Maple Finance barred from launching syrupBTC after Core Foundation injunctionMaple Finance’s syrupBTC is a direct rival to lstBTC

Maple Finance is facing an injunction from Core Foundation, the organization behind the Bitcoin-secured Core blockchain, over an alleged breach of confidentiality and exclusivity agreements tied to their Bitcoin yield partnership.

- Core Foundation accused Maple Finance of breaching a commercial agreement.

- A Cayman Islands court has granted an injunction restricting Maple Finance from launching syrupBTC.

- Maple Finance has denied all allegations against it.

“The Grand Court of the Cayman Islands has granted an injunction against Maple Finance entities, finding that there is a serious issue to be tried regarding Maple’s alleged breaches of its commercial agreement with Core Foundation to develop lstBTC, the joint Core-powered liquid staked Bitcoin token,” the foundation announced in a Nov. 19 X post.

The Core Foundation alleges that Maple misused confidential information and violated exclusivity provisions to build a competing product. Further, the foundation is challenging Maple’s right to declare an “impairment” on millions of dollars worth of Bitcoin it is holding for lenders in the “Bitcoin Yield product.”

Maple Finance’s syrupBTC is a direct rival to lstBTC

Maple Finance and Core Foundation partnered in early 2025 to launch lstBTC, a liquid staked Bitcoin product designed for institutional investors. The success of the initial rollout may have encouraged Maple to divert from the agreement and develop a rival offering, the announcement said.

Maple allegedly began misusing “confidential information” and internal resources from mid-2025 while simultaneously developing “syrupBTC,” a new liquid staking product intended to directly rival lstBTC, despite being bound by a 24-month exclusivity clause.

After Core Foundation initiated arbitration proceedings, the Honourable Justice Jalil Asif KC from the Grand Court of the Cayman Islands ruled that there was a serious issue to be tried in relation to Maple’s conduct.

“The Court found damages would not be an adequate remedy because of (i) the risk of Maple dealing in or shedding CORE tokens and (ii) the head-start Maple would gain by launching a competing product,” Core said.

Per the injunction, Maple is prohibited from launching or promoting syrupBTC, using Core Foundation’s confidential information, or dealing in CORE tokens without prior written consent while the legal process remains ongoing.

However, not long after the injunction was granted, Maple allegedly moved to declare an impairment worth millions of dollars against lenders in its Bitcoin Yield product, which, according to Core Foundation, casts further doubt on Maple’s handling of client assets and its obligations under the original agreement.

The foundation said it had been led to believe that the Bitcoin underpinning the yield product was held with “reputable custodians,” meaning those assets should have remained untouched regardless of internal issues at Maple.

“It is unclear why Maple maintains that they are unable to return the Bitcoin to their lenders at this time, or if they have the right to impair them,” Core Foundation said.

According to the announcement, the foundation added that it may “take this legal action as far as necessary” to protect its community.

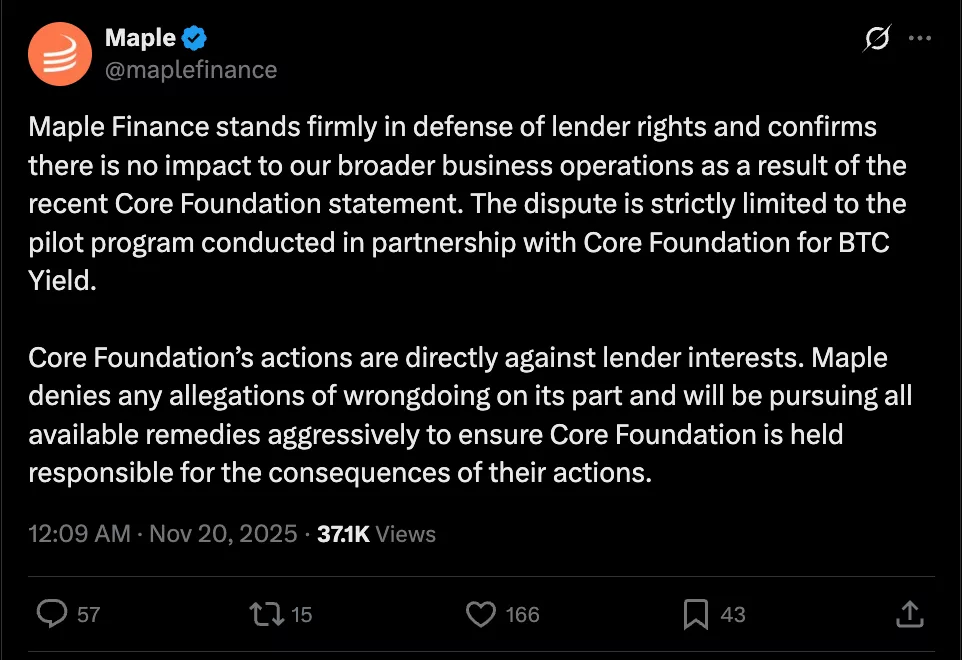

Maple Finance, however, denied all allegations in a Nov. 20 X post, adding that the dispute was limited to the pilot program. See below.

Maple Finance responds to Core Foundation. Source: Maple on X

Maple Finance responds to Core Foundation. Source: Maple on X

Maple sunsets SYRUP staking

Against this backdrop of legal tensions and product disputes, Maple Finance has undergone significant structural changes regarding the tokenomics of SYRUP, its native governance and fee-sharing token.

Earlier this month, Maple pulled the plug on SYRUP staking rewards and switched to a new revenue-based model, where 25% of all protocol revenue will be used to fund the newly formed Syrup Strategic Fund, which in turn, will buy back tokens and inject liquidity as required.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Dominance Nears 60% as Altcoins Lag Behind

Bitcoin dominance hits 60% in November as traders move capital to BTC during broader market pullback, reports NYDIG.Why Bitcoin Outperforms in Bearish ConditionsWhat This Means for the Market

Altcoins Shine as Spot ETF Flows Shift

Bitcoin and Ethereum see heavy outflows, while Solana and XRP gain momentum in last week’s Spot ETF flows.Solana and XRP Attract Investor Confidence

SEI Perpetuals Surge 3x in Just 30 Days

SEI perpetual contracts have tripled in value over the last 30 days, reflecting a strong surge in market interest.What’s Driving SEI’s Growing Popularity?Can SEI Sustain the Momentum?

Bitcoin Forecasts Dip to $78K in 2025

Kalshi traders now expect Bitcoin to hit a low of $78K in 2025, indicating a more optimistic outlook for BTC.Why This Matters for InvestorsA Bullish Floor or Overconfidence?