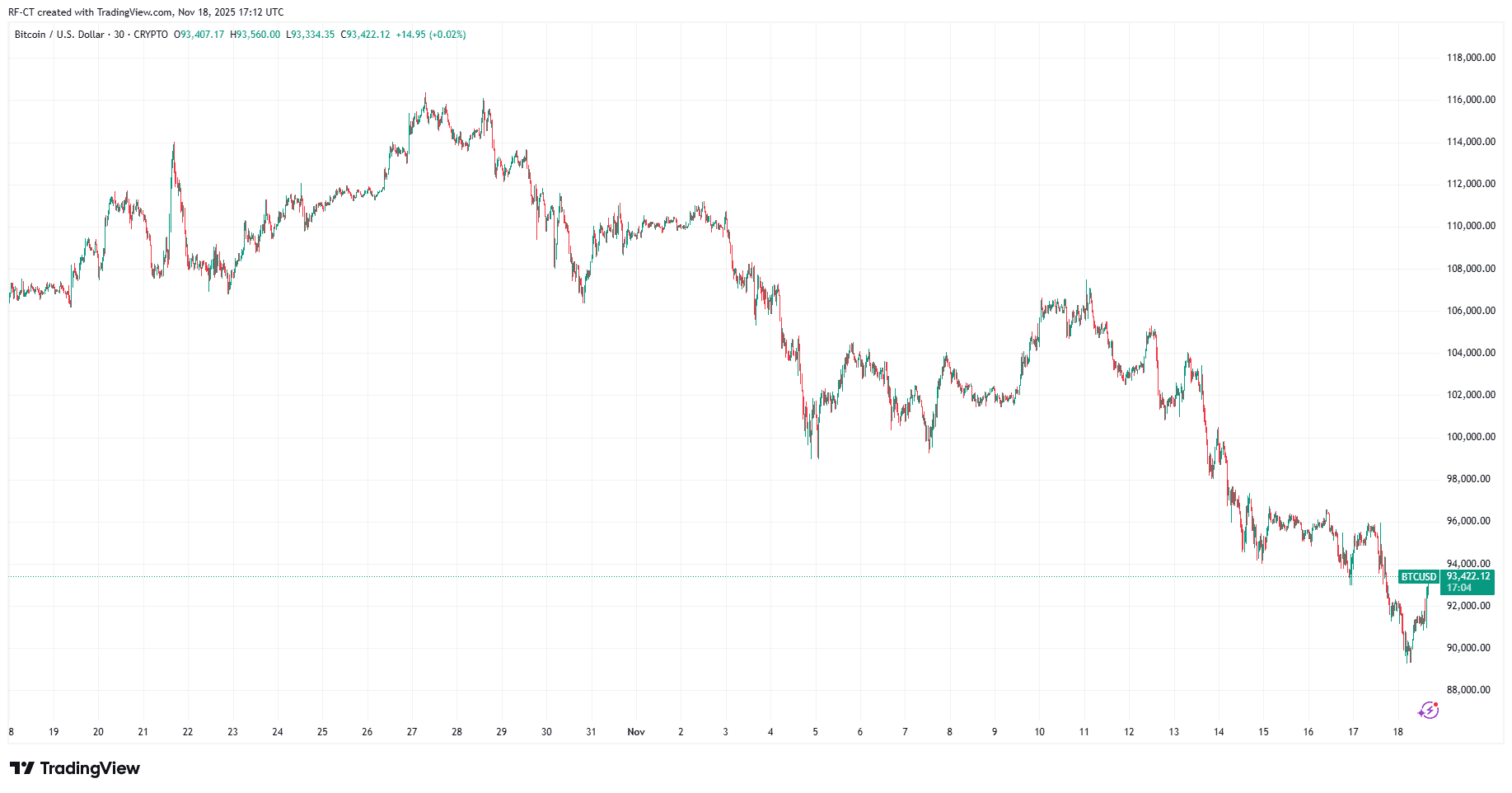

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

Bitcoin has dropped to its lowest point in seven months, hovering around $89,250, which has led to discussions among experts about whether the cryptocurrency is approaching a significant bottom or facing an extended downturn. Technical signals indicate that a revisit to the $82,400 mark is possible, while

The latest decline has wiped out Bitcoin’s gains for 2025, with the price now sitting 30% below its all-time high of $126,200 set in October

Michael Saylor, MicroStrategy’s CEO, has reaffirmed his commitment to

Market sentiment has taken a sharp downturn, with the Fear & Greed Index

Technical analysts, including Plan C, anticipate that the current correction will be brief—similar to the earlier dip to $75,000 this year—followed by a rebound to the $111,000–$116,000 range by year’s end

Despite ongoing volatility, the wider crypto sector is demonstrating strength.

The next few weeks will be pivotal for Bitcoin’s direction. With economic headwinds and key technical levels under scrutiny, whether the market can stabilize—and if whale accumulation leads to a sustained uptrend—will determine if the projected 40% rally happens before the year ends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio