The Canary in the Coalmine: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Eric Trump was right when he reportedly said on Sept. 27 that the fourth quarter would be unbelievable for crypto holders. It has been so far ... just not the way bulls would have hoped.

Bitcoin BTC$82,123.83 has plunged 28% to $82,000, with a drop of over 5% in the past 24 hours alone. Total crypto market capitalization has shrunk 27% to $2.8 trillion.

Regular readers of the Daybook are well aware of the catalysts: the Oct. 10 auto-deleveraging event that rattled market confidence, leaving arbitrageurs as marginal sellers in the spot market; the exhaustion of the digital-asset treasury narrative; a strengthening dollar; diminishing expectations for interest-rate cuts in the U.S.

On top of that, spot bitcoin and ether ETFs are seeing record redemptions. These investment vehicles are viewed as proxies for institutional capital, which we were told tends to be sticky and takes long-term positions.

If that’s the case, then these record outflows make me wonder: Are these redemptions and price declines a sign of institutions preparing for a bigger macroeconomic stress? After all, bitcoin and the wider crypto market are fundamentally liquidity-driven, risk-on/risk-off plays. Note that BTC peaked at least a month before stocks did in late 2021.

There are several issues that could escalate, such as Japan’s fiscal challenges, deteriorating private credit in the U.S., and a potential outsized rally in the dollar, all themes we’ve mentioned recently.

These may evolve into a bigger crisis. For now, the crypto market dip keeps giving, with BTC's price chart showing next major support directly at around $75,000 alongside growing investor interest in deep out-of-the-money puts tied to BlackRock's spot ETF. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Nothing scheduled.

- Macro

- Nov. 21, 8:45 a.m.: Fed Vice Chair Philip N. Jefferson speech on "Financial Stability." Watch live.

- Nov. 21, 9:45 a.m.: S&P Global U.S. Nov. PMI. Manufacturing Est. 52, Services Est. 54.6, Composite Est. 54.5.

- Nov. 21, 10 a.m.: University of Michigan's Final Nov. data. Consumer Sentiment Index Est. 50.5, 5-Year Inflation Expectations Est. 3.6%.

- Earnings (Estimates based on FactSet data)

- Nov. 21: Bitmine Immersion Technologies (BMNR), pre-market.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes and calls

- River (RIVER) is hosting an ask-me-anything on X at 8 a.m. to discuss upcoming changes.

- Unlocks

- None

- Token Launches

- Capybobo (PYBOBO) to list on Gate with PYBOBO/USDT pair.

- SAPIEN$0.1367 to list on Bitmart with SAPIEN/USDT pair.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 1 of 3: BITFEST 2025 (Manchester, U.K.)

Market Movements

- BTC is down 4.5% from 4 p.m. ET Thursday at $91,891.98 (24hrs: -9.71%)

- ETH is down 5.42% at $2,720.57 (24hrs: -10.18%)

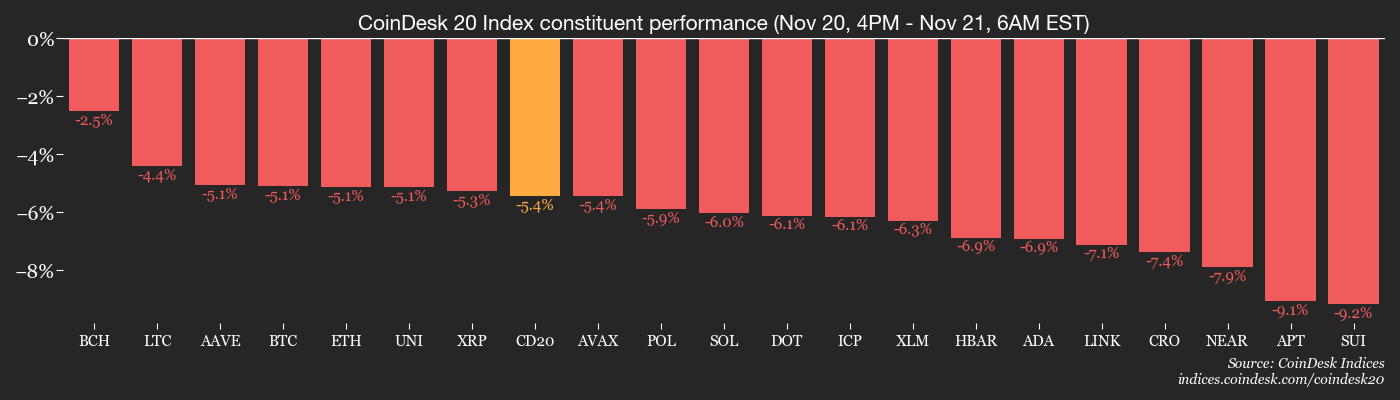

- CoinDesk 20 is down -6.38% at 2,950.83 (24hrs: -10.42%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.93%

- BTC funding rate is at 0.0072% (7.446% annualized) on Binance

- DXY is unchanged at 100.22

- Gold futures are down 0.70% at $4,031.70

- Silver futures are down 4.14% at $48.22

- Nikkei 225 closed down 2.40% at 48,625.88

- Hang Seng closed down 2.38% at 25,220.02

- FTSE is down 0.49% at 9,480.78

- Euro Stoxx 50 is down 1.26% at 5,499.73

- DJIA closed on down 0.84% at 45,752.26

- S&P 500 closed down 1.56% at 6,538.76

- Nasdaq Composite closed down 2.15% at 22,078.05

- S&P/TSX Composite closed down 1.23% at 29,906.55

- S&P 40 Latin America closed down 1.32% at3,029.45

- U.S. 10-Year Treasury rate is down 4.3 bps at 4.061%

- E-mini S&P 500 futures are down 0.08% at 6,552.50

- E-mini Nasdaq-100 futures are down 0.34% at 24,048.75

- E-mini Dow Jones Industrial Average Index are up 0.26% at 45,944.00

Bitcoin Stats

- BTC Dominance: 58.83% (-0.14%)

- Ether-bitcoin ratio: 0.03261 (-0.3%)

- Hashrate (seven-day moving average): 1,048 EH/s

- Hashprice (spot): $34.10

- Total fees: 3.17 BTC / $285,386

- CME Futures Open Interest: 134,245 BTC

- BTC priced in gold: 20.5 oz.

- BTC vs gold market cap: 5.55%

Technical Analysis

- With a drop to nearly $81,000, BTC has retraced 80% of the rally from $75,000 in April to over $126,000 in early October.

- Prices have dipped below the 0.786 Fibonacci retracement.

- The next support is seen at around $75,000.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $238.16 (-7.44%), -2.71% at $231.71 in pre-market

- Circle Internet (CRCL): closed at $66.93 (-4%), -2.66% at $65.15

- Galaxy Digital (GLXY): closed at $24.03 (-6.72%), -5.58% at $22.69

- Bullish (BLSH): closed at $36.50 (0.3%), -3.01% at $35.40

- MARA Holdings (MARA): closed at $10.24 (-7.75%), -4% at $9.83

- Riot Platforms (RIOT): closed at $12.78 (-4.27%), -4.85% at $12.16

- Core Scientific (CORZ): closed at $15.16 (-1.49%), -2.37% at $14.80

- CleanSpark (CLSK): closed at $9.78 (-4.31%), -3.99% at $9.39

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $38.76 (-4.06%)

- Exodus Movement (EXOD): closed at $14.19 (-2%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $177.13 (-5.02%), -5.41% at $167.55

- Semler Scientific (SMLR): closed at $18.47 (-6.39%)

- SharpLink Gaming (SBET): closed at $9.30 (-5.78%), -5.38% at $8.80

- Upexi (UPXI): closed at $2.47 (-8.18%), -3.24%at $2.39

- Lite Strategy (LITS): closed at $1.70 (-4.49%), -4.12% at $1.63

ETF Flows

Spot BTC ETFs

- Daily net flows: -$903.2 million

- Cumulative net flows: $57.38 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: -$261.6 million

- Cumulative net flows: $12.6 billion

- Total ETH holdings ~6.24 million

Source: Farside Investors

While You Were Sleeping

- BTC Falls Toward Mid-$80Ks as Market Structure Weakens Into Year-End (CoinDesk): Market maker FlowDesk said coins from long-dormant wallets are flooding exchanges and overwhelming bids, leading to defensive positioning, thin liquidity and a rotation into lower-strike puts for downside protection.

- Exactly One Year After Strategy’s All Time High, the Bitcoin-Linked Slide Intensifies (CoinDesk): Strategy has dropped 68% from its record high of $543 last November, while bitcoin has fallen from October’s all-time high of more than $126,000 to as low as $81,000.

- Yen Slump Is Bullish for BTC and Risk Assets. Or Is It? (CoinDesk): Rising yields in Japan are no longer lifting the yen as mounting debt fears and monetary policy constraints undermine investor confidence and cloud its usefulness as a signal for crypto markets.

- Bitcoin Heading for Worst Month Since Crypto Collapse of 2022 (Bloomberg): Bitcoin has shed about 23% this month, analysts say, as massive liquidations, spot ETF outflows and weak institutional demand deepen a correction in what could become the worst month since June 2022.

- Japan Approves $135 Billion Stimulus Shot to Help Households, Economy (The Wall Street Journal): The liquidity injection signals a pivot to aggressive fiscal policy, lifting growth expectations but stoking fears of debt strain, further yen depreciation and reduced monetary policy flexibility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH rises 20.24% in a day amid insider selling and growth strategy announcements

- DoorDash executives sold shares via prearranged Rule 10b5-1 plans, including $2.7M by CFO Ravi Inukonda and $4.6M by President Prabir Adarkar. - Sales occurred amid strategic expansion plans, including DashPass enhancements and global food delivery partnerships to strengthen market leadership. - DASH shares rose 20.24% in 24 hours despite insider sales, with institutional investors adding 53,632 shares as confidence in expansion persists. - Analysts maintain positive outlooks (avg. $275.62 target), thoug

Bitcoin News Update: Nasdaq's IBIT Options Growth Signals Bitcoin's Entry into Institutional Mainstream

- Nasdaq proposes raising IBIT options limits to 1M contracts, aligning Bitcoin with top-tier assets like Apple and Microsoft . - BlackRock's IBIT now manages $65.34B in assets, dominating 69% of Bitcoin ETF volume with $157B+ market cap. - Texas and Abu Dhabi's $5M IBIT investments highlight growing institutional adoption, with Abu Dhabi tripling holdings in Q3 2025. - Analysts predict Bitcoin could reach $100K by 2026 as derivatives expansion enables hedging and reduces volatility.

AI’s Diverging Trajectories: Business Integration and Speculative Investment Drive Expansion and Hurdles

- US AI sector saw 49 startups secure $100M+ in 2025, driven by C3.ai-Microsoft enterprise AI integration and cloud partnerships. - C3.ai's industry-specific solutions (energy, manufacturing) achieved $87.2M Q1 revenue, with $370M+ FY2025 projections. - OpenAI faces $207B funding gap by 2030 despite $288B cloud contracts, highlighting sector's capital intensity and monetization challenges. - Market duality emerges: C3.ai focuses on enterprise adoption with consumption-based pricing, while OpenAI relies on

Ethereum News Update: Hyperliquid Whales Drive $100M in Long Positions While Crypto Market Recovery Remains Uncertain

- Hyperliquid whales injected $100M in leveraged longs on Bitcoin and Ethereum , signaling confidence amid crypto's fragile recovery. - BitMine Immersion's 3% ETH holdings (3.63M coins) and ETF inflows highlight institutional accumulation despite price volatility. - Ethereum trades near $2,830 with critical support/resistance levels at $2,720–$2,960, while Bitcoin struggles near $90,000 amid liquidation risks. - SEC's softer enforcement and Grayscale's Dogecoin ETF reflect regulatory shifts, as privacy coi