BitMine Faces Over $4 Billion in Unrealized Loss as Digital Asset Treasury Model Faces Scrutiny

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings. The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model. BitMine’s Mounting Losses Create ‘Hotel California’ Scenario In a recent

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings.

The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model.

BitMine’s Mounting Losses Create ‘Hotel California’ Scenario

In a recent disclosure released earlier this week, BitMine revealed that it held nearly 3.6 million ETH, equivalent to approximately 2.97% of Ethereum’s supply. The company is steadily approaching its long-stated goal of accumulating 5% of all ETH.

However, its treasury is increasingly feeling the strain from the asset’s sharp price decline. Ethereum has dropped 27.4% over the past month, now trading below $3,000. Concurrently, BitMine’s balance sheet has reflected that drop.

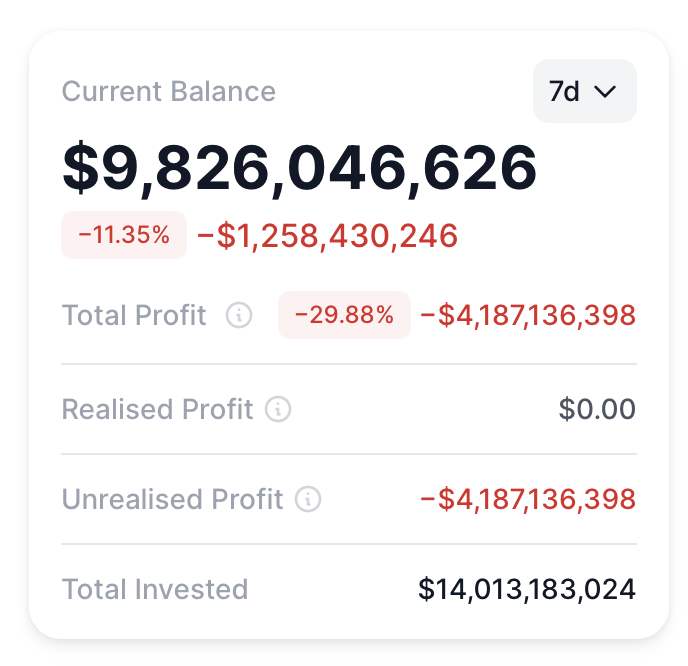

The latest figures show that the firm’s ETH stack is now worth just under $10 billion, placing BitMine’s unrealized losses at around $4.18 billion.

BitMine Unrealized Losses. Source:

BitMine Unrealized Losses. Source:

According to BitmineTracker data, the company’s basic market-to-net-asset-value (mNAV) ratio stands at 0.73, while its diluted mNAV is 0.88. Research firm 10x Research highlighted the implications in a recent post on X (formerly Twitter).

The post emphasized that shifts in NAV tend to reward long-term shareholders when the metric rises, but can amplify losses when it declines — a pattern that many investors in digital-asset vehicles still overlook.

“Treasury companies will face a hard reality: attracting new retail investors becomes nearly impossible when existing shareholders are sitting on billions in losses. When the premium inevitably shrinks to zero, as it is doing now, investors find themselves trapped in the structure, unable to get out without significant damage, a true Hotel California scenario,” 10x Research wrote.

The strain is equally visible in the company’s stock performance. Google Finance data shows that BMNR’s monthly dip is nearly twice that of ETH, with the share price dropping 49.8% over the same period.

This divergence is not unique to BMNR. Several Bitcoin-oriented treasuries have displayed the same pattern, registering declines that exceed BTC’s own downturn.

BitMine (BMNR) Stock Performance. Source:

BitMine (BMNR) Stock Performance. Source:

Meanwhile, BitMine is not alone in these challenges. Sharplink Gaming, the second-largest corporate holder of ETH, faces over half a billion dollars in unrealized losses. It owns 859,853 ETH valued at $2.4 billion at current market prices. The firm’s stock, SBET, is down 35.15% over the past month.

Despite this, on-chain data reveals BitMine is still actively buying ETH. Earlier this month, the firm bought 110,288 ETH. OnchainLens also reported a recent purchase of 17,242 ETH, valued at $49.07 million, from FalconX and BitGo.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea’s $13.8B Fintech Consolidation Connects Conventional Finance with Crypto, Aiming for Worldwide Leadership

- South Korea's Dunamu merges with Naver to form a $13.8B fintech entity, combining blockchain and payments expertise for global crypto expansion. - The stock-swap deal reduces Naver's ownership to 17% while retaining operational control through voting rights, addressing shareholder concerns. - Regulators assess the merger's compliance with anti-money laundering rules and market competition risks amid South Korea's evolving crypto regulations. - A potential 2026 Nasdaq IPO could capitalize on strong earnin

Ethereum Updates Today: Dual Challenges: Trump’s Tariff Policies and Cryptocurrency Fluctuations Put Global Markets to the Test

- Trump exempts Brazilian coffee, beef from 40% tariffs, shielding key exports amid Lula's strategic defiance. - Lula's tariff victory boosts agricultural sector and political standing as U.S. economic concerns grow. - Bitcoin drops to $82,000 while crypto funds face $1.94B outflows amid Ethereum's deflationary challenges. - Market volatility underscores global fragility as Trump's trade policies and crypto turbulence intersect.

Bitcoin News Today: Leverage-Induced Bitcoin Correction: $700 Million in Liquidations Sets Stage for Recovery

- Bitcoin's open interest fell 8,500 BTC in 48 hours, triggering $700M in leveraged liquidations and pushing price below $82,000 per Decrypt. - Total crypto market cap dropped below $3T for first time in seven months, with $2B+ in derivatives liquidations across Bybit and Hyperliquid. - Record $3.79B ETF outflows in November, led by BlackRock's IBIT, amplified selling pressure as ETF buffers disappeared. - Analysts note leveraged deleveraging could form a "solid bottom," but macro risks like strong USD and