Key Market Information Discrepancy on November 19th - A Must-Read! | Alpha Morning Report

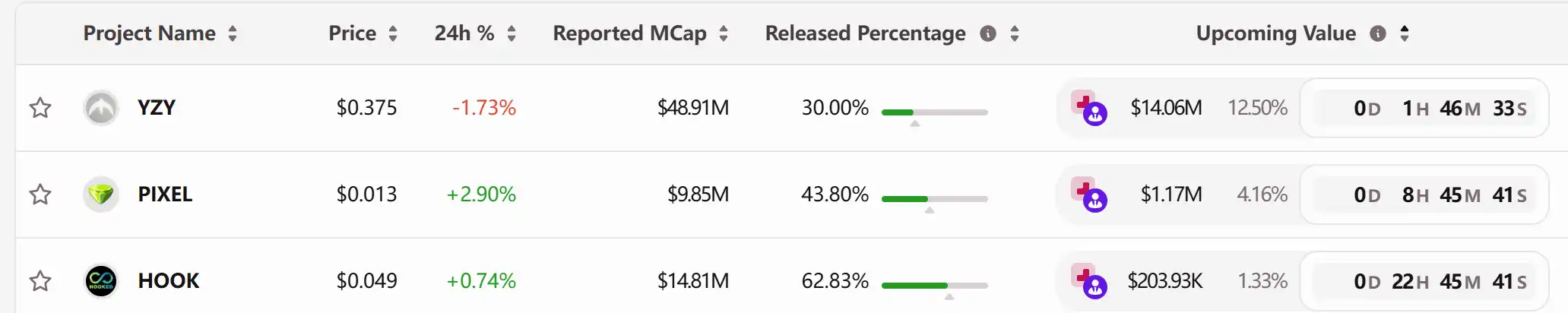

1. Top News: This Thursday, the U.S. will fill in missing employment data and release a new set of economic data. 2. Token Unlock: $TZT, $PIXEL, $HOOK

Featured News

1.Starting This Thursday, the U.S. Will Fill in Missing Jobs Data and Release a New Batch of Economic Data

2.Market Revisits December Rate Cut Bet Amid "Missing Data to Be Filled In" News

3.U.S. Three Major Stock Indexes Fall, Crypto Concept Stocks Rebound Against the Trend

4.ASTER Surges Over 9% in 24 Hours, Market Cap Reaches $32.72 Billion

5.FORM Surges Over 18% in 24 Hours, Market Cap Reaches $169 Million

Articles & Threads

1. "Compliance Privacy, Ethereum's Latest Privacy Big Upgrade Kohaku What Is It?"

On November 16, Ethereum founder Vitalik showcased Kohaku at Devcon 2025 in Buenos Aires, Argentina, a set of privacy-first tools for the Ethereum ecosystem aimed at enhancing the privacy and security of the Ethereum ecosystem. What exactly is Kohaku? How will it achieve privacy? Is privacy becoming increasingly important in the Ethereum ecosystem?

2. "Cryptocurrency Projects Still Queuing for Listing in This Bear Market"

The intersection of crypto and traditional finance is happening faster than anyone imagined. Trading platforms acquiring infrastructure, perpetual contract platforms launching stock indexes, stablecoins entering payment networks, BlackRock's BUIDL Fund turning on-chain dividends into daily operations, and even intercontinental trading platforms are willing to bet up to $2 billion for a prediction market platform. Cryptocurrency companies going public is no longer a symbol of "betraying the blockchain," but rather traditional finance actively reaching out, wanting to lock the next round of growth into their system.

Market Data

Daily Market Overall Funding Heatmap (based on Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buterin: Quantum Computing May Undermine Confidence in Crypto by 2028

- Ethereum co-founder Vitalik Buterin warns quantum computing could break Bitcoin/Ethereum's ECC security by 2028, enabling private key theft. - Quantum-resistant cryptography migration is urgent as tech giants advance 1000s-qubit systems, with ECC-breaking machines expected by 2030. - Industry faces dual challenges: developing post-quantum algorithms while maintaining blockchain functionality during complex decentralized upgrades. - Buterin urges accelerated global collaboration, highlighting that delayed

Pi Network's Journey: Evolving from a Community Movement to an International Travel Platform

- Pi Network launches Pitogo Testnet token, enabling travel bookings via decentralized platform to expand real-world utility. - Over 770,000 Pi coins migrated to mainnet in 24 hours, signaling readiness for broader applications ahead of v24.1.0 protocol upgrade. - MiCA-compliant whitepaper reveals EU market entry plans, positioning Pi as non-custodial layer-1 crypto aligned with global regulatory standards. - Ecosystem advances include Pi App Studio upgrades and Sesame Exchange airdrops, accelerating devel

Bitcoin News Update: Hayes Moves Crypto Holdings to Zcash, Anticipates Surge Fueled by Privacy

- Arthur Hayes transferred $2.5M in ETH/ENA to institutional market makers, sparking speculation about Zcash (ZEC) accumulation ahead of Bitcoin's 25% decline. - He advocates ZEC > XRP , forecasting $10k-$20k prices, while attributing BTC's slump to U.S. dollar liquidity contraction rather than macroeconomic shifts. - Market volatility pushed Fear & Greed Index to "extreme fear," yet Hayes predicts 2026 U.S. midterms-driven liquidity will reignite Bitcoin amid $500B global central bank injections. - Zcash'

Ethereum Updates Today: The Fall of Ethereum DAT Highlights the Vulnerability of Crypto's Institutional Aspirations

- Ethereum's $1B DAT project collapsed, refunding $200M amid crypto market volatility and regulatory uncertainty. - The initiative aimed to bridge traditional finance and crypto but reversed due to risk aversion and macroeconomic pressures. - Ethereum prices dipped below $3,100 while Bitcoin fell below $91,000, reflecting broader market turbulence and liquidity challenges. - Project creators may relaunch DAT if conditions stabilize, emphasizing risk management over short-term crypto ambitions.