Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening

The crypto market is drowning in red , fear is at extreme levels, and Bitcoin just slipped deeper into bear-market territory . Yet in the middle of the chaos, Zcash (ZEC) is suddenly exploding in value—up double digits while major altcoins collapse.

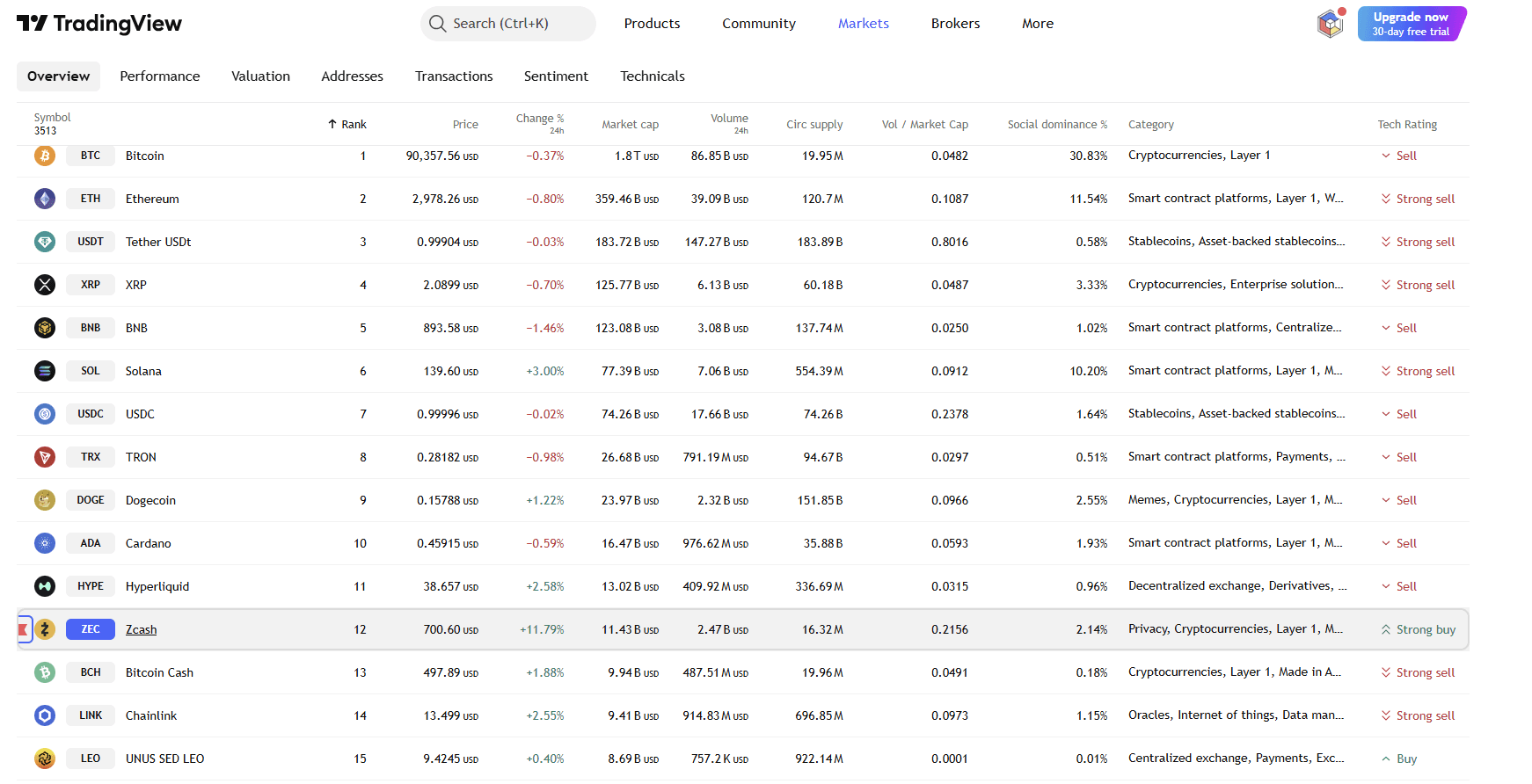

How did ZEC climb to Rank #12, outperforming Ethereum, BNB, XRP, ADA, and even memecoins? And more importantly: should you buy ZEC during this market crash?

By TradingView - Major Cryptos (24h)

By TradingView - Major Cryptos (24h)

Here’s a full breakdown.

1. Why Is ZEC Pumping While the Market Is Crashing?

Instead of following the broader capitulation, ZEC is doing the opposite . This isn’t random—it’s driven by five powerful catalysts.

1.1 Rotation Into Privacy Coins During Panic

When fear spikes, investors flock to privacy-based assets.

Historically:

- Risk-off → BTC down

- Market panic → privacy coins up

ZEC acts like a hedge when markets break down.

With:

- unemployment rising

- ETF outflows piling up

- BTC volatility exploding

- sentiment at Extreme Fear (10/100)

This is the perfect environment for ZEC to rally.

1.2 ZEC Is the Most “Legitimate” Privacy Coin

Unlike newer projects built on hype, Zcash comes from:

- leading cryptographers

- academic researchers

- the creators of zk-SNARKs

Institutions looking for privacy exposure choose ZEC over niche alternatives.

This is smart-money accumulation, not retail speculation.

1.3 ZEC Was Oversold for Years — Now Snapping Back

ZEC has been crushed for 4+ years:

- lowest BTC ratio in history

- lowest USD price in years

- hitting multi-year support

This creates a coiled spring effect.

Any positive catalyst = rapid short squeeze + strong bounce.

That’s exactly what we’re seeing now.

1.4 Privacy Coins Move Opposite to Bitcoin

ZEC has a unique behavior:

- When BTC pumps → ZEC lags

- When BTC crashes → ZEC pumps

This inverse correlation makes ZEC attractive during panic selling.

Right now, BTC is struggling to hold $90K with a downside target toward $82K—so buyers are rotating into assets like ZEC.

1.5 Quiet Institutional Accumulation

OTC data during the past month shows:

- large wallets accumulating

- elevated inflows on dips

- renewed interest in privacy research

- zk-technology demand rising globally

Institutions accumulate quietly. Retail is only noticing it now because price finally reacted.

2. How ZEC Jumped to Rank #12

This is not because ZEC “suddenly turned huge.”

It’s because:

- Altcoins collapsed -20% to -40%

- ZEC rose +30% to +150% in some trading pairs

- Market cap re-ordering happened instantly

Coins like ADA, TRX, DOGE, LINK, and SOL lost billions while ZEC grew.

Result: ZEC overtook them during the crash.

3. ZEC History: Why It Matters Now

To understand why ZEC is relevant again , you need its backstory.

3.1 Launch Date

26 October 2016

ZEC is almost 9 years old, older than most of today’s top coins.

3.2 Origins & Team

Created by:

- Zooko Wilcox

- Researchers from MIT, Johns Hopkins, UC Berkeley, and Tel Aviv University

ZEC is backed by serious cryptography—no hype, no meme-culture.

3.3 ZEC’s Biggest Innovation: zk-SNARKs

Zcash introduced the first real-world implementation of zero-knowledge proofs, which now power:

- Polygon zkEVM

- zkSync

- StarkWare

- Ethereum L2 scaling

- countless privacy and rollup solutions

Everything “zk” today started with Zcash.

This is why deep-tech investors still follow it.

4. Should You Buy ZEC Now? (Pros & Risks)

Here’s the honest breakdown.

4.1 Reasons to Consider Buying ZEC

✔ Privacy demand is rising

Regulation, recession fears, and data sovereignty all boost ZEC’s long-term relevance.

✔ ZEC pumps during fear cycles

Historically, ZEC outperforms when Bitcoin dumps—exactly the current setup.

✔ Strong technological foundation

ZEC isn’t a meme. It's a cryptographic breakthrough.

✔ Long bear market makes ZEC undervalued

Prices corrected for years—making upside magnified.

✔ Institutional whispers

zk-research, private settlement layers, and privacy-testnets are still being built around ZEC.

4.2 The Risks You Must Consider

❌ It does NOT pump in normal bull markets

When Bitcoin rallies → ZEC lags behind.

❌ Regulatory uncertainty

Privacy coins sometimes face exchange delistings.

❌ Volatility is extreme

ZEC’s rallies are violent—but so are its corrections.

❌ No strong retail narrative

Memecoins attract retail, ZEC attracts specialists. That limits hype-driven upside.

5. Price Outlook — What Happens Next?

Here’s the realistic outlook :

If Bitcoin continues falling to $82K or $75K:

ZEC could keep outperforming in the short term.

If Bitcoin stabilizes above $90K:

ZEC cools off, but holds gains.

If Bitcoin begins a strong recovery:

ZEC may underperform again—as capital rotates back to majors and memecoins.

This is why ZEC is ideal during crashes, not during euphoric bull phases.

6. Final Verdict: Should You Buy ZEC?

Short-term answer:

✔ Yes — if you want an asset that performs well during panic and uncertainty.

ZEC is one of the only green coins in a sea of red because its value rises during macro fear.

Medium-term answer:

🟧 Consider a small position if you expect more BTC downside.

ZEC historically shines in exactly this environment.

Long-term answer:

🟩 ZEC remains one of the strongest cryptographic projects in existence.

But it is not a “mainstream” investment like ETH or SOL.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Sharp Decline as Macroeconomic Conditions Change: The Impact of Increasing Interest Rates and Heightened Regulatory Oversight on Cryptocurrency Values

- Bitcoin's 2025 late-year drop from $126,000 to $80,000 reflects heightened sensitivity to Fed policy shifts and regulatory pressures. - Fed officials like Susan Collins signaled "mildly restrictive" policy, crushing rate cut expectations and triggering 70% decline in December cut odds. - Regulatory crackdowns on crypto mixing and mining contrasted with institutional buying (e.g., Cardone Capital's $15. 3M Bitcoin purchase) amid market volatility. - Political uncertainty (60% expect Trump-era crypto gains

Bitcoin’s Abrupt Price Swings and Institutional Outflows: An In-Depth Analysis of Market Dynamics and Liquidity Challenges

- Institutional investors are shifting capital from Bitcoin to AI infrastructure, driven by higher returns in 2025. - Bitcoin's liquidity has declined, with order book depth dropping to $14M by mid-2025, exacerbating volatility. - Structural shifts, including mining repurposing and AI-focused capital flows, threaten Bitcoin's hash rate and market stability. - Alternative projects like XRP Tundra and AI-driven risks challenge Bitcoin's dominance, complicating investor strategies.

X Financial Shifts to Risk-First Approach: Third Quarter Revenue Drops 13.7% Amid Strategic Change

- X Financial reported 23.9% YoY revenue growth to RMB1.96B in Q3 2025, but saw 13.7% sequential decline due to cautious lending and risk prioritization. - Net income rose 12.1% annually to RMB421M but fell 20.2% sequentially, driven by higher credit provisions and operating costs. - Share repurchases under $100M buyback program totaled $67.9M, with $48M remaining as the company emphasizes disciplined risk management. - Strategic pivot to risk mitigation contrasts with broader fintech sector caution, refle

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks