US Govt and Mt. Gox Shift Millions in Hidden Crypto Transfers

New blockchain movements from the US government and Mt. Gox are drawing trader scrutiny, with delayed creditor payouts helping calm market fears.

Blockchain tool Arkham detected small but impactful moves that could have lasting effects for months.

The US government and Mt. Gox, the defunct Japanese exchange, made significant transfers that have traders watching closely.

US Government Moves Seized Crypto

Blockchain intelligence firm Arkham revealed that the US government recently moved $23,000 worth of WIN tokens on Tron. These assets were seized from Alameda Research nearly two years ago.

ARKHAM ALERT: US GOVERNMENT MOVING FUNDSThe US Government moved $23K of WIN on Tron seized from Alameda Research 2 years ago. pic.twitter.com/98goLfxUrd

— Arkham (@arkham) November 18, 2025

While small in dollar terms, the move signals that authorities are still actively managing high-profile crypto seizures.

Such transfers can precede auctions, compliance actions, or other administrative steps, with minor movements, just like major ones, capable of influencing market sentiment for linked tokens.

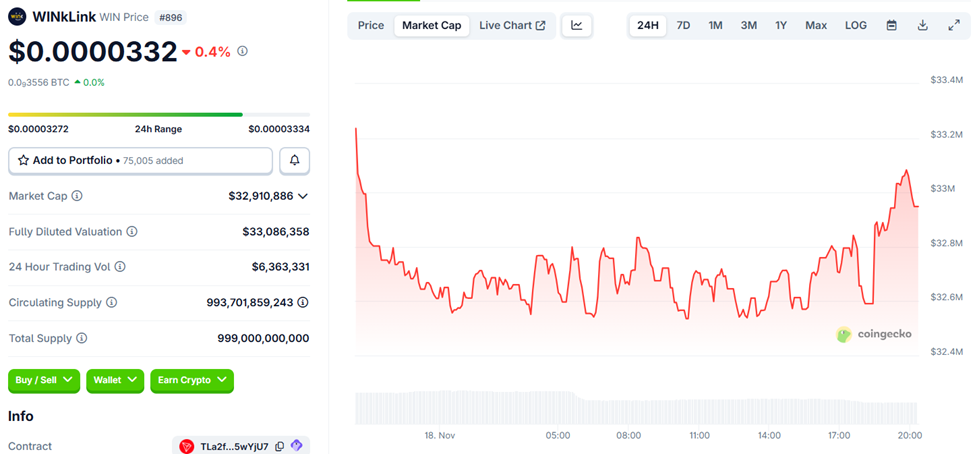

WINkLink (WIN) Price Performance. Source:

WINkLink (WIN) Price Performance. Source:

Data on CoinGecko shows the WINkLink token on Tron was trading for $0.0000332 as of this writing, down by 0.4% in the last 24 hours.

Mt. Gox Transfers $16.8 Million in Bitcoin

More attention is focused on Mt. Gox, which transferred 185 BTC, valued at approximately $16.8 million, to the following a test transaction. An additional $936 million in Bitcoin was shifted to another Mt. Gox wallet, according to Arkham.

MT GOX JUST TRANSFERRED $16.8M OF $BTC TO KRAKENMt Gox just transferred 185 BTC ($16.8M) to Kraken after a test transaction. $936M of change BTC has been moved to another Mt. Gox wallet.Mt. Gox made their last major movement 8 months ago, depositing $77.4M worth of Bitcoin to… pic.twitter.com/5YQYJqqxBw

— Arkham (@arkham) November 18, 2025

This follows the exchange’s last major transfer, eight months ago, when $77.4 million in Bitcoin was sent to Kraken for creditor distributions.

On October 27, Mt. Gox announced that Bitcoin repayments will now occur by October 31, 2026. This locks 34,689 BTC, approximately $4 billion, and temporarily removes a significant source of potential selling pressure.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” rehabilitation trustee Nobuaki Kobayashi stated in the letter, citing court approval for the one-year extension.

Analysts say the delay calms Mt. Gox FUD and provides near-term market clarity. By pushing the next major liquidity event out by a year, investors gain stability and confidence amid delayed selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON’s DeFi Transformation: Ending the Algorithmic Era to Embrace a Stability-Secured Tomorrow

- TRON's USDJ algorithmic stablecoin ends after 5.5 years, transitioning to a fixed 1 USDJ = 1.5532 TRX rate as part of strategic realignment. - The shift reflects TRON's focus on liquidity-backed stablecoins like USDD, aligning with industry trends toward overcollateralized models for market stability. - USDJ's decline followed waning liquidity and persistent undervaluation, prompting a phased wind-down to eliminate confusion and provide clear exit paths for holders. - Community reactions are mixed, with

Cloudflare Disruption Highlights the Inherent Dangers of Centralized Internet Infrastructure

- Cloudflare's Nov 18 global outage disrupted services for ChatGPT, X, Shopify , and crypto platforms due to a configuration file error exceeding expected size limits. - The incident caused 500 errors affecting 20% of Cloudflare-dependent websites, with 5,000+ user complaints reported at peak disruption. - Shares fell 4% premarket as experts warned about systemic risks from internet infrastructure consolidation, highlighting vulnerabilities exposed by outages at Amazon , Microsoft , and now Cloudflare . -

New Toku–PDAX partnership lets Filipino workers receive pay in stablecoins