Bitwise CIO pushes back on bear market fears, says institutions want Bitcoin's value as a 'service'

Quick Take Bitwise CIO Matt Hougan said Bitcoin’s value comes from its role as a digital wealth-storage “service” without relying on governments, banks, or other third parties. Hougan argued that rising institutional demand for that service underpins Bitcoin’s long-term trajectory, despite recent market pullback concerns.

Bitwise Chief Investment Officer Matt Hougan pushed back on fears of a deeper Bitcoin downturn, arguing that the asset's long-term value stems from the "service" it provides rather than near-term price action.

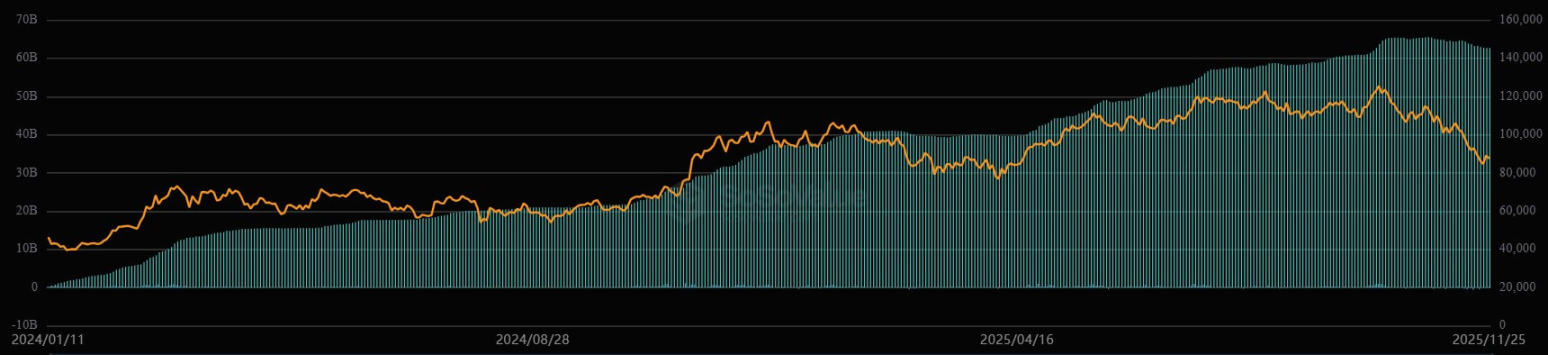

Bitcoin has fallen around 27.5% since its all-time high of almost $126,000 on Oct. 6, briefly dipping below the $90,000 level this week, according to The Block's BTC price page . However, in a memo to clients late Tuesday, Hougan said he remains unconcerned about the current pullback, which he views as short-term in nature.

Hougan said he routinely begins advisor discussions by addressing a basic question: why does Bitcoin have any value at all? It doesn't generate profits, cash flow, or dividends, and it can't be physically touched, he noted, leading many to question how it can command a $2 trillion market cap. The answer, Hougan said, is to stop viewing Bitcoin as an object and instead see it as a service.

Bitcoin as a digital wealth-storage service

According to Hougan, Bitcoin's service is the ability to store wealth digitally without relying on a government, bank, or other third party. Reframing it this way, he argued, removes the skepticism some feel toward buying something intangible, as we are all used to services having value, drawing a comparison to Microsoft.

"To say something obvious: The value of Microsoft's stock is tied to how many people want its service," Hougan said, adding that Bitcoin operates under a similar demand curve. "The more people who want Bitcoin's service, the more valuable it becomes; if fewer people wanted its service, the value would be lower; if no one wanted Bitcoin's service, its value would be zero," he wrote. But unlike Microsoft, "you can't subscribe to or rent Bitcoin's service. The only way you get the service is to buy the asset."

He pointed to Bitcoin's approximate 28,000% gain over the past decade as evidence of rising demand for that service. Today, he said, institutions such as Harvard's endowment , the Abu Dhabi sovereign wealth fund , prominent investors including Ray Dalio and Stan Druckenmiller, state pensions, and millions of individual holders all want access to it.

"In our increasingly digital age, with governments piling up more and more debt, I'm guessing a lot more people will want its service in the future," he concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infinex will launch a Sonar token sale, aiming to raise $15 million.

Texas establishes Bitcoin reserves—why choose BlackRock BTC ETF as the first option?

Texas has officially taken the first step and is likely to become the first state in the United States to designate bitcoin as a strategic reserve asset.

The four-year cycle of bitcoin has ended, replaced by a more predictable two-year cycle.

Exploring alternative frameworks for assessing cycles of prosperity and depression in the future era.