Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising

Institutional Adoption: Driving Expansion

Hyperliquid’s traction among institutions has grown rapidly, thanks to collaborations with leading crypto entities. The creation of the HYPE Digital Asset Treasury (DAT) through a merger with Rorschach I LLC—a company linked to Paradigm Operations LP—has been pivotal. This $888 million transaction, which combines existing HYPE holdings and $305 million in cash, is set to establish a $1 billion DAT dedicated to acquiring and retaining HYPE tokens. Although the shareholder vote was postponed by two weeks to achieve the necessary majority,

Recent alliances have further strengthened this institutional support. In October 2025,

Market Sentiment and Technical Factors

Analysis of HYPE’s Q3 2025 market performance shows a mixed yet sturdy path. After

Despite these ups and downs, on-chain indicators remain strong.

Wider Market Landscape and Strategic Endurance

Hyperliquid’s advancement comes at a time when the broader DAT sector is experiencing a downturn, with fewer new treasury entities being announced and shrinking overall market capitalizations. Despite these headwinds, Hyperliquid Strategies has not been discouraged,

Nonetheless, macroeconomic trends remain crucial.

Summary

The surge in Hyperliquid’s price highlights the influence of institutional involvement and strategic governance within decentralized trading. Although there are ongoing challenges such as volatility and manipulation threats, the token’s strong on-chain performance, expanding collaborations, and positive technical indicators make it a noteworthy asset in the diverse crypto market. The upcoming months will be pivotal for investors to see if HYPE can move beyond its current consolidation and establish itself as a key player in institutional-grade DeFi.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

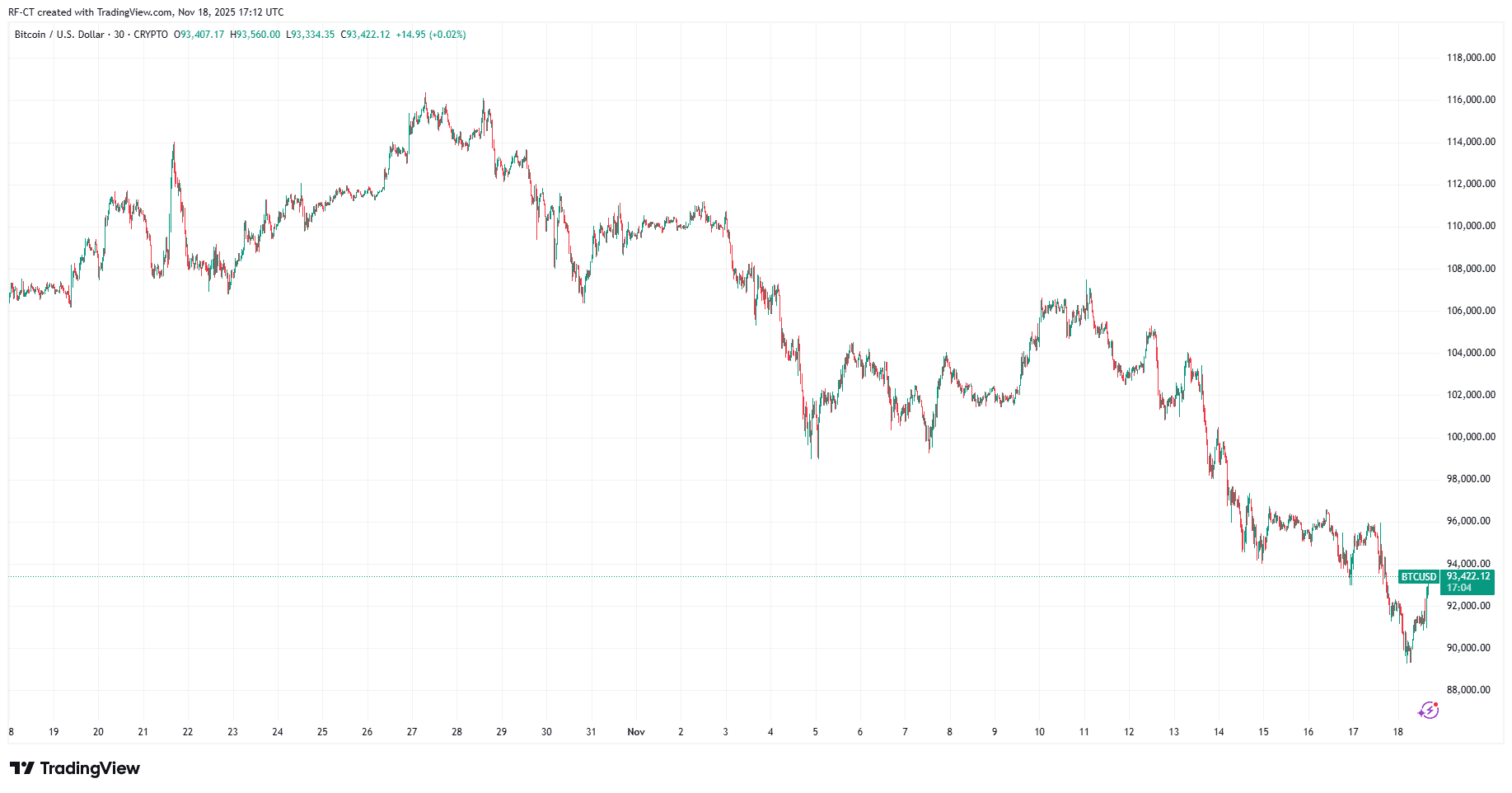

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio