4 Key Drivers That Could Push ZCash (ZEC) to $1,000

Rising institutional interest, independent price action and accelerating community momentum position Zcash for a potential run toward $1,000 in 2025. Technical signals and market behavior reinforce its growing appeal.

Zcash (ZEC), a privacy-focused altcoin built on zero-knowledge proofs, continues to dominate community discussions in November. The token is showing independent momentum that stands apart from the broader negative market sentiment.

Many experts predict that ZEC could reach $1,000 this year, based on several factors. The following analysis breaks these drivers down in detail.

Why Zcash Could Reach $1,000

First, ZEC is no longer behaving like a short-term speculative asset. It is evolving into a strategic reserve asset.

Cypherpunk Technologies Inc., which is backed by Winklevoss Capital, recently announced the purchase of an additional 29,869.29 ZEC, valued at approximately $18 million. This acquisition complements the company’s earlier purchase of 203,775.27 ZEC. As a result, Cypherpunk now holds a total of 233,644.56 ZEC, with an average entry price of $291.04 per unit.

Therefore, analysts expect more firms to follow this trend and accumulate ZEC as a strategic reserve. Some even anticipate the approval of a ZEC ETF.

“The Winklevoss twins have started the first ZEC DAT. I’d expect a higher mNAV and stronger buy pressure for a privacy-coin DAT because it isn’t legal to hold in many regions. An ETF is likely as well. Shielded/unshielded will act as a trojan horse for privacy at planetary scale.” – Mert, CEO of Helius, predicts.

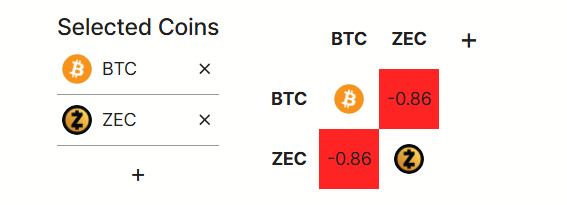

Second, Zcash is proving its independence from Bitcoin. Its movements are no longer dictated by the volatility of the “king of crypto.”

Over the past month, Zcash and Bitcoin have maintained a negative correlation. When Bitcoin fluctuates, ZEC often moves in the opposite direction or remains more stable.

Zcash and Bitcoin Correlation. Source:

Zcash and Bitcoin Correlation. Source:

Data from DeFiLlama confirms this negative correlation. This indicates that ZEC has its own drivers and is not dependent on Bitcoin’s volatility.

Bitcoin usually leads altcoin trends. However, Zcash is breaking this pattern thanks to its focus on privacy. In a period of negative BTC volatility, maintaining a negative correlation becomes a significant advantage for ZEC.

Third, the increase in social discussion around Zcash is outpacing that of Bitcoin, indicating growing interest from retail investors.

Comparing Bitcoin and Zcash Social Discussion. Source:

Comparing Bitcoin and Zcash Social Discussion. Source:

LunarCrush data shows that Bitcoin remains the leader in total mentions, with 17.97 million. Zcash recorded 346.72 thousand mentions. Yet ZEC’s discussion growth rate over the past year reached +15,245%. Bitcoin’s growth was only +190%.

Lastly, technical indicators suggest breakout potential.

According to analyst Ardi on X, the ZEC chart is forming an inverse head-and-shoulders pattern on the 4-hour timeframe. This setup suggests a target of between $800 and $1,000 if ZEC breaks above the neckline at $680–$700.

Additionally, recent analysis from BeInCrypto supports this outlook. A daily close above $748 opens a path to $1,010 and $1,332. A drop below $488 would invalidate the setup and reset the structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Rally: On-Chain Usage and Institutional Engagement Fuel Lasting Expansion

- Astar (ASTR) surged 40% in late 2025 driven by on-chain adoption and institutional investments. - Q3 2025 saw 20% growth in active wallets and $2.38M TVL, supported by Agile Coretime upgrades and 150,000 TPS cross-chain infrastructure. - A $3.16M institutional investment and Astar 2.0's EVM compatibility highlight its multichain infrastructure vision and technical maturity. - Strategic partnerships with Animoca Brands and Sony Soneium, plus Chainlink CCIP integration, strengthen Astar's interoperability

DASH Soars 150% in a Week: Unpacking the Factors Behind the Privacy Coin’s Comeback

- Dash (DASH) cryptocurrency surged 150% in 7 days, driven by institutional adoption and thematic investment trends in blockchain privacy solutions. - The rally coincided with DoorDash (NASDAQ:DASH) stock's media attention, creating confusion between the crypto and equity assets despite unrelated fundamentals. - On-chain data showed increased DASH activity, reflecting retail interest in privacy-focused protocols amid post-FTX market shifts and DeFi optimism . - Analysts warn of risks from ticker symbol amb

Vitalik Buterin Supports ZKsync: Strategic Impact on Ethereum Layer 2 Growth and Institutional Investment in Crypto

- Vitalik Buterin endorsed ZKsync's 2025 Atlas upgrade, highlighting its role in Ethereum's scalability and institutional adoption. - The upgrade enables 15,000 TPS with near-zero fees via ZK Stack, enhancing liquidity sharing and Layer 2 interoperability. - ZKsync attracted $15B in 2025 inflows, with ZK token surging 50% post-endorsement, signaling institutional confidence. - Upcoming Fusaka upgrade aims for 30,000 TPS, strengthening ZKsync's position against rivals like Arbitrum and Optimism . - Buterin'

Google reports that cybercriminals accessed information from 200 firms after the Gainsight security incident