain reaction of liquidations. Next are those who mistakenly believe low leverage is safe. Just like the flash crash on October 10-11 this time, I was also one of the low-leverage gamblers caught in the 1011 black swan event: "coin-margined, 3X contracts, isolated margin positions liquidated immediately." In just a few minutes across multiple accounts, my email was bombarded with liquidation notifications, and once breached, the impact spread horizontally.

The painful lesson: low leverage is not safe; liquidation may be delayed, but it will come.

Source: Author

The second batch: market makers and quant institutions

Do you think market makers are invincible? Remember March 12, 2020? Market makers' depth dropped to almost nothing.

During the liquidation wave of 2021, even Alameda couldn't withstand it.

When LUNA collapsed in 2022, even crypto banks were taken down with it.

Stablecoins lost their pegs in succession, market makers, lending whales, and quant institutions withdrew one after another, and sometimes they themselves became the spark for "accelerated crashes." The "market supporters" are not "permanent bottom holders." When depth starts to thin and hedging costs rise, what they do is not stabilize the market, but save themselves.

The third batch: DAT model institutions, token reserve institutions, family funds

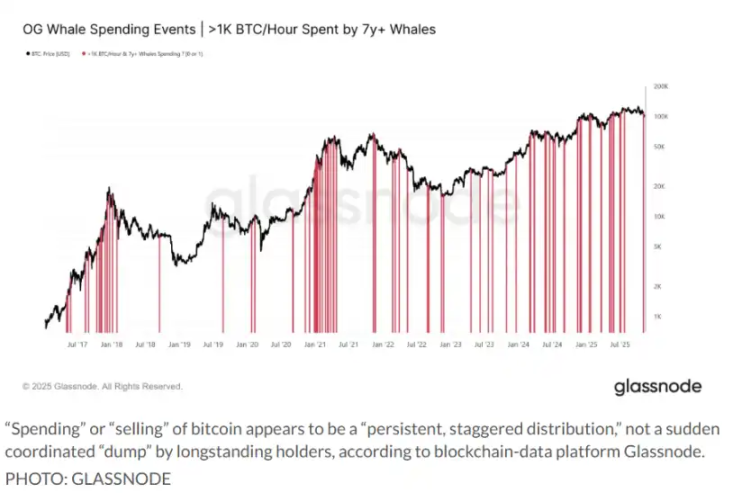

They are the "accelerators" of the bull market, but don't forget, as institutions, they have no faith, only spreadsheets. Once the logic for price increases breaks down, they are the first to pull back. In the past two weeks, their on-chain selling and transfer data have been rising, which is almost identical to the pattern seen in December 2021 and early 2022.

So when you put all this together, you'll find that the current market is very similar to the aftershocks following the 2019 bubble, as well as the prelude to the liquidation wave in 2021.

Combining the above three, you can see the essential state of the current market: it's not that the bull market is over, but the vehicle is too heavy and needs to "unload."

The strength of the bulls has been exhausted, market making depth has been withdrawn, institutional structural demand has weakened, and upward momentum is temporarily depleted.

Of course, this is not yet the "total devastation" at the end of a bear market. There is no extreme panic on-chain, capital has not fully withdrawn, and whales are not panic selling. It's more like the bull market story is only half told, the narrative isn't dead, but the main actors are starting to exit, leaving a melee among the second-tier players.

Back to the key question: is this a new bear market liquidation chain?

From historical experience, on-chain data, market maker reactions, and institutional postures, this indeed has the characteristics of an "early bear market liquidation"—not the kind of obvious crash, but a "chronic ischemia" that gradually makes the market realize the upward logic has been exhausted.

In the next 1–2 months, if BTC continues to repeatedly test the $90,000 support and rebounds remain weak, it can basically be confirmed:

The first half of the bull market is over, and the market has entered a "structural reconstruction period."

But if capital flows back in, depth recovers, and institutions resume buying (though it's tough, as most have already bought in), then this dip is just a "mid-bull market liquidation," similar to the "halftime breaks" in September 2017 and September 2020.

Everything now is at a watershed moment.

In any case, the trend of Bitcoin is always more complex than the charts. The market is deciding who will be the next to take over the liquidation: complete market maker liquidation? DAT model institutions? Crypto banks? Small reserve countries?

We can't clearly predict the trend, but what we can do is put down leverage and avoid wishful thinking.