LIBRA Price Pumps 30% as Investigators Uncover a Political Bombshell

LIBRA suddenly surged more than 30% today—just hours after Argentina’s investigative commission published a 200-page report accusing the token’s organizers and political allies of running a coordinated rugpull. Lawmakers claim insider trading, executive obstruction, and “inescapable” presidential responsibility.

The LIBRA price surged more than 30% on Wednesday, even as Argentina’s Congress released a devastating 200-page report accusing the token’s organizers and political allies of orchestrating a coordinated rug pull.

The explosive findings have sent shockwaves through the country’s crypto and political spaces, turning LIBRA into the most controversial token of the week.

LIBRA Pumps Over 30% in the Middle of a Scandal

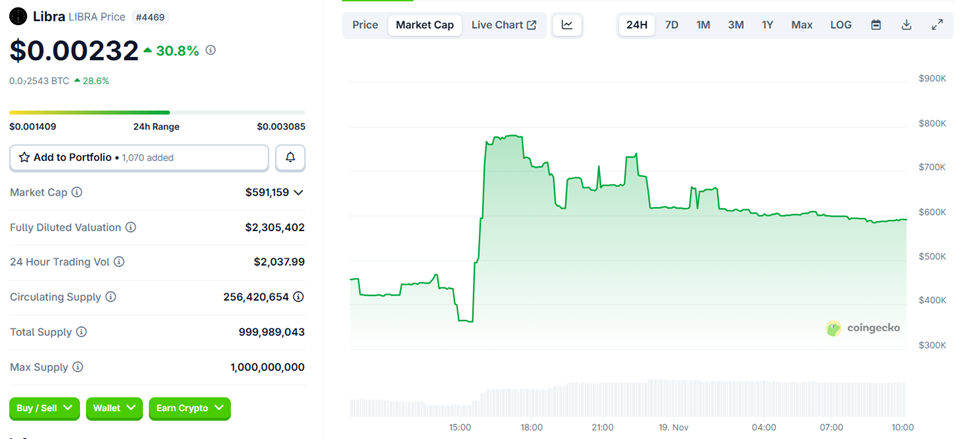

As of this writing, LIBRA was trading at $0.00232, representing an increase of almost 31% in the last 24 hours. The abrupt price spike comes at a tense moment, only hours after the climax of Argentina’s LIBRA investigation.

LIBRA Price Performance. Source:

CoinGecko

LIBRA Price Performance. Source:

CoinGecko

Hours earlier, the Investigative Commission formally submitted its final report to the Chamber of Deputies, concluding that “LIBRA was not an isolated incident,” according to Commission president Maxi Ferraro.

The report draws on months of testimony, blockchain forensics, expert analysis, and more than 2,000 pages of documentation.

In his public statement, Maxi Ferraro, President of the LIBRA Investigative Commission, said the evidence shows a consistent “pattern of behaviors and responsibilities” across multiple previous token schemes, including the 2024 $KIP operation.

Maxi Ferraro, President of the LIBRA Investigative Commission

Maxi Ferraro, President of the LIBRA Investigative Commission

The Commission asserts that LIBRA followed the same formula, citing:

- Misleading marketing,

- Rapid hype amplification,

- Insider positioning, and

- An orchestrated exit.

LIBRA Was a Textbook Rug Pull, Investigators Say

According to the report, the February 14 launch of LIBRA was engineered as a classic rug pull. Investigators argue the President’s tweet, described in the report as the “determining factor” behind LIBRA’s sudden price spike, created the perfect liquidity surge for insiders to cash out.

The contract address was first revealed in the President’s own post on X (Twitter), enabling immediate public exposure and a surge of retail traders.

That rush proved devastating as the Commission found that:

- 87 wallets traded on insider information in the 22 seconds before Milei’s post went live.

- Of those, 36 wallets earned more than $1 million each,

- More than 114,000 retail investors were wiped out.

These findings further challenge Milei’s televised denial of widespread losses after initial reports cited over 1,300 Argentines affected by LIBRA’s crash.

“This task laid bare, without any room for doubt, the workings of a scam operation, whose highest political responsibility lies with the President, who allowed a few to collude in order to harm more than 111,000 victims,” said Esteban Pauló, one of the National Deputies elected in Argentina’s Santa Fe Province.

Financial Links and Prior Coordination

Investigators say they traced financial and operational links between the key organizers, comprising Novelli, Terrones Godoy, Hayden Davis, and Sergio Morales, and previous token schemes.

These links were “confirmed by the judiciary,” according to the report, establishing continuity between LIBRA, KIP, and other prior projects promoted or amplified by political figures.

Ferraro emphasized that the President’s political responsibility is inescapable, citing prior meetings with organizers, ignored warnings, and repeated attempts to obstruct legislative oversight.

Deputy Sabrina Selva echoed this conclusion, saying LIBRA was never a real investment project, but a coordinated operation in which a few walked away with millions.

$LIBRA NO FUE UN HECHO AISLADO. Milei tenía vínculo previo con los gestores de $LIBRA y la promocionó como un proyecto de inversión que NUNCA existió. Hubo pocos que se llevaron millones y el Presidente garantizó que eso suceda con su tweet aquel 14 de febrero. 🔗 Les… pic.twitter.com/CRD37oPE9Q

— Sabrina Selva (@SabriSelva) November 19, 2025

Obstruction and Institutional Silence

The report outlines what it describes as systematic obstruction by executive agencies, including the Ministry of Justice, UIF, CNV, and OA, which allegedly refused to provide documents or testimony.

Karina Milei is also cited for facilitating access to the Casa Rosada for organizers and declining to appear before the Commission.

Investigators further accuse the judiciary of undermining parliamentary oversight by denying access to key case materials.

Despite the avalanche of allegations, LIBRA’s price rally highlights how speculative crypto markets can behave in moments of political drama.

Traders appear to be betting on volatility rather than fundamentals, even as the token becomes the center of a national scandal.

With the congressional report now public, pressure is mounting on Argentina’s political leadership. Therefore, the LIBRA saga may be far from over.

President Milei has yet to comment publicly on the matter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Berachain's Unique Refund Conditions Raise MFN Issues in Cryptocurrency Agreement"

- Berachain co-founder Smokey dismissed a $25M refund clause for Nova Digital as "inaccurate," citing compliance needs for Brevan Howard's Abu Dhabi fund. - The clause allows Nova to reclaim its investment until Feb 2026 if $5M is deposited post-TGE, but activation remains unconfirmed. - Four crypto attorneys called the refund mechanism "highly unusual," raising concerns about potential violations of "Most Favored Nation" investor clauses. - Smokey denied MFN breaches, noting no other Series B investors re

Paxos Purchases Fordefi to Drive a New Era of Secure Institutional Crypto Custody

- Paxos acquires Fordefi for over $100 million to strengthen institutional crypto custody. - The deal integrates Fordefi's MPC wallet tech and DeFi tools into Paxos's regulated infrastructure. - This marks Paxos's second 2025 acquisition, reflecting growing demand for secure digital asset solutions. - Fordefi's $28M prior funding and institutional client base (300+) enhance Paxos's market position. - The move aligns with industry trends as firms prioritize secure, scalable crypto infrastructure amid regula

Across Connects 21 Blockchains: One-Click Bridging Integrates DeFi into a Unified Ecosystem

- Across Protocol introduces a single-click cross-chain swap feature, bridging 21+ blockchains in one seamless transaction. - The "intents architecture" automates routing and execution, reducing transaction failure rates to 2.3% and cutting transfer times to 8–15 seconds. - By unifying bridge and swap functions, it addresses DeFi inefficiencies, enabling users to access liquidity across chains without manual juggling. - Positioned among mid-tier cross-chain solutions, Across supports 28 chains, competing w

Security Assessments Propel Mutuum’s $18.9M Presale Surge

- Mutuum Finance (MUTM) raised $18.9M in Phase 6, with 90% of tokens sold ahead of a 20% price hike in Phase 7. - Token price surged 600% since Phase 1, driven by structured pricing, community rewards, and expanded payment options. - Halborn and CertiK audits validate smart contracts, a key step before Q4 2025 testnet launch supporting ETH/USDT. - The dual-model protocol combines pooled liquidity with P2P lending, using mtTokens for staking and liquidity management. - Analysts highlight security validation