Bitcoin (BTC) price has extended its losses below $87k on Thursday, November 20, 2025. The flagship coin dropped over 5% during the past 24 hours to reach a new seven-month low of about $86.3k before rebounding to trade about $87.3k at press time.

The wider crypto market followed Bitcoin in losses, thus resulting in over $914 million liquidated from leveraged traders. Notably, more than $703 million involved long traders, thus further fueling bearish sentiment via a long squeeze.

In the weekly timeframe, Bitcoin price has been forming a symmetrical rising channel since early 2023. Since hitting its all-time high of about $126k in October, Bitcoin price has been trapped in a correction mode, thus retesting the lower border of its macro rising channel.

Source: TradingView

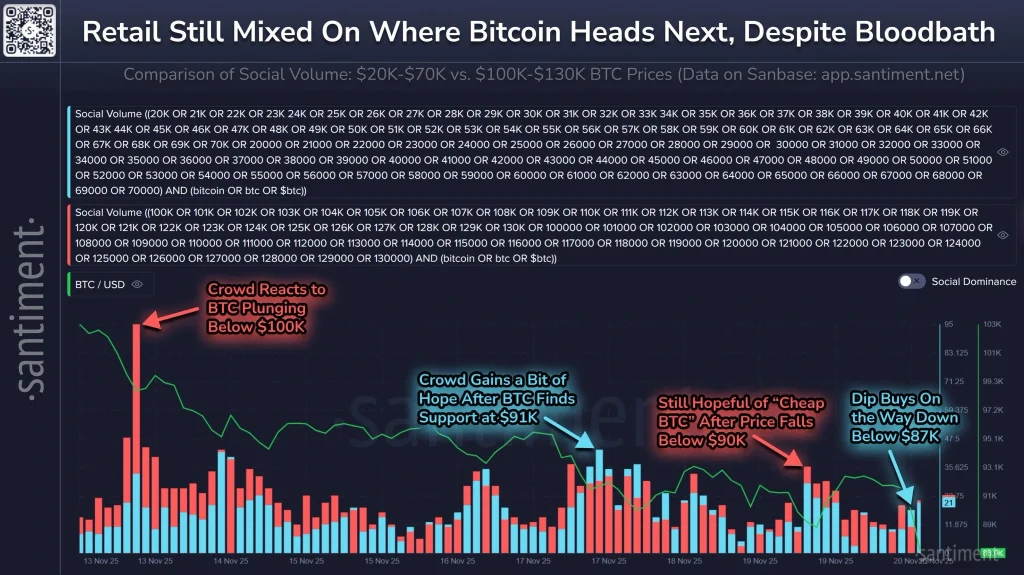

According to market data analysis from Santiment, retail traders have shown increased predictions of BTC price falling below $70k. However, Santiment noted that the market tends to move in the opposite direction of the retail traders.

Source: Santiment

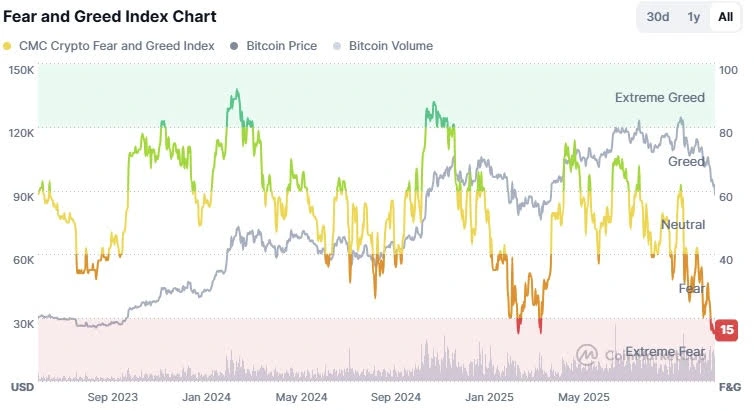

The midterm bullish sentiment is bolstered by the extreme fear of further crypto capitulation. Notably, CoinMarketCap’s Fear and Greed Index dropped to its yearly low of about 15/100.

Source: CoinMarketCap

The last time that this index dropped to such levels resulted in a bullish rebound in the subsequent few months.

Following the reopening of the U.S. government, liquidity is expected to find its way to the crypto market amid the anticipated Federal Reserve’s Quantitative Easing (QE). As CoinPedia reported , the Bitcoin price is likely to experience a similar rebound to the post-U.S. government shutdown of 2019.