Odds of December Fed rate cut plunge to 33% as BTC falls below $89K

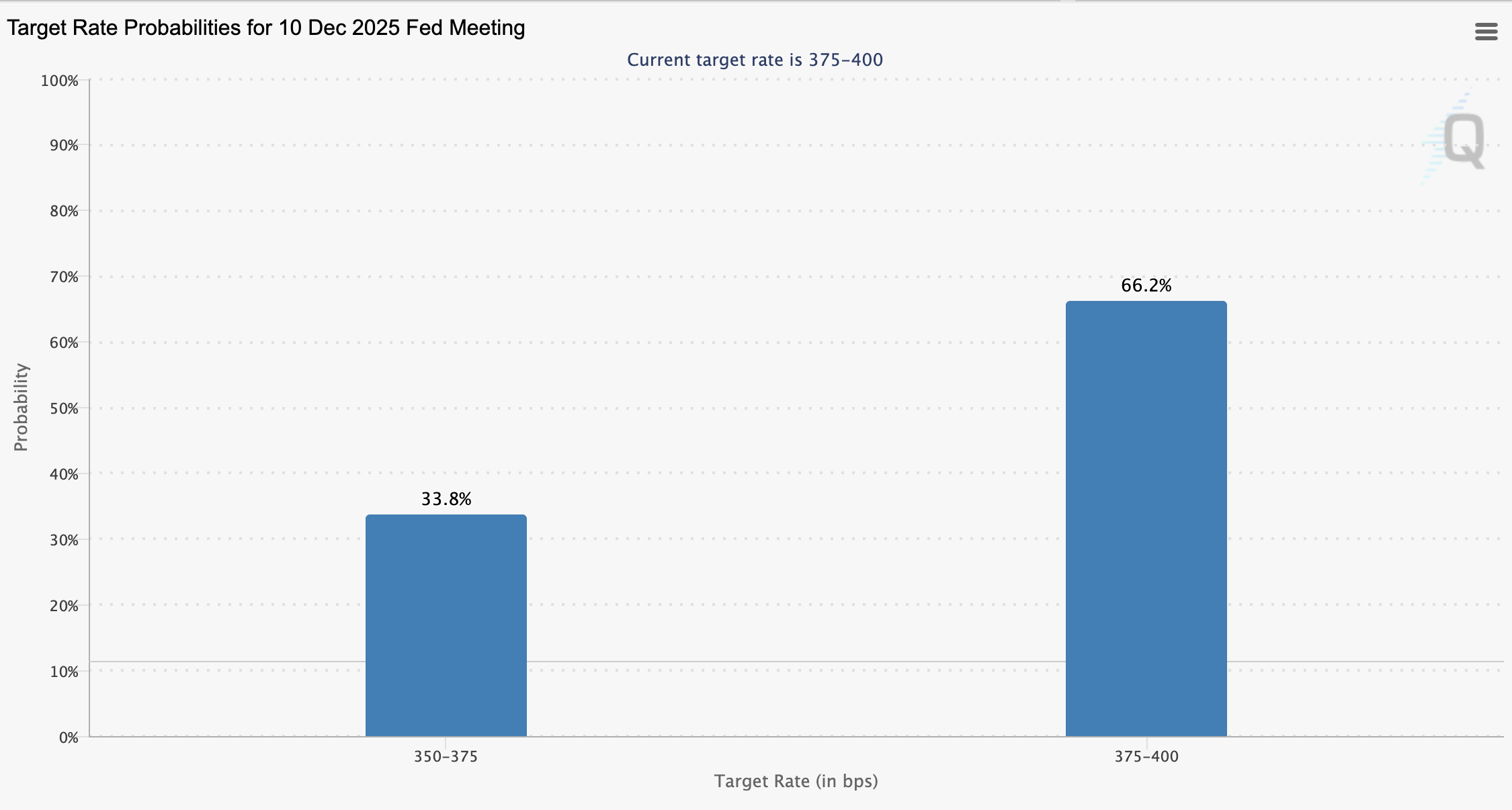

The odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting have plunged to 33% as “extreme fear” grips the crypto market and the price of Bitcoin (BTC) dips below $89,000.

Investors placed the odds of a December rate cut at about 67% during the first week of November, with the odds dropping below 50% on Thursday, according to data from the Chicago Mercantile Exchange (CME).

Traders on prediction markets Kalshi and Polymarket forecast the odds of a December rate cut at about 70% and 67%, respectively. While higher than CME, traders in general appear more hesitant about rate cuts due to persistent fears about inflation, according to The Kobeissi Letter.

The plummeting odds of a December rate cut and declining crypto prices have sparked a panic, with some analysts now warning that the downturn could signal the start of an extended crypto bear market and falling asset prices.

The price of BTC falls below $89,000 as market sentiment hovers just above the yearly low

The price of BTC fell below $90,000 again on Wednesday after failing to defend the key support level and has been trading well below its 365-day moving average, a critical support level, for the last six days.

Bitcoin’s 50-day exponential moving average (EMA) has also crossed below the 200-day EMA. This signal, known as the “death cross,” suggests further downside for BTC.

Some analysts now forecast a drop to $75,000, where the price could bottom out before rebounding by the end of 2025, while others speculate whether the cycle top is already in.

“The time for Bitcoin to bounce, if the cycle is not over, would start within the next week,” market analyst Benjamin Cowen said on Sunday.

“If no bounce occurs within 1 week, probably another dump before a larger rally back to the 200-day simple moving average (SMA), which would then mark a macro lower high,” Cowen added.

The forecasts came amid cratering crypto investor sentiment. Investor sentiment measured by the “Crypto Fear & Greed Index” is at 16 at the time of this writing, indicating “extreme fear” among investors.

This places crypto investor market sentiment at just one point above the yearly low, according to CoinMarketCap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: PENGU Faces a Price Showdown: Balancing Market Stability and Ecosystem Expansion

- PENGU token, Pudgy Penguins' governance token, trades near $0.012 after 5% weekly decline, with traders eyeing a potential rebound toward $0.023. - Projected 2030 growth to $35–$180 hinges on ecosystem expansion in gaming/metaverse and brand partnerships driving token utility. - Broader crypto market weakness, including Bitcoin's $95k slump and $867M ETF outflows, pressures PENGU amid heightened bearish sentiment. - Key factors for PENGU's trajectory include NFT floor price stability, institutional crypt

Hyperliquid News Today: Hyperliquid's Reduced Fees Ignite Growth in DeFi's Overlooked Sectors

- Hyperliquid launches HIP-3 Growth Mode, slashing trading fees by over 90% to boost liquidity in niche assets and challenge centralized exchanges. - The permissionless framework allows deployers to activate ultra-low taker fees (as low as 0.00144%) while preventing parasitic volume capture through 30-day fee locks. - With $10B+ daily volume and infrastructure advantages like HyperBFT, the platform aims to attract liquidity providers to emerging markets despite past bad debt risks. - Analysts highlight the

Bitcoin News Today: Bitcoin Plunges 25%—Is This a Deleveraging Shakeout or a Warning Sign for a 2026 'Tariff Wave'?

- Bitcoin fell below $95,000 on Nov. 14, 2025, a 25% drop from October's peak amid macroeconomic uncertainty and institutional outflows. - ETFs saw $866.7M in net outflows, led by BlackRock and Grayscale, as investors shifted to cash, bonds, and gold . - Fed rate cut expectations dropped to 30%, technical indicators showed bearish "death cross," and Treasury yields pressured risk assets. - Market fear reached pandemic-level lows (Fear & Greed Index at 10), though ETF outflows remain small relative to $80B

Hyperliquid News Today: The escalating AI chip conflict between the U.S. and China drives a spike in trading activity and deepens divisions in international markets

- Alpha Arena's 1.5 season introduces Kimi 2 model for live U.S. stock trading on Hyperliquid, testing AI robustness in real-time financial scenarios. - Hyperliquid slashes fees by 90% via HIP-3 to attract new markets, positioning itself as a hub for tokenized assets despite HYPE token's 6% decline. - U.S. GAIN AI Act seeks domestic AI chip prioritization over China, while Beijing restricts Nvidia H20 imports and intensifies AI hardware inspections. - Geopolitical tensions over semiconductor access risk gl