HBAR Price’s 25% Crash May Extend As Traders Fail To Pick A Direction

Hedera faces intensified selling pressure after a sharp weekly decline. Trader indecision and weakening indicators suggest HBAR may extend its correction.

Hedera’s price is under sharp pressure as the altcoin faces a significant decline driven by weakening market sentiment. HBAR has struggled to regain momentum after a steep pullback, and ongoing bearish conditions suggest further downside risk.

Traders remain cautious, and the broader market environment is offering little support for a recovery.

Hedera Futures Market Shows Uncertainity

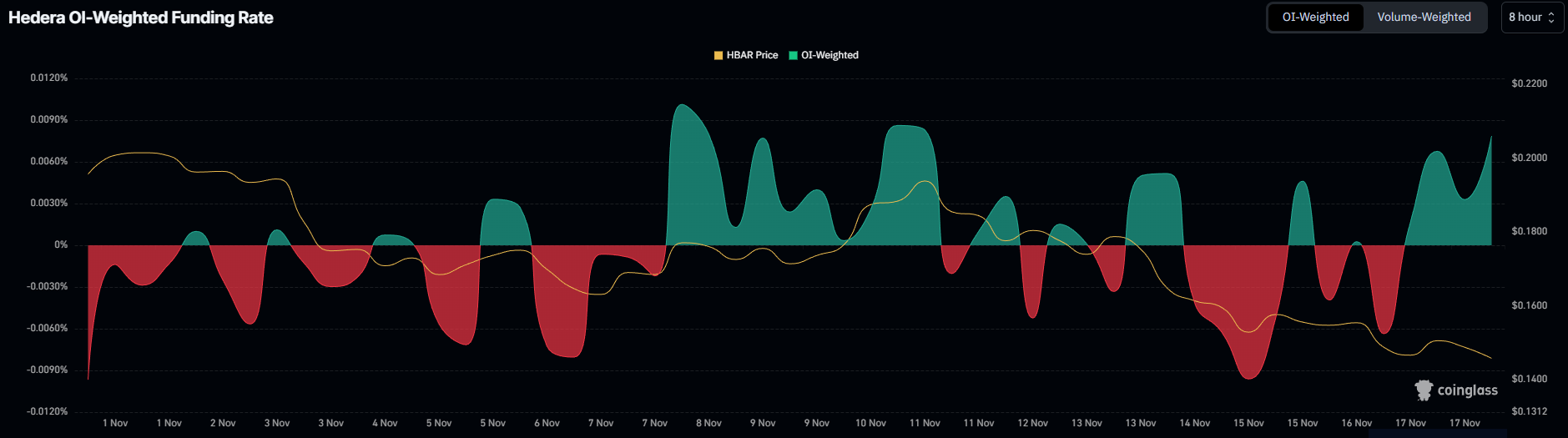

HBAR’s funding rate has fluctuated notably over the past several days, highlighting an absence of trader conviction. This inconsistency reflects uncertainty among market participants, who are reluctant to take decisive long or short positions. Such hesitation often keeps prices directionless and vulnerable to continued losses.

The lack of clear sentiment direction is bearish for Hedera at this stage. Funding rate instability typically signals indecision, which can weaken support levels and extend volatility during downtrends.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

The Relative Strength Index is dropping and currently sits below the neutral 50.0 mark, signaling a shift into bearish territory. Positioned closer to the oversold threshold of 30.0, the indicator suggests that downward momentum remains strong. This trend does not favor immediate recovery, as sellers continue to dominate.

Although assets often rebound once they enter oversold conditions, HBAR has yet to reach that zone. Until the RSI dips further, the bearish pressure is likely to persist. This signals that the altcoin may face additional weakness before any significant reversal emerges.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price Could Continue Its Decline

HBAR has fallen 25% over the last week and trades at $0.144, hovering near the $0.145 level. The steep decline has pushed the token into a vulnerable position where bearish sentiment continues to overshadow attempts at stabilization.

Based on current indicators, HBAR could slip below its $0.139 support level. A drop to $0.133 or even $0.120 is possible if selling accelerates and market conditions worsen. Such a move may trigger panic among investors and deepen the correction.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If HBAR manages to hold the $0.145 support and bounce, the price could attempt a recovery toward $0.154. A breakout above that level may open the path to $0.162 or even $0.175. This scenario would invalidate the bearish outlook and signal renewed buyer interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi