Analysts Reveal Key Support Levels for Bitcoin if Selling Pressure Doesn’t Ease in November

Bitcoin faces mounting selling pressure, pushing it under key thresholds. Traders now focus on three major support levels that could define November’s market direction.

November 2025 is witnessing a heavy wave of selling pressure on Bitcoin (BTC). This pressure has pushed the world’s largest cryptocurrency below $90,000 and wiped out all gains accumulated this year. The question now is whether the selling will ease soon.

If it continues, several support levels may offer opportunities. The following analysis breaks down the details.

Why Bitcoin’s Decline May Not Be Over

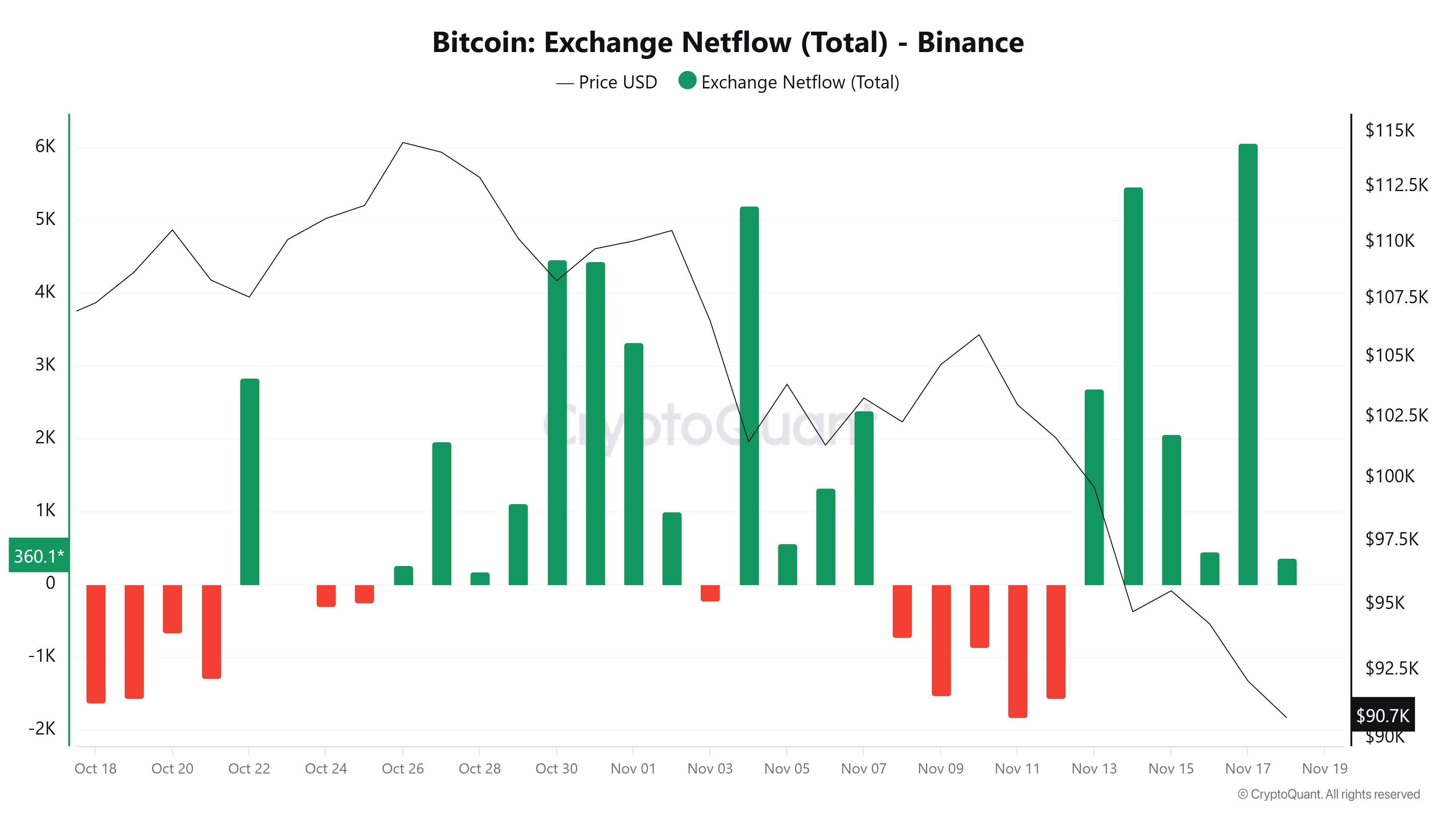

Data from CryptoQuant shows that Binance Exchange Netflow recently recorded daily inflows exceeding 6,000 BTC in October, the highest level in a month.

The chart also shows that most days recorded positive netflows, meaning inflows exceeded outflows. This pattern reflects a growing tendency to move BTC onto exchanges for selling, driven by fears of further price declines.

Bitcoin Exchange Netflow – Binance. Source:

CryptoQuant

Bitcoin Exchange Netflow – Binance. Source:

CryptoQuant

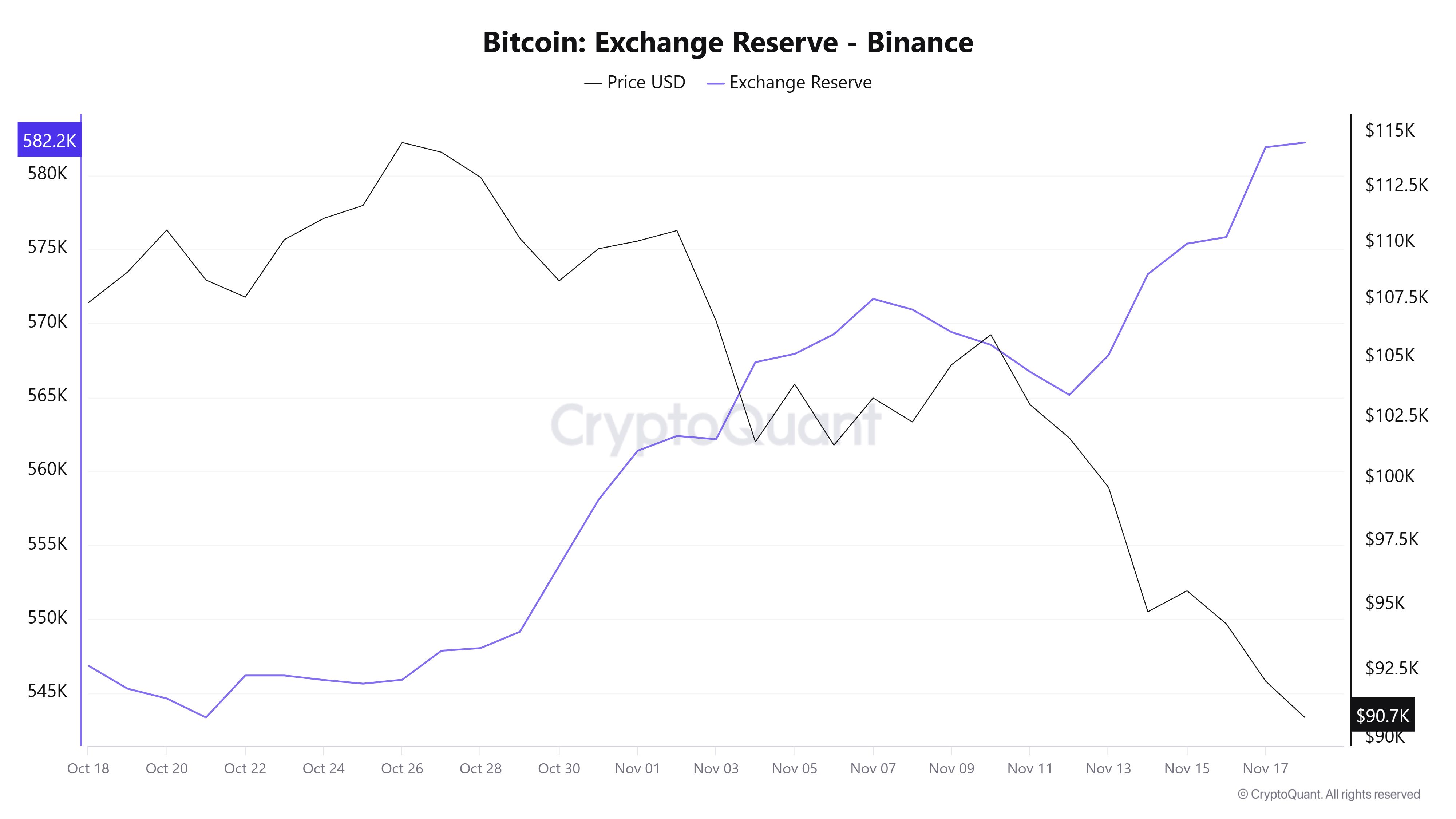

This sentiment has pushed Bitcoin reserves on exchanges higher in November, adding even more selling pressure this month.

Specifically, Bitcoin reserves on Binance— the exchange with the highest BTC liquidity — rose from 540,000 BTC last month to more than 582,000 BTC in November.

Bitcoin Exchange Reserve – Binance. Source:

CryptoQuant

Bitcoin Exchange Reserve – Binance. Source:

CryptoQuant

This trend, combined with selling pressure from BTC ETFs in November, has raised concerns among analysts that the downturn may continue.

“Selling pressure is increasing while demand remains weak. A true market bottom usually shows strong demand inflows — but current on-chain data, such as market buy volume and other demand indicators, do not yet signal a bottom. Caution is advised, as further downside remains likely,” analyst CoinDream commented.

3 Support Levels to Watch

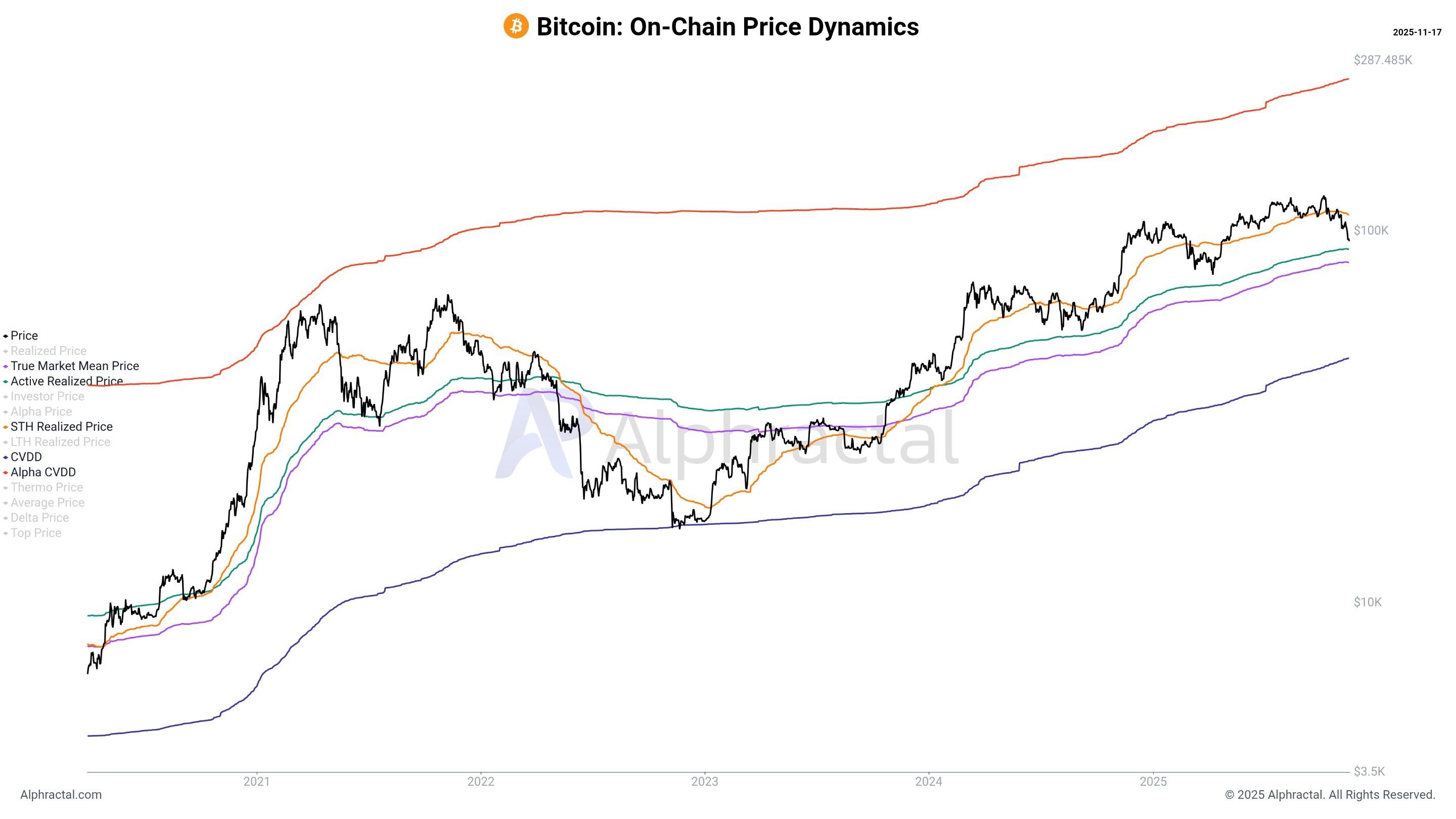

In this context, Joao Wedson — founder of Alphractal — highlighted two important support levels to monitor if BTC closes below $92,000.

- The first is the Active Realized Price at $89,400, which represents the realized value of all BTC based on on-chain activity. This level served as strong support in previous cycles.

- The second is the True Market Mean Price at $82,400, representing the true average of the market, where the price found a perfect equilibrium in July 2021.

In a worst-case scenario, if a genuine bear market begins, BTC could slide toward $45,500. This estimate is based on the Cumulative Value Days Destroyed (CVDD) model.

Bitcoin On-chain Price Dynamics. Source:

Alphractal

Bitcoin On-chain Price Dynamics. Source:

Alphractal

CVDD tracks the cumulative sum of value–time destruction as coins move from old holders to new holders relative to the market’s age. Historically, this metric has accurately predicted major Bitcoin bottoms.

A drop of this magnitude would bring significant consequences, especially in a market where institutions and governments have been accumulating BTC.

However, current analyses still expect Bitcoin to find a bottom around $80,000. A bullish reversal may occur if the new wave of government liquidity continues to accelerate.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Policymakers Disagree on Balancing Inflation and Employment in December Rate Cut Discussion

- Fed officials clash over December rate cut amid resilient economy and stubborn inflation, with Boston's Collins and Dallas' Logan urging caution while New York's Williams supports flexibility. - Market pricing for a 25-basis-point cut rose to 70% after Williams' dovish remarks, contrasting with Collins' emphasis on monitoring labor market slowdown risks. - Government shutdown delays key data like October CPI, complicating policy decisions as officials rely on outdated metrics to balance inflation control

Bitcoin Updates: Institutional Interest Fails to Counter Widespread Crypto Market Decline

- Bitcoin ETFs face record $3.5B outflows in November as prices drop to $80,657, driven by macroeconomic risks and Fed policy uncertainty. - Franklin Templeton launches XRP ETF amid sector institutionalization, contrasting with $4.9B crypto ETP outflows and DATCo liquidity risks. - Solana shows resilience with $380M ETF inflows and $2.85B revenue, but Ethereum's 45% decline intensifies institutional capital competition. - Market fragility persists as overleveraged crypto treasuries face forced selling, whi

Abercrombie's Resurgence Fueled by Nostalgia: Surpassing Sales Expectations and Leaving Doubters Behind?

- Abercrombie & Fitch's Q2 2025 $1.2B sales and $2.32 EPS exceeded forecasts, driven by customer-centric strategies and a Taco Bell collaboration. - Analysts show mixed reactions: BTIG lowers price target to $118 while maintaining "Buy," JPMorgan downgrades to "neutral" over growth concerns. - The Hollister x Taco Bell capsule collection (11 styles) targets Gen Z with "future vintage" nostalgia, aligning with CEO Fran Horowitz's retail expertise expansion. - Despite 6.6% YoY revenue growth and consistent e

ECB Raises Concerns Over Systemic Threats While Canada Develops Stablecoin Rules

- Canada's 2025 budget introduces stablecoin regulations requiring reserves, redemption policies, and risk frameworks, overseen by the Bank of Canada with $10M allocated for implementation. - ECB warns $280B stablecoin market risks destabilizing finance by draining bank deposits, triggering reserve asset fire sales, and threatening U.S. Treasury markets during "runs." - Industry advocates like Coinbase argue reserve-backed stablecoins enhance stability, while firms like Republic Technologies invest $100M i