Factors Leading to the Latest BTC Decline and What It Means for Cryptocurrency Investors

- Bitcoin's 2025 crash (30% drop) underperforms gold/Nasdaq, forcing investors to reevaluate strategies. - Whale trades and supply constraints amplify volatility, contrasting with traditional markets' liquidity. - Regulatory uncertainty (e.g., SEC actions, GENIUS Act) creates instability, complicating institutional investments. - Investors adopt defensive strategies (dollar-cost averaging), but systemic risks persist amid macroeconomic and regulatory shifts. - Bitcoin's future hinges on regulatory clarity

Market Fundamentals: Scarcity and Speculation

Bitcoin’s finite supply of 21 million coins has often been promoted as protection against inflation, but this very limitation also increases its vulnerability to large-scale trades.

Adding to these challenges is the broader economic backdrop. Disappointing macroeconomic indicators and a waning appetite for risk among investors have heightened Bitcoin’s price fluctuations.

Regulatory Sentiment: Uncertainty and Shifting Policies

Regulatory shifts in the United States have significantly influenced Bitcoin’s recent path. The last quarter featured a blend of supportive and restrictive measures, fostering an environment of unpredictability. For example,

This back-and-forth in policy has produced real-world effects.

Implications for Crypto Investors

The intersection of these elements has led to changes in investor tactics.

For those holding Bitcoin for the long haul, today’s climate requires a more sophisticated strategy. While the fixed supply remains a fundamental strength, future price trends will increasingly be shaped by external factors—like regulatory transparency and economic steadiness—that are outside the market’s direct influence. Investors must also consider the dangers of concentrating too much capital in a single, highly speculative asset.

Conclusion

The 2025 Bitcoin downturn highlights the cryptocurrency’s dual identity: a decentralized store of value subject to speculative forces and regulatory uncertainty. As market drivers and policy changes continue to intersect, investors need to maintain discipline and a keen awareness of risk. Bitcoin’s future will likely depend on whether regulators can create consistent guidelines and if the wider economy finds stability. Until then, volatility is expected to persist, and adaptability will be essential for navigating this ever-changing landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Competitive Advantage: Healthcare and Financial Sectors Flourish as Markets Evolve

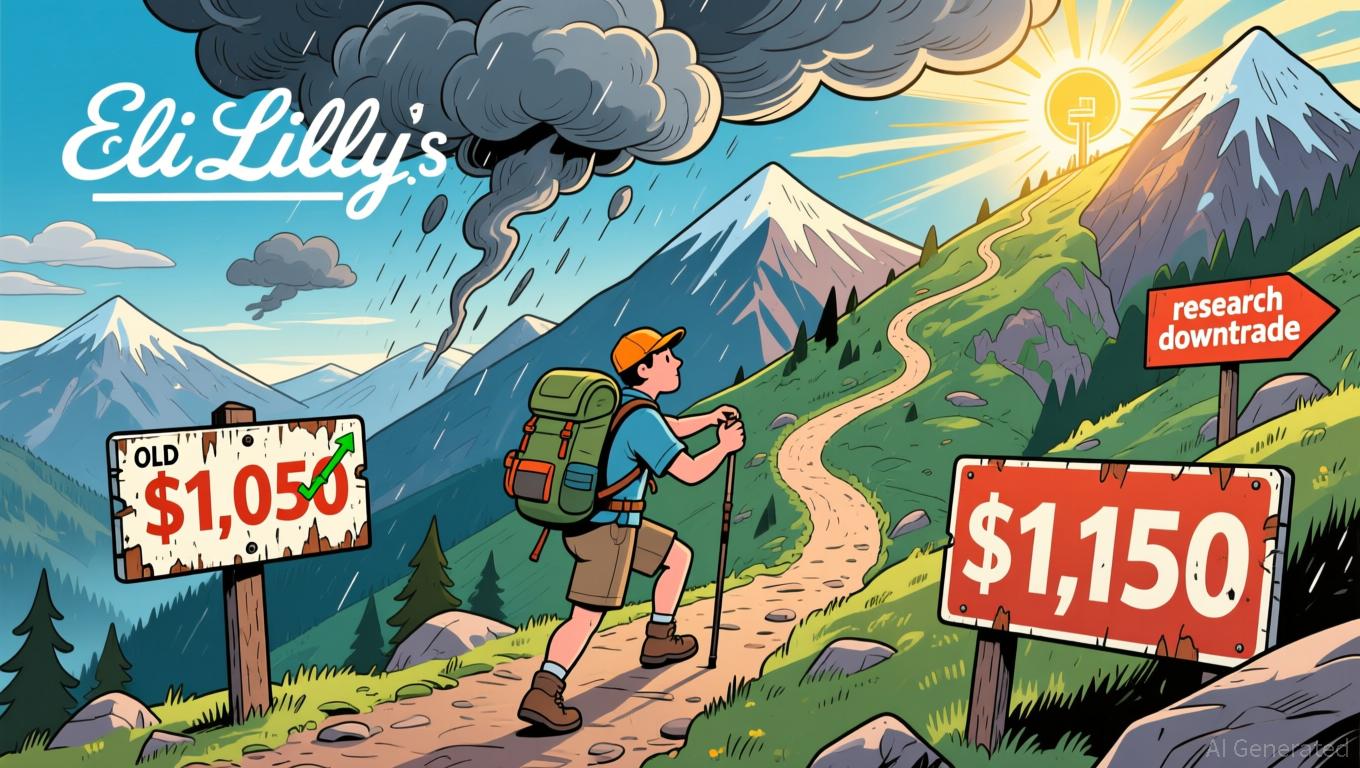

- JPMorgan views current U.S. equity pullback as a buying opportunity, signaling potential stabilization after valuation-driven corrections. - Raised Eli Lilly's price target to $1,150 citing regulatory tailwinds for obesity drugs despite sector challenges like Merck's Cidara acquisition. - Dominated leveraged loan markets with $20B EA financing, leveraging $50B regulatory exposure limits to outpace rivals in high-risk deals. - Faces legal scrutiny over Epstein ties and $73M Javice liability, contrasting w

Crypto Takes a Hit, ARK Invests: Major Wagers on Key Industry Leaders

- ARK Invest heavily buys crypto-linked stocks like Coinbase , Circle , and Bullish amid market declines, signaling sector resilience bets. - Purchases occur as Bitcoin drops below $90,000 and regulatory uncertainties persist, with ARK's "buy the dip" strategy targeting foundational crypto players. - Analysts highlight Circle's stablecoin leadership and Bullish's growth potential, despite post-earnings stock declines and broader crypto volatility. - Institutional moves like Canary Capital's XRP ETF and Kra

Bitcoin News Update: Institutions Increase Bitcoin Holdings Threefold During Market Fluctuations, Strengthening Abu Dhabi’s Aspirations as a Crypto Hub

- A 10-year Bitcoin model by Sminston With shows 300% returns even with poor timing, highlighting its long-term resilience despite 2025 volatility. - Global liquidity ($113 trillion) and undervalued BTC (-1.52σ below fair value) suggest favorable conditions for Bitcoin's $170,000 projected fair price. - Institutional confidence grows as Abu Dhabi's Mubadala triples Bitcoin holdings and invests $2B in Binance, reinforcing its crypto hub ambitions. - New projects like Bitcoin Munari (BTCM) and regulatory shi

Bitcoin Updates: Institutions Remain Wary Amid Regulatory Turbulence—Will Bitcoin Reach $80K?

- Bitcoin fell below $90,000 in late 2025 amid regulatory scrutiny, macroeconomic uncertainty, and institutional outflows, losing 26% from its October peak. - Record $523M ETF outflows and $19B leveraged liquidations highlight market fragility, while Harvard's $443M IBIT allocation signals cautious institutional interest. - Fed ethics scandals and delayed rate cuts (now 46% chance in December) exacerbate uncertainty, alongside Japan/Brazil's regulatory headwinds raising compliance costs. - Analysts debate