Musk's Vision of a Future Without Mandatory Work Ignites Discussions on the Practicality of AI and Social Disparities

- Elon Musk predicts work will become optional in 10-20 years as AI/robotics render traditional labor obsolete, comparing future employment to leisure activities. - Tesla aims for 80% of its value to derive from Optimus robots, while economists question scalability challenges and decreasing returns in robotics adoption. - AI-driven sectors like Energy Management Systems are projected to grow rapidly, but face high costs and integration barriers for small businesses. - Critics warn Musk's vision risks exace

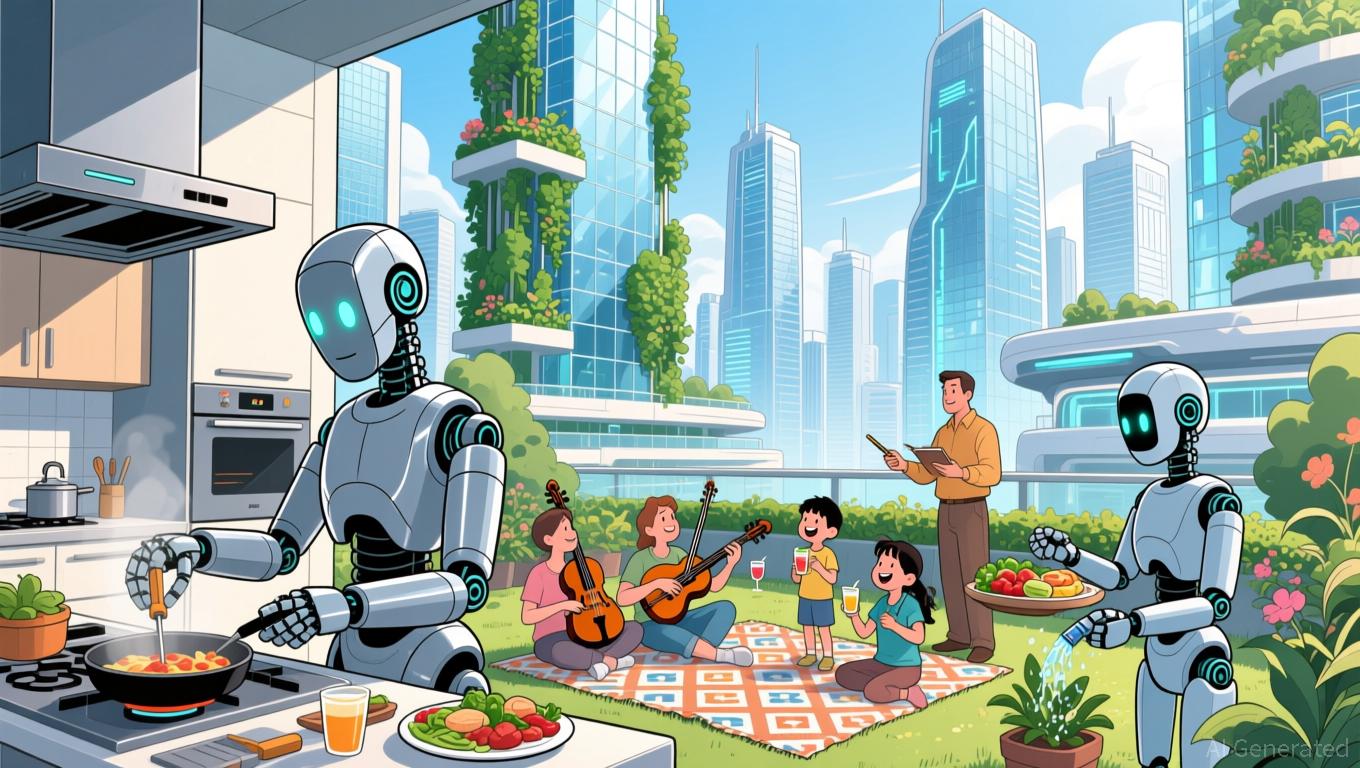

Elon Musk has forecasted that within the next decade or two, employment will become a matter of personal preference and financial concerns will diminish, all due to rapid progress in artificial intelligence (AI) and robotics. During his appearance at the U.S.-Saudi Investment Forum in Washington, D.C., the

Musk’s outlook is based on a world where countless robots take over physically demanding jobs, driving productivity so high that people can work for pleasure rather than for survival. His $470 billion company, Tesla,

The idea of a future where scarcity is eliminated and money becomes obsolete is inspired by science fiction writer Iain M. Banks’ Culture series, which

Major corporations are also evolving. C3.ai, a top provider of AI solutions for businesses,

Critics say Musk’s optimistic outlook ignores significant social and political barriers. Anton Korinek, an economist at the University of Virginia, cautions that a society where work is optional could disrupt social bonds,

As discussions about AI’s broader effects continue, Musk’s forecasts remain at the center of attention. Whether his vision of a society beyond work becomes reality will hinge not only on technological breakthroughs but also on tackling inequality and redefining human roles in an automated world

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Addresses Crypto Privacy Challenge: Balancing Investor Security and Technological Autonomy

- SEC hosts roundtable to address crypto privacy vs. surveillance tensions amid evolving regulatory framework. - Agency shifts focus to core compliance areas, deprioritizing crypto enforcement compared to prior administration. - DOJ intensifies crackdown on privacy tools, convicting Samourai Wallet founders for AML violations. - Regulatory divide between SEC and DOJ creates uncertainty as Congress delays digital asset bill. - Debate highlights tension between investor protection and crypto's decentralizati

JPMorgan Lowers Bullish's 2026 Projection, Adjusts Focus to Fundamental Earnings

- JPMorgan cuts Bullish's 2026 price target to $45 from $46, excluding $6.2M in high-margin stablecoin promotion revenue from IPO proceeds. - Bullish's Q3 results exceeded forecasts with $77M revenue and $29M adjusted EBITDA, though seasonal trading weakness tempered optimism. - Deutsche Bank upgrades Bullish to "Buy" with $51 target, citing U.S. expansion and infrastructure role for traditional finance firms in crypto. - Bullish's stock trades near 52-week low despite 72% Q3 revenue growth, as JPMorgan hi

Bitcoin News Update: Arizona's Approach to Bitcoin Through MSTR—Smart Equity Move or Risky Pension Gamble?

- Arizona's pension fund holds $13.5M in Bitcoin via 76,238 MSTR shares, down from $24M as the stock fell 60% since November 2024. - MSTR faces potential $2.8B outflows if excluded from MSCI indices, exacerbating liquidity risks amid its heavy reliance on index-linked passive flows. - The firm recently bought 8,178 BTC ($835.6M) to reach 649,870 tokens ($48.37B cost value), defended by CEO Saylor as a long-term strategy. - Institutional investors increasingly use equity-linked crypto exposure through firms

DASH Aster DEX: Transforming Decentralized Exchange Frameworks and Enhancing User Engagement in DeFi

- DASH Aster DEX emerges as a leading DeFi DEX in 2025 with a hybrid AMM-CEX model, cross-chain liquidity routing, and AI optimization. - The platform secures $50B in assets, processes 10,000 TPS, and achieves $1.399B TVL with 2 million users post-September 2025 TGE. - It outperforms Uniswap in weekly fee generation ($69.5M vs. $32M) while competing with PancakeSwap's $1.2T 365-day volume. - Strategic partnerships with Binance and YZi Labs enhance institutional credibility but expose risks in cross-chain i