Fed Minutes Reveal December Rate Cut on a Knife’s Edge, Bitcoin Slips Below $89,000

The latest FOMC minutes reveal December is now a razor-thin policy call, with a narrow majority leaning against a rate cut. Liquidity stress, tariff-driven inflation, and Bitcoin’s fragile momentum are all feeding into one of the Fed’s most delicate decisions in years.

The Federal Reserve’s newly released minutes from the October 28–29 meeting have thrown fresh uncertainty into the December policy outlook, sharpening market volatility across equities, bonds, and Bitcoin.

While the minutes reflect economic data only available at the time of the meeting, the language shift inside the document has become the latest flashpoint for analysts dissecting the Fed’s next move.

Fed Minutes Expose a Narrow Majority Against a December Rate Cut

The Fed described “many” officials as seeing a December rate cut as “likely not appropriate,” while “several” said a cut “could well be appropriate.”

In Fed-watcher parlance, the hierarchy matters. “some” > “several”, and “many” outweighs both. This indicates that a narrow majority opposed cutting rates in December at the time of the meeting.

💥BREAKING:FOMC MINUTES: – MANY SAW DECEMBER RATE CUT AS LIKELY NOT APPROPRIATE– SEVERAL SAID DECEMBER CUT 'COULD WELL BE' APPROPRIATE

— Crypto Rover

The minutes also indicated emerging stress points in money markets:

- Repo volatility,

- Declining ON RRP usage, and

- Reserves drifting toward scarcity.

This combination historically preceded the end of quantitative tightening (QT). Sentiment, therefore, is that the Fed may be closer than expected to ending balance-sheet runoff.

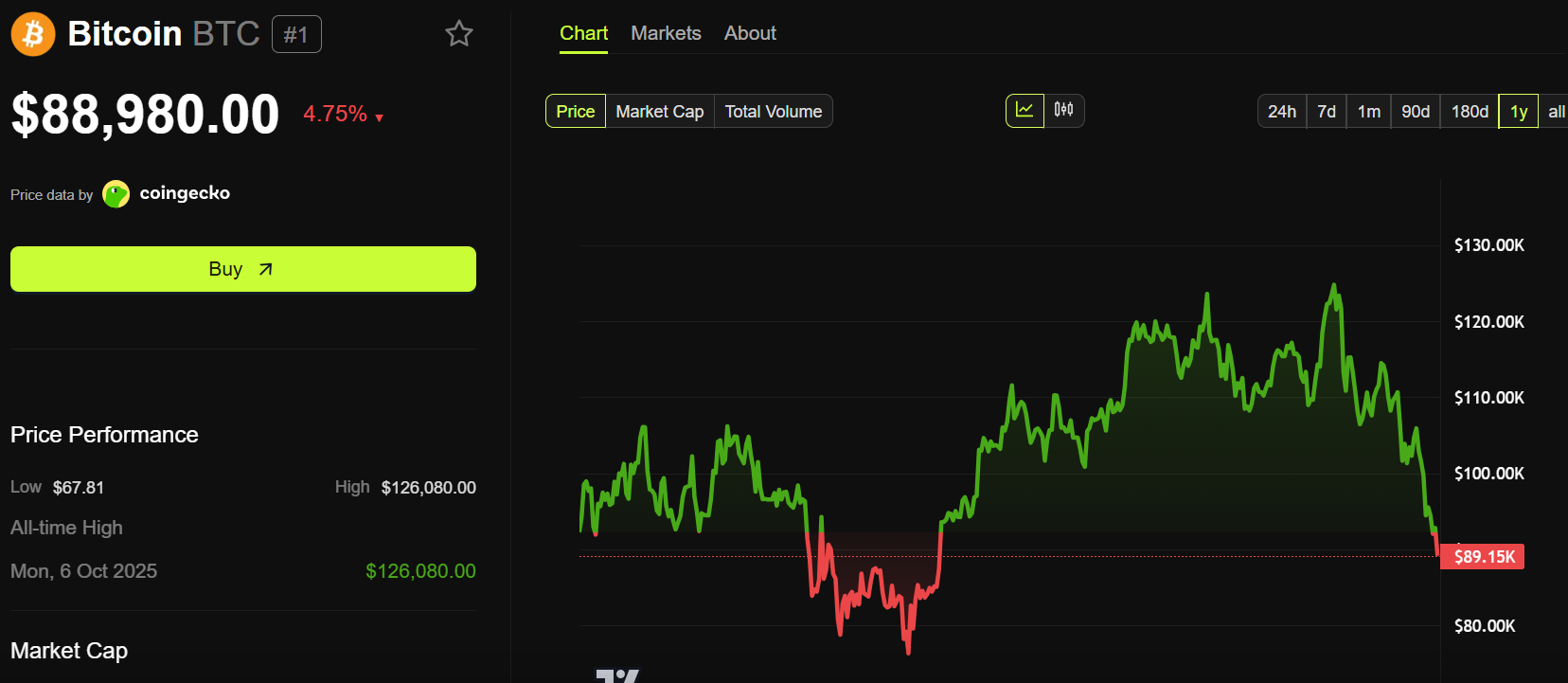

Ahead of this release, markets had already de-risked, with the Bitcoin price slipping below $89,000 to a 7-month low. The sentiment spread across crypto stocks and TradFi indices.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

Macro traders say the real story is the razor-thin nature of the Fed divide. The minutes indicate no firm consensus, suggesting December is shaping up to be one of the tightest policy calls since the Fed began its inflation fight.

Some officials emphasized still-elevated inflation risks; others pointed to cooling labor conditions and fading demand. With both sides arming themselves with recent post-meeting data, including softer CPI, stable jobless claims, and cooling retail activity, December could swing on the next two data prints.

For now, the market is recalibrating to a scenario where liquidity is tightening, policy uncertainty is rising, and Bitcoin sits in a structurally vulnerable zone until buyers regain initiative.

If the Fed chooses to hold in December, markets may need to brace for a longer-than-expected plateau and more volatility ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash News Today: Zcash's Return to Exchanges Reignites Discussion on 'Third-Party' Privacy in Crypto

- OKX's Zcash relisting triggered a 12% price surge to $600, outpacing Bitcoin amid U.S. regulatory easing. - Analysts debate Zcash's role: Balchunas warns it splits institutional Bitcoin support, while Van Eck calls it essential privacy complement. - Zcash's quantum-resistant upgrades and $9.24B market cap highlight growing institutional interest despite maximalist skepticism. - Winklevoss twins' Cypherpunk Tech and SEC's regulatory shift signal privacy protocols' rising acceptance in crypto mainstream.

Devices with Extended Lifespans Enhance Sustainability but Reduce Productivity

- Americans now keep smartphones for 29 months (up from 22 in 2016), driven by cost-cutting and sustainability, but this trend slows productivity as outdated devices struggle with modern demands. - Federal Reserve data shows each delayed equipment upgrade reduces productivity by 0.33%, while experts warn aging tech causes systemic inefficiencies through throttled networks and outdated software. - Solutions like modular upgrades and circular economies aim to balance sustainability with functionality, yet ri

Bitcoin Updates Today: Gemini Introduces Bitcoin Card: Incentivizing Users to Connect Cryptocurrency with Everyday Purchases

- Gemini launches Bitcoin credit card with referral rewards and cashback to bridge crypto and traditional finance. - Market analysis shows mid-cycle holders driving Bitcoin's 12% selloff below $90,000 amid oversold futures conditions. - Crypto cards differ from traditional offerings by enabling direct Bitcoin spending without fiat conversion, addressing user accessibility challenges. - Experts like Saylor and Winklevoss highlight Bitcoin's reduced volatility and potential for recovery, positioning crypto a

Ethereum Updates: Yi Lihua's Careful Buying Strategy Stands Out Amid Ethereum's Sharp Downturn

- Yi Lihua, Liquid Capital founder, accumulates Ethereum in $3,000–$3,300 range via spot buys, avoiding leverage amid volatile market conditions. - Ethereum faces $689M outflows, rising leverage ratios (0.5617), and $47.59B exchange reserves, signaling heightened bearish caution. - Macroeconomic factors like Fed hawkishness and 4.08% 10-year yields drive capital outflows, pushing Ethereum down 6.5% to $3,080 weekly. - Yi's low-risk accumulation contrasts with $29.23M long liquidations, positioning him to c