Paxos Labs and LayerZero Launch USDG0 Stablecoin Infrastructure

Quick Breakdown

- USDG0 brings fully backed USDG stablecoins to the Hyperliquid, Plume, and Aptos ecosystems.

- Built on LayerZero’s Omnichain Fungible Token standard, enabling cross-chain, compliant liquidity.

- Supports yield-aligned trading, lending, and treasury operations for DeFi applications.

Paxos Labs, in collaboration with LayerZero, has unveiled USDG0, the next evolution in stablecoin infrastructure, extending the reach of the regulated Global Dollar (USDG) across multiple blockchain ecosystems. The launch introduces USDG0 to Hyperliquid, Plume Network, and Aptos, enabling seamless, compliant stablecoin usage and liquidity directly within decentralized finance (DeFi) applications.

Announcing USDG0: the next evolution of stablecoin infrastructure.

Developed by Paxos Labs and powered by @LayerZero_Core , USDG0 brings the @global_dollar (USDG) to every ecosystem starting with @HyperliquidX , @PlumeNetwork , and @Aptos . 🧵 pic.twitter.com/PDsJUaQ5Kf

— Paxos Labs (@paxoslabs) November 18, 2025

USDG, issued by Paxos and governed by the Global Dollar Network (GDN), is fully backed 1:1 by U.S. dollars held in regulated financial institutions. Since 2018, Paxos has overseen over $180 billion in tokenization activity, providing institutional-grade stability to digital assets . USDG0 leverages LayerZero’s Omnichain Fungible Token (OFT) standard to enable the Global Dollar to move safely across different blockchain networks, creating interoperable and compliant liquidity opportunities.

Expanding stablecoin utility across DeFi ecosystems

The first phase of USDG0 rollout integrates Hyperliquid, Plume, and Aptos, each highlighting unique benefits for decentralized finance and tokenized yield generation. On Hyperliquid, USDG0 supports deep liquidity and yield-aligned trading across HyperEVM and HIP-3 markets, powering incentive-aligned lending and Hyperbeat’s Liquid bank. Aptos benefits from Paxos’ enterprise-grade stablecoin rails on a high-performance Layer 1 blockchain, while Plume enhances cross-chain liquidity and treasury management.

Across all three ecosystems, USDG0 enables applications and protocols to embed stablecoin liquidity natively, earn yield aligned with treasury benchmarks, and bridge value between networks without friction.

Bringing institutional stability to next-gen finance

USDG0 represents a major step toward integrating regulated, fully-backed stablecoins into scalable DeFi infrastructure. By combining institutional-grade stability with omnichain functionality, Paxos and LayerZero aim to foster secure, interoperable, and yield-efficient environments for users and developers across multiple networks. The rollout marks a critical milestone in making compliant stablecoin liquidity a foundational component of modern decentralized finance.

Notably, Aptos Labs announced the acquisition of HashPalette Inc., a subsidiary of HashPort Inc. and the developer of the Palette blockchain. This acquisition is part of Aptos’ strategic initiative to strengthen its foothold in Japan’s rapidly growing blockchain ecosystem, further enhancing its value proposition for users and partners alike.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

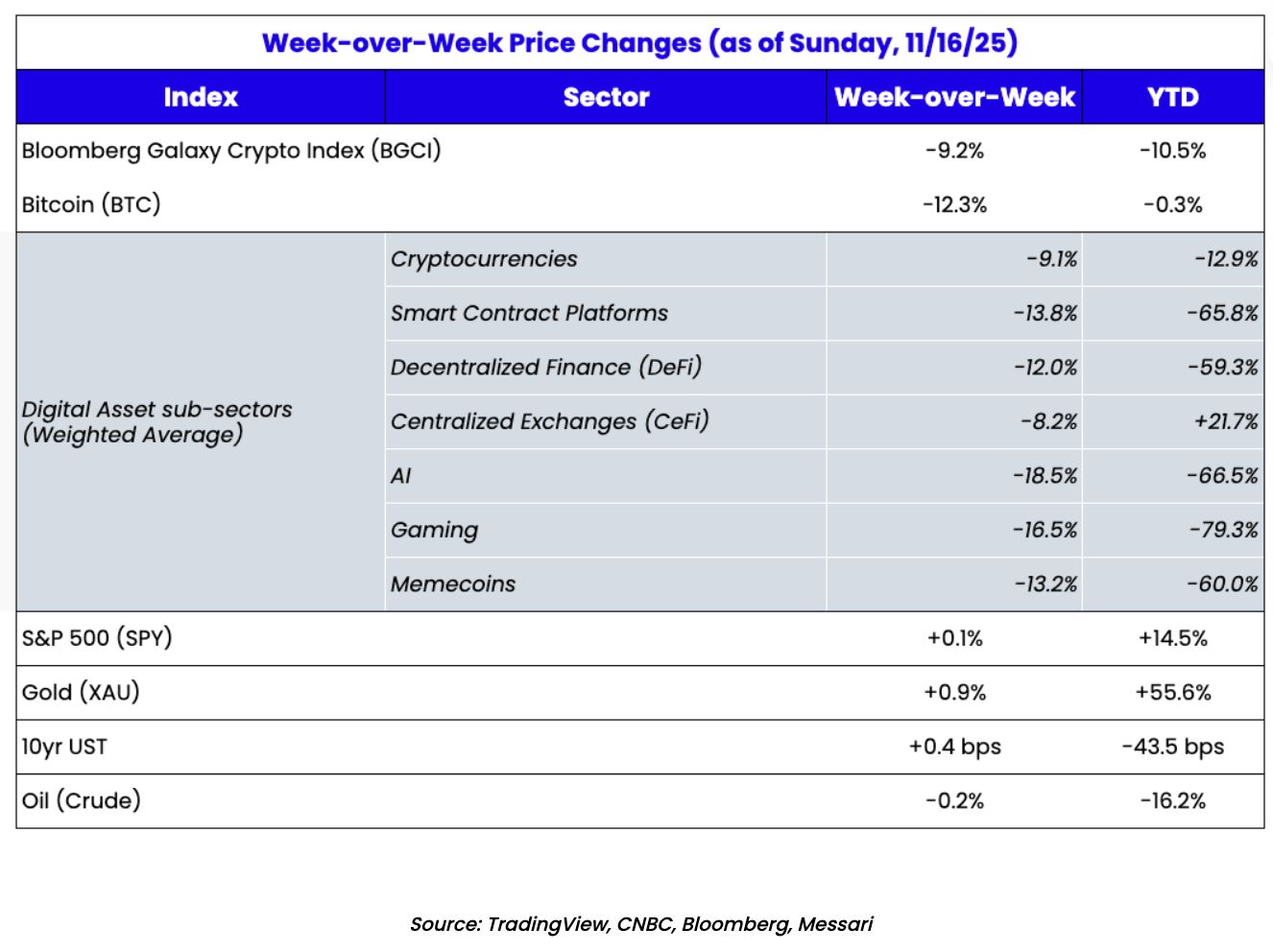

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.