- Pepe was trading in a narrow 24-hour range, which is above the support level of $0.054703.

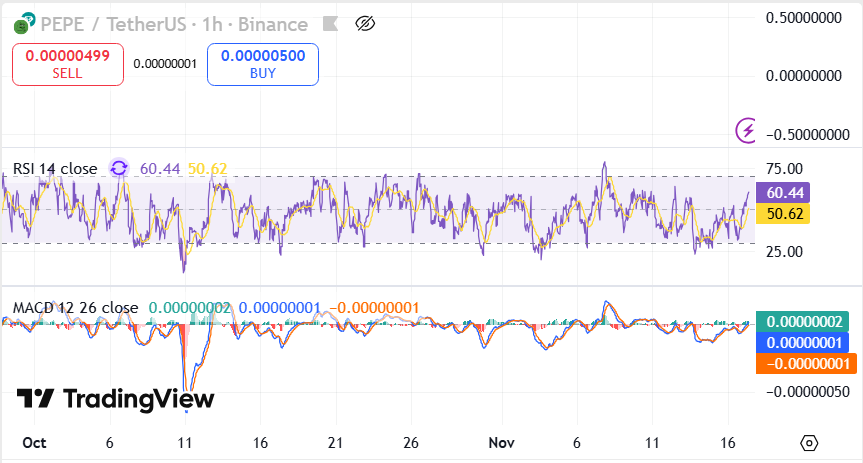

- RSI and MACD both on the 1-hour chart were at a neutral level keeping the price at the resistance of $0.05504.

- The market indicators recorded a consistent momentum, in line with the narrow intraday movement of the token.

Pepe was traded in a close band in the last 24 hrs because the price of the stock was close to the support band. The token was traded at $0.054998, a minor 0.1 per cent fall in a day. This narrow shift came as trading indicators stayed constrained within established levels.

The market showed limited movement, yet the price remained close to key thresholds that shaped recent intraday behavior. This provided a clearer view of short-term dynamics as the asset moved between immediate resistance and support. The setup created a stable backdrop for tracking hourly performance, and it offered data-driven insight into ongoing activity.

PEPE Maintains Steady Momentum Within a Tight Intraday Range

The RSI on the one-hour chart held near the mid-zone, with the latest reading around 50.62, while the recent swing reached 60.44. These levels signaled steady momentum, and they kept movements within the wider band between 25 and 75. The MACD lines also stayed near neutral territory, with values fluctuating closely around zero. This kept the indicator aligned with the broader price consolidation. However, these readings helped outline current intraday trends, and they anchored market focus on how the token reacted to small price changes.

Source: TradingView

Source: TradingView

Pepe remained above its identified support at $0.054703, which shaped the lower boundary of its trading activity. The token approached the resistance at $0.05504, yet it stayed within a narrow 24-hour range. This kept price behavior contained, and it showed how the market respected both levels during the period. Notably, this structure offered a defined framework for observing the next shift, and it created a consistent pattern across recent sessions.

Market Structure Points to Steady Short-Term Behavior

The asset held close to its core trading zone, and this reinforced the controlled pace seen across the chart. The stable pattern linked directly with the aligned indicator readings, and it kept movements synchronized with hourly signals.

Additionally, the narrow difference between support and resistance shaped short-term expectations, and it highlighted the importance of monitoring upcoming reactions within this band. The setup continued to center attention on how the price interacted with these levels as the market processed new data.