Standard Chartered Sees Year-End Bitcoin Rally Amid Sell-Off Signals

Bitcoin’s pullback may be nearing exhaustion, with Standard Chartered expecting a year-end rally even as macro pressures and technical signals keep volatility high. Traders now watch liquidity trends and on-chain metrics to gauge the next move.

Bitcoin (BTC) is pulling back again after slipping below the $90,000 psychological level. Amid the ongoing recovery, Standard Chartered signals that the recent sell-off may have run its course.

Elsewhere, BitMine chairman Tom Lee says if the Bitcoin price manages to achieve a new all-time high this year, it would obviate the fact that there is a four-year cycle.

Bitcoin Set for Year-End Rally, Standard Chartered Says

In an email to clients, the bank’s Head of Digital Asset Research noted the recent pullback “is nothing more than a fast, painful version of the third one of the past couple of years.”

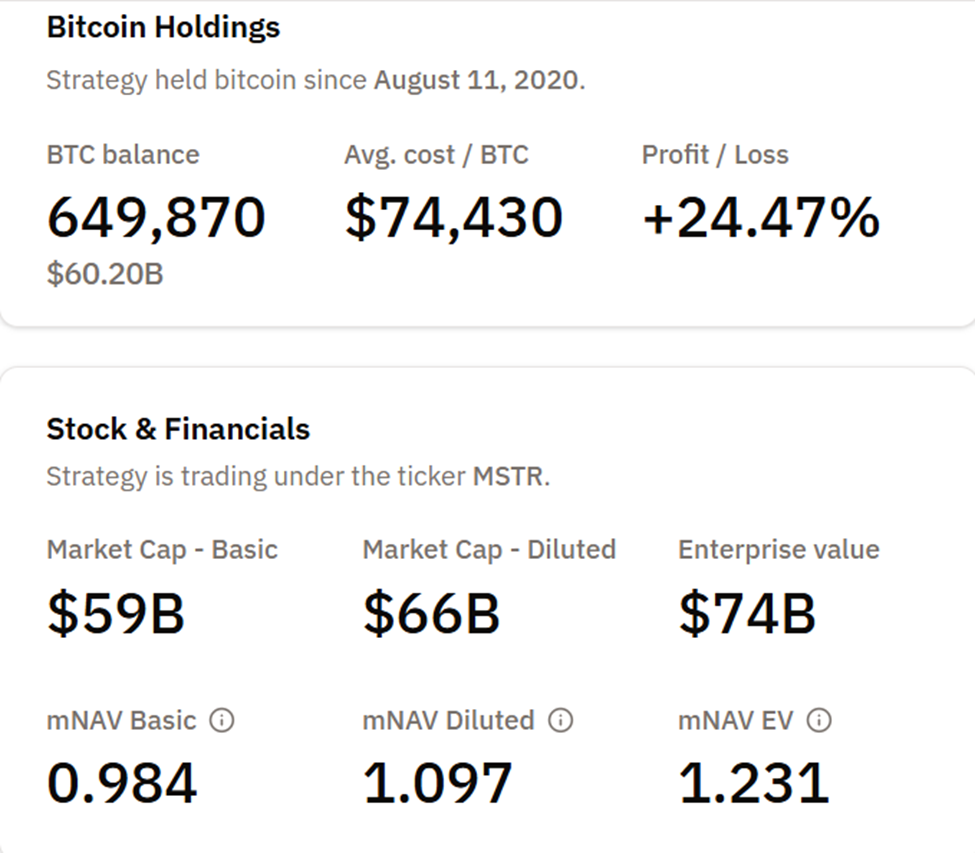

According to Geoff Kendrick, multiple on-chain metrics have reached absolute lows, including MicroStrategy’s mNAV, which is now at 1.0.

MicroStrategy mNAV. Source:

Bitcoin Treasuries

MicroStrategy mNAV. Source:

Bitcoin Treasuries

“A rally into year-end is my base case,” Kendrick said in the email.

On-chain analyst Ali highlighted that Bitcoin’s realized loss margin currently stands at -16%, which is below the -12% threshold historically associated with rebounds.

Bitcoin $BTC usually rebounds when traders’ realized loss margin falls below -12%. It’s now sitting at -16%.

— Ali

Additionally, the SuperTrend indicator on the weekly chart, which has consistently flagged major trend shifts since 2014, recently flipped to sell mode. Past signals have resulted in declines averaging 61%, indicating potential near-term volatility.

“Applying that average to the current market structure points to a potential move toward $40,000,” the analyst stated.

These mixed signals reflect a market caught between historical corrective patterns and bullish expectations from major financial institutions.

Macro Context: Liquidity vs. Opportunity Cost

Despite a $7 trillion increase in global M2 money supply since late 2024, Bitcoin has struggled to capitalize on the liquidity surge fully. EndGame Macro explained that, while the global liquidity pool remains historically high, much of the capital is being absorbed by government debt issuance and short-term instruments that pay yields of 4–5%.

“The way I see it, liquidity is being taxed,” the analyst noted.

With risk-free alternatives yielding tangible returns, speculative assets like Bitcoin face a higher opportunity cost.

This dynamic has contributed to choppy trading, with sharp bounces when shorts get crowded and sudden drops triggered by macro jitters. This reflects a more cautious investor environment.

Bullish commentators argue Bitcoin’s current price reflects undervaluation, suggesting the cryptocurrency could reach $150,000 amid ongoing monetary expansion. Meanwhile, Skeptics say that the correlation between liquidity and BTC price is no longer straightforward, citing competing market forces and regulatory nudges toward safer assets.

Traders and investors should brace for continued volatility as leverage unwinds and macro positioning adjusts.

Standard Chartered’s forecast of a year-end rally hinges on the assumption that the sell-off has exhausted its momentum. Still, risks remain in the form of potential corrections or policy-induced market swings.

On-chain metrics, including realized loss margins and SuperTrend signals, will likely remain key indicators for timing entries and exits.

As 2025 draws to a close, Bitcoin could either rebound in line with institutional forecasts or continue trading as a volatile, non-yielding asset, amid a macro environment that increasingly rewards caution.

Investors must conduct their own research and watch both liquidity flows and policy signals to gauge the next leg of price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano News Update: Frustrated Operator Uses AI to Disrupt Cardano Blockchain, Prompting Urgent Repairs

- Cardano (ADA) faced a chain split from a "premeditated attack" exploiting a 2022 ledger bug, forcing an emergency network upgrade. - A user submitted a malformed delegation transaction bypassing validation checks, creating competing "poisoned" and "healthy" chains. - ADA's price dropped 6% during the incident, with $91M in short leverage, as developers patched the bug and restored consensus. - The attacker, identified as "Homer J.", apologized for using AI-generated commands, while experts highlighted Ca

Solana Updates Today: Sunrise: Solana's Gateway to Online Capital Markets

- Wormhole Labs launches Sunrise, a Solana liquidity gateway enabling direct onboarding of external assets like Monad's MON token via NTT framework. - The platform unifies liquidity across Solana DEXs and block explorers, addressing fragmented bridging challenges through native token transfers. - By designating Sunrise as Monad's primary entry point, Wormhole aims to capture early trading flows and expand support to tokenized commodities and RWAs. - This initiative strengthens Solana's DeFi infrastructure,

Zcash News Today: Institutions Place Their Bets on Zcash’s Quantum Security While Bitcoin Falls Behind

- Zcash developers prioritize quantum-resistant upgrades via modular design, outpacing Bitcoin's slower response to post-quantum threats. - Electric Coin Company integrates NIST-standard algorithms like CRYSTALS-Dilithium, with quantum recoverability protocols nearing completion for 2025 deployment. - Institutional $18M ZEC purchase and 125% price surge highlight market confidence in Zcash's shielded pools and proactive quantum resilience strategy. - Bitcoin lacks concrete post-quantum roadmap despite Vita

Solana News Update: Sunrise Connects Conventional Finance with Blockchain Technology on Solana

- Sunrise, a new platform by Wormhole Labs, streamlines cross-chain token onboarding for Solana via unified gateway. - Launched alongside Monad’s MON token, it addresses Solana’s fragmented liquidity and complex integration challenges. - Using Wormhole’s NTT infrastructure, it ensures fungibility and enables immediate trading on Solana DEXs like Jupiter. - The platform aims to attract investors and expand to tokenized commodities and stocks, bridging traditional finance with blockchain.