Japan’s Metaplanet to raise about $135m to buy Bitcoin

Tokyo-listed Metaplanet plans to issue Class B perpetual shares worth $135 million to expand its Bitcoin reserves.

- Metaplanet announced issuing about $135 million in shares to buy Bitcoin

- Class B shares will have no voting rights, but will have redemption at listing

- The firm currently owns 30,823 Bitcoin, worth about $2.69 billion

As corporate Bitcoin adoption strengthens worldwide, one Metaplanet is taking an increasingly aggressive approach. On Thursday, November 20, the Tokyo-listed Bitcoin treasury firm announced the issuance of 23.61 million Class B Preferred Shares, valued at about $135 million.

The firm will use the proceeds of these sales from these sales to expand its Bitcoin holdings. The firm will issue these shares at ¥900 per share, with an annualised 4.9% dividend rate. Holders will then be able to convert these shares into common shares, which hold voting rights.

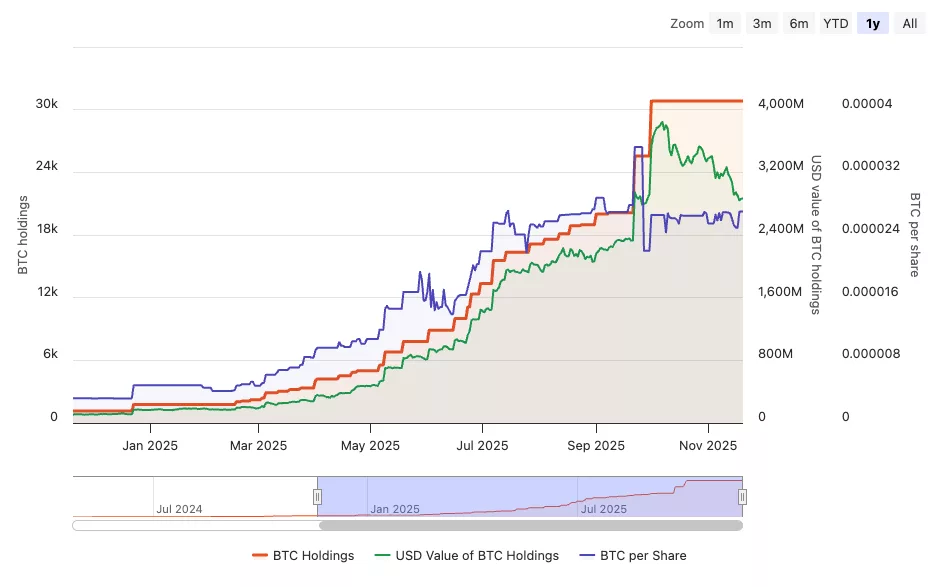

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

What is more, holders will be able to redeem their shares if they are not listed by 20 business days after Dec. 29, 2026.

Metaplanet mirrors Strategy in Bitcoin accumulation

The issuance of Class B Preferred Shares mirrors the model used by Michael Saylor’s Strategy. Notably, it enables the firm to raise more capital to pursue its aggressive accumulation. While the issuance initially dilutes shareholders, it does not immediately increase common stock. For that reason, its profitability hinges on Bitcoin’s near-term growth, which Metaplanet is betting on.

“The Company believes that Bitcoin will deliver long-term returns that exceed the preferred share dividend yield,” Metaplanet wrote in the filing.

Currently, Metaplanet holds 30,823 BTC , worth approximately $2.69 billion. The firm purchased its Bitcoin at an average price of $108,036, and is down 19.33% on its investment. Despite this, the firm has $3 billion in market cap, which is higher than its BTC holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: JPMorgan's Shutdown of Strike Opposes Trump's Directive Against Debanking

- JPMorgan's closure of Strike CEO Jack Mallers' accounts contradicts Trump's August executive order banning crypto "debanking," sparking regulatory scrutiny. - Mallers criticized the lack of transparency, noting JPMorgan cited "concerning activity" without specifics and warned against future account access. - Industry experts argue such actions risk pushing crypto innovation to unregulated markets, undermining U.S. financial leadership and democratic systems. - The incident highlights contradictions in JP

Bitcoin News Update: With Trump's Crypto Faltering, Investors Turn to Stablecoins for Security

- Trump's crypto investments lost $1B as ABTC and TMTG collapsed, prompting a shift to stablecoins exceeding $300B market cap. - Trump Media's $250M Bitcoin investment initially boosted shares but was overshadowed by broader crypto market declines. - SEC probes and central bank warnings highlight risks in politically connected crypto projects and stablecoin redemption vulnerabilities. - Despite losses, Trump family members remain bullish on Bitcoin, while DOGE meme coin surged post-program termination. - M

Investors Abandon HBAR Due to Instability, Turn to Small-Cap Options

- HBAR price collapsed below $0.1440, triggering bearish signals as key support levels failed to hold amid surging trading volume. - Zero-volume trading halts and distribution patterns highlight liquidity risks, with critics questioning market depth infrastructure. - Investors shift toward low-cap alternatives as HBAR's volatility contrasts with gains in fintech (SoFi +87.7%) and space-tech (BlackSky $71.4M revenue). - Analysts warn further downside to $0.1340 remains likely without institutional support,

ECB Cautions That Fluctuations in Tech and Crypto May Trigger a Market Crash Similar to 2000

- ECB warns U.S. tech and crypto volatility risks triggering a 2000-style market crash, citing sharp asset corrections and AI-driven valuation fragility. - ECB officials stress central banks must retain rate-cut flexibility amid rising risks, as crypto outflows and equity inflows highlight market divergence. - JPMorgan analysis flags crypto panic-selling risks spilling into broader systems, while MSCI warns a 63% sector collapse could follow AI confidence loss. - ECB and BIS caution stablecoin growth threa