Pi Coin Price Still In Green, Yet The Chart Now Shows 3 Red Flags — Pullback Soon?

Pi Coin price is still green on the monthly chart, but the short-term structure has shifted. A bearish engulfing pattern, weakening OBV, and a hidden bearish divergence now hint that the recent bounce may be losing strength. Unless PI reclaims key resistance soon, a deeper pullback zone could open up.

Pi Coin price is still up about 9% over the past month, but the short-term picture has started to soften. PI trades near $0.226 today, almost flat over the past 24 hours. Traders may see this as stability, but the charts are flashing several signs that the rebound from $0.209 may be running out of steam.

These early signals suggest a pullback could come unless buyers regain control.

Chart Signals Hint At A Weakening Bounce

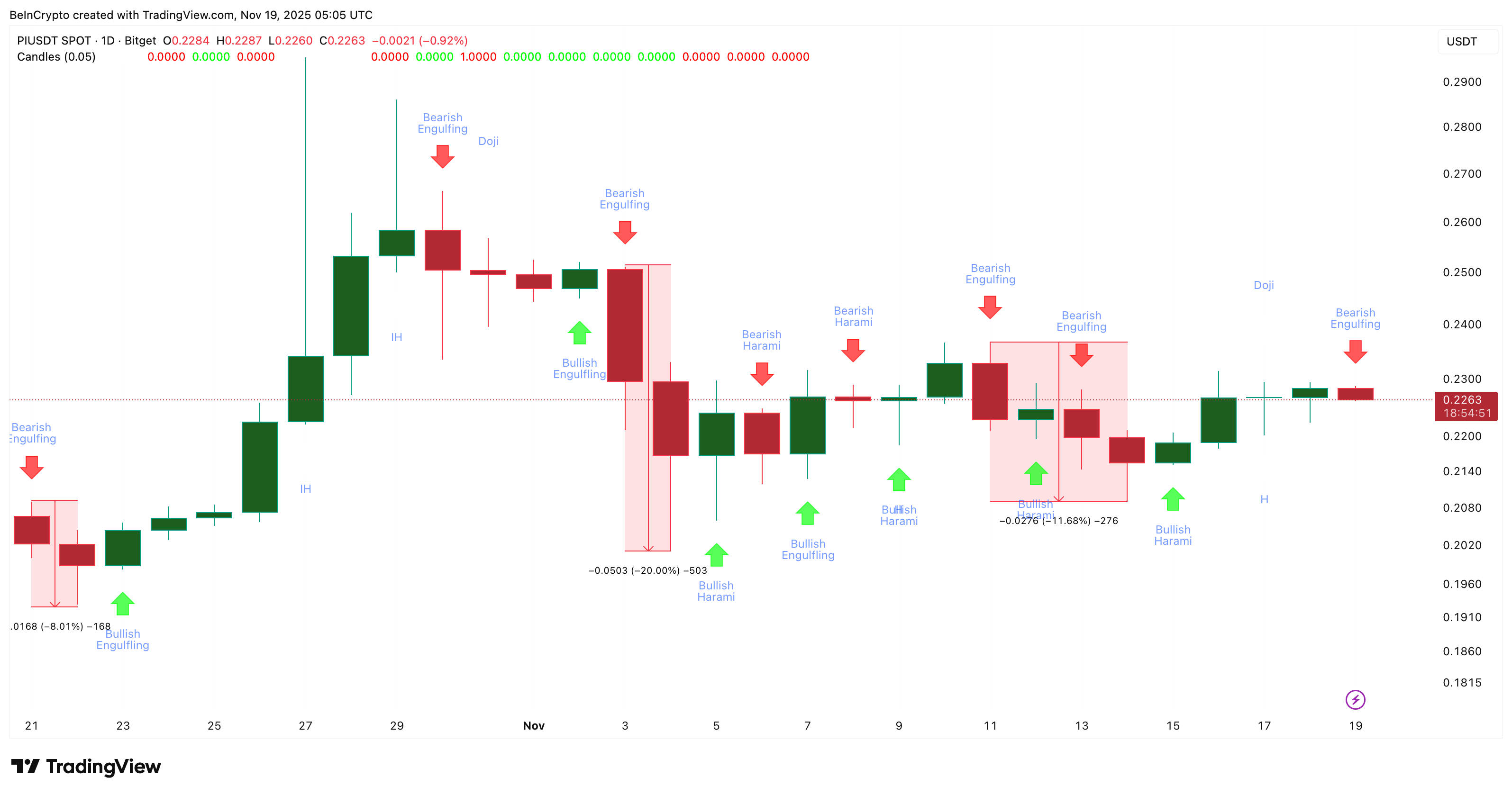

The first sign comes from a bearish engulfing pattern that formed on the daily Pi Coin chart. A bearish engulfing appears when a red candle fully covers the previous green candle. It often shows that sellers have regained control after buyers lose momentum.

Each time this pattern has appeared on Pi Coin since October 21, the price has dropped sharply, sometimes by 8% and sometimes by as much as 20%.

Key Candlestick Patterns:

TradingView

Key Candlestick Patterns:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

The second sign comes from the on-balance volume (OBV) indicator. OBV helps show whether real money is flowing into or out of a token.

Between November 14 and 18, OBV made higher lows while the price also made higher lows. That showed real buying support during the bounce. But OBV has now broken below the rising trend line that has supported it for days. If OBV falls under –1.36 billion, it will confirm a lower low on volume, which is already sell-biased. That shift usually happens when buyers lose strength and sellers take over, completely.

Pi Coin Volume Takes A Hit:

TradingView

Pi Coin Volume Takes A Hit:

TradingView

The third sign is a hidden bearish divergence on the Relative Strength Index (RSI). RSI measures buying strength.

Between November 16 and 18, the price made a lower high while the RSI made a higher high. This pattern is called hidden bearish divergence. It signals that the broader downtrend may still be in control and usually appears just before the next leg down in an ongoing downtrend.

Hidden Bearish Divergence Flashes:

TradingView

Hidden Bearish Divergence Flashes:

TradingView

Together, these three signals show that Pi Coin’s recent bounce still sits inside a bigger downward structure.

Pi Coin Price Levels That Matter Now

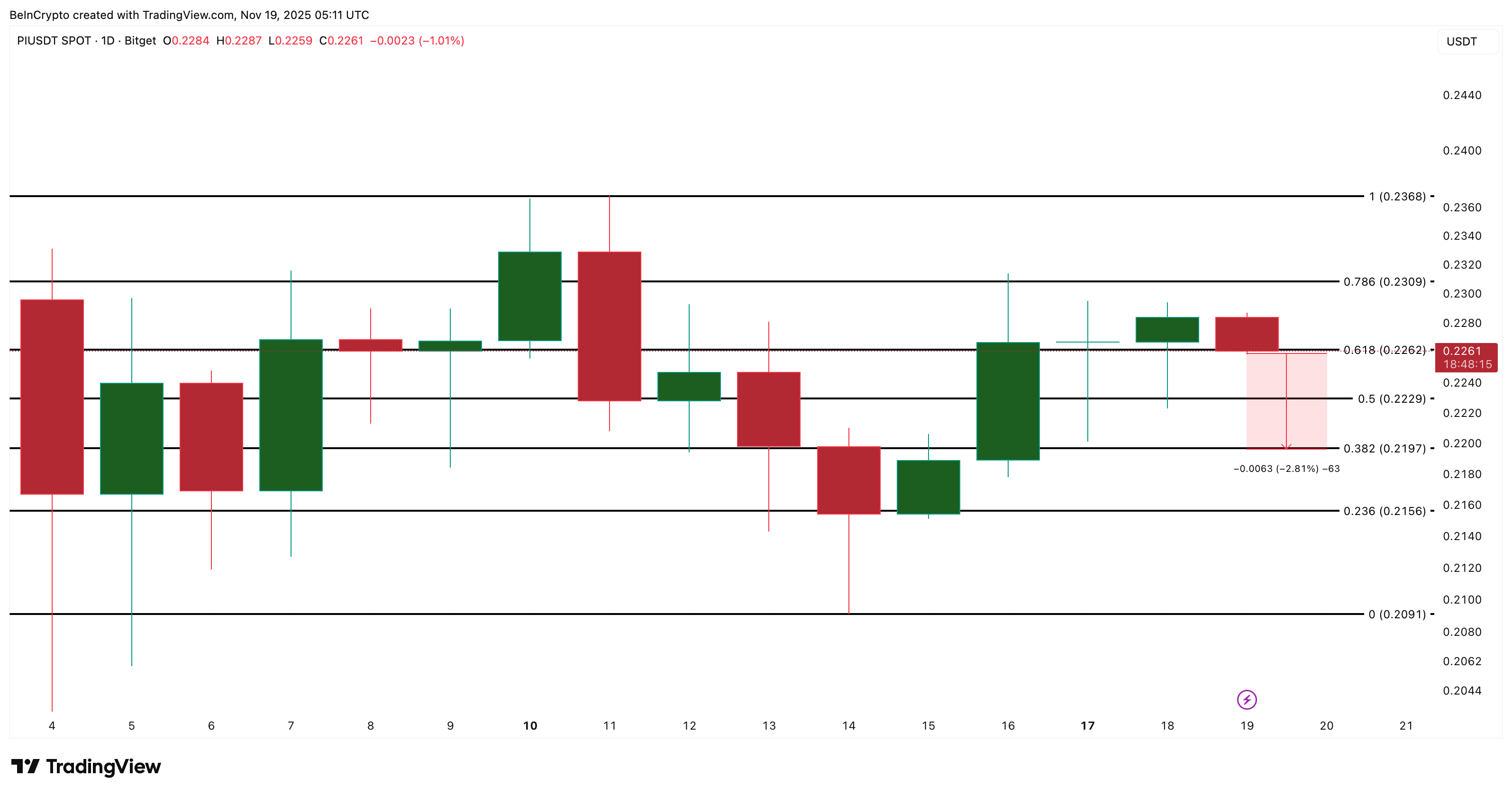

If a deeper pullback starts, the first key level PI must protect is $0.219. Holding above this level keeps the bounce alive. Losing it opens the way toward $0.209, which is the base where the last rebound began.

If buyers want to invalidate the bearish signs, PI needs to reclaim $0.230 and then break $0.236 with strong volume. Only then would the short-term trend flip back to positive.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Pi Coin price is still green on the monthly chart, but the latest structure suggests traders should stay cautious. The indicators show rising weakness, and unless PI clears its resistance soon, the pullback zone may come into play.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Removal from Index May Undermine MSTR’s Bitcoin-Based Strategy

- JPMorgan warns MSTR faces $8.8B in forced selling if MSCI excludes it from indices due to 50%+ digital asset threshold. - MSTR's stock dropped 67% since November 2024 peak as its valuation increasingly aligns with Bitcoin holdings (mNAV ~1.1). - CEO Saylor defends MSTR as "Bitcoin-backed enterprise," but critics argue its financial model lacks sustainability outside benchmarks. - Retail backlash against JPMorgan intensified, with figures like Grant Cardone closing accounts amid short-selling allegations.

Bitcoin News Update: MSTR's Business Role Under Scrutiny as MSCI Considers $8.8B Removal

- MSCI's proposed exclusion of MicroStrategy from global indices could trigger up to $8.8B in outflows due to its 50%+ bitcoin asset allocation. - JPMorgan warns the removal would damage MSTR's liquidity and capital-raising ability, with shares down 67% since November 2024. - CEO Michael Saylor defends MSTR's operational identity, rejecting "passive bitcoin fund" claims while adding $835M in crypto holdings. - MSCI's Jan. 15 decision could disrupt index-linked investor exposure to bitcoin, with MSTR shares

Bitcoin News Update: Institutions Acquire Crypto Shares Amid Rising Bearish Bets on Bitcoin

- Bitcoin's $80,000 put options dominate trading with $2B open interest, signaling sharp bearish reversal after its worst monthly drop since 2022. - ETF outflows accelerated declines, with $3.8B November redemptions, while Ark Invest added $38.7M in crypto equities amid market fragmentation. - Analysts warn leveraged losses ($19B in October) and forced liquidations amplify downturn, with Citi noting critical support at $80,000. - Market remains divided: Binance calls pullback "healthy," while Peter Brandt

Hyperliquid News Today: Speculation Drives Meme Coin Rally Despite Regulatory Alerts

- Meme coins surged on Nov 24, 2025, with PIPPIN rising 80% in 2 hours to $0.053 and $53.15M market cap. - BANANA (+20%) and TNSR (+50%) joined the frenzy, reflecting speculative flows shifting to high-risk assets amid Bitcoin stabilization. - Perpetual DEX protocols hit $4.24M daily revenue while Fed rate-cut expectations and token unlocks fueled volatility. - Regulators warned of risks as India exposed an AI-generated deepfake fraud, highlighting sector instability and regulatory scrutiny. - Analysts cau