NEAR Intents Hits Record Transaction Volume, Raising Hopes That a Price Recovery is “NEAR”

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range. These positive metrics sparked expectations that investors may secure strong entry positions before

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range.

These positive metrics sparked expectations that investors may secure strong entry positions before overall market fear fades and fundamentals begin to take effect.

How NEAR Intents Became a Late-2025 Catalyst for NEAR’s Price

NEAR Intents is a multichain trading protocol built on NEAR Protocol, a blockchain platform focused on AI and chain abstraction.

The protocol removes the need for users to perform complex manual actions. These include bridging tokens, managing gas fees across multiple networks, or handling intermediate steps. NEAR Intents allows users—or AI agents—to express an “intent” for the desired outcome. The protocol then automates the entire process, delivering a smooth and efficient experience.

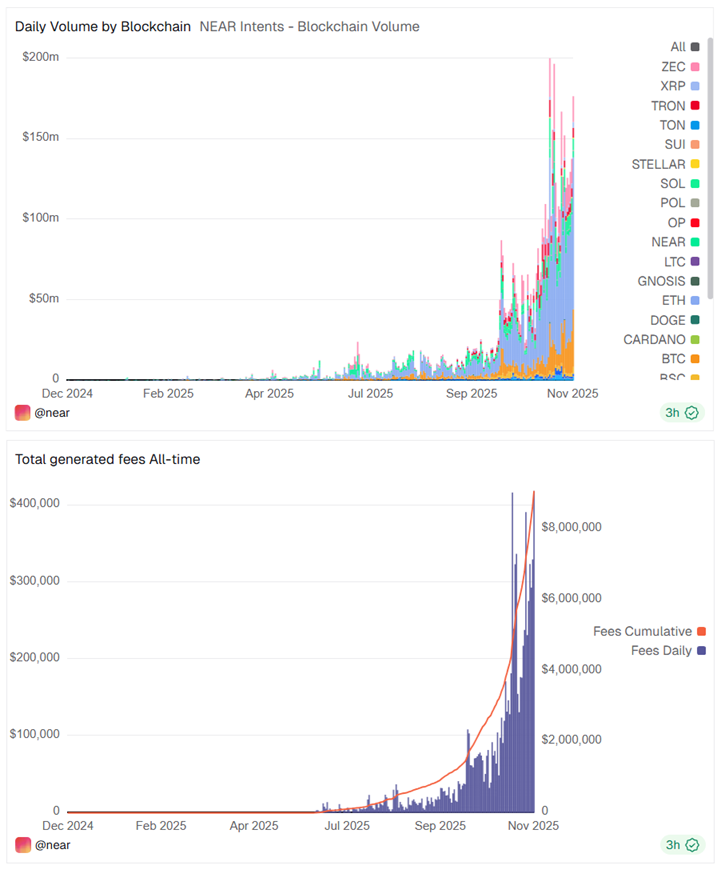

According to Dune Analytics, NEAR Intents’ daily fee revenue reached a record level of more than $400,000. This pushed total cumulative fees above $10 million. Meanwhile, daily trading volume consistently remained above $150 million, representing a tenfold increase from the previous quarter.

Daily Volume & Fee on NEAR Intents. Source: Dune.

Daily Volume & Fee on NEAR Intents. Source: Dune.

NEAR Protocol also reported that its 30-day cumulative trading volume recently surpassed $3 billion.

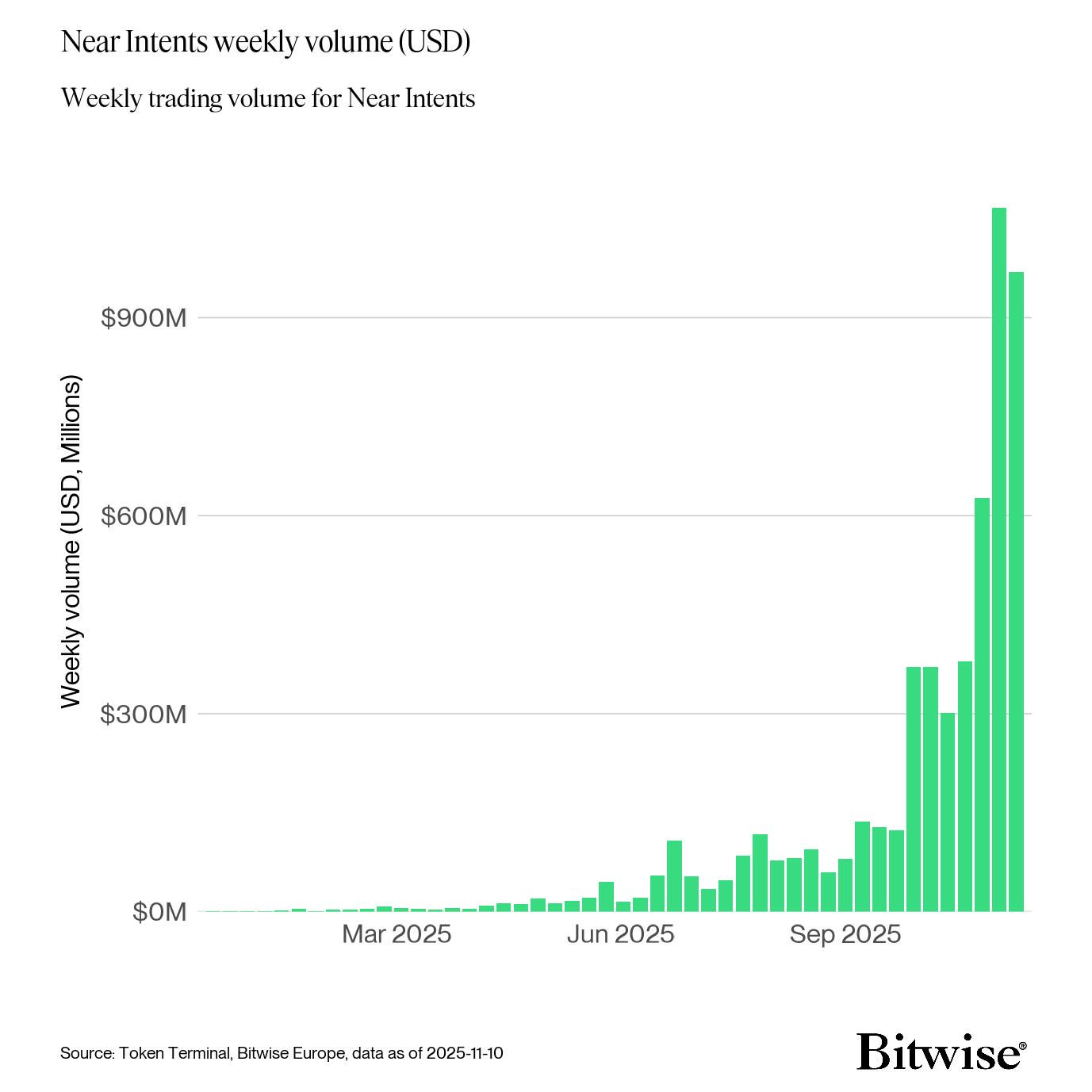

Additionally, a Bitwise report noted that NEAR Intents recorded $969 million in trading volume for the week beginning November 10, 2025. Bitwise predicted that NEAR Intents will expand weekly trading volume more than tenfold and reach $10 billion by June 2026.

Near Intents Weekly Volume. Source:

Bitwise

Near Intents Weekly Volume. Source:

Bitwise

This growth will naturally have a positive impact on the NEAR token.

“NEAR’s token model is designed to capture value from AI-native activity. This includes intent-routing fees, infrastructure services, and model execution, extending beyond traditional blockspace monetisation,” Bitwise stated.

What Drives This Surge in Volume?

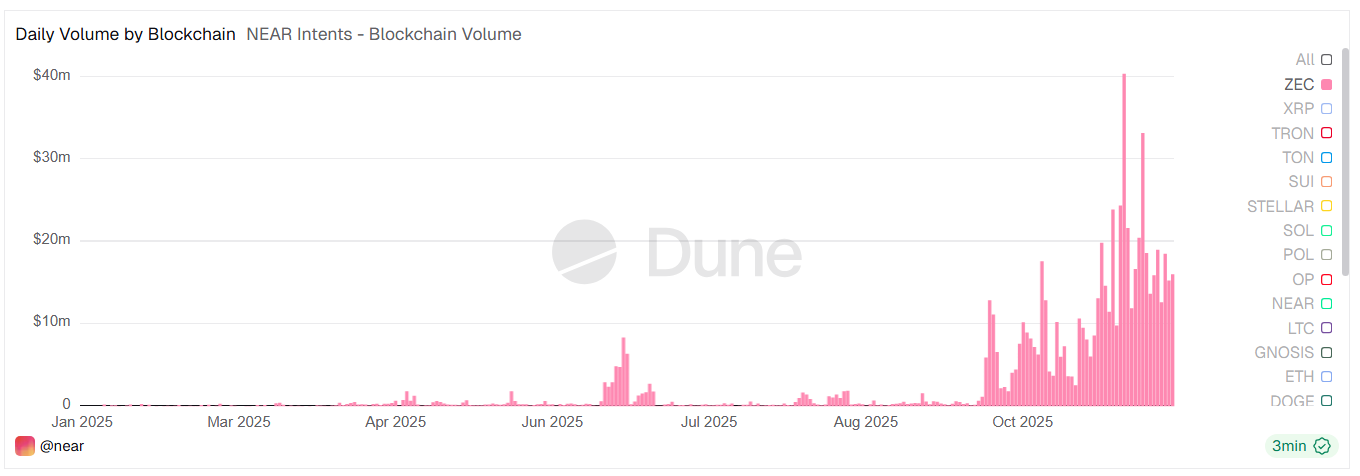

A CoinMetrics report highlighted the role of the Zashi wallet. This wallet integrates with NEAR Intents, enabling seamless multichain swaps into shielded ZEC. Meanwhile, the amount of ZEC held in shield pools reached new highs as demand for privacy accelerated.

ZEC Volume on NEAR Intents. Source:

Dune

ZEC Volume on NEAR Intents. Source:

Dune

As a result, investors have increasingly turned to NEAR Intents. Trading in ZEC now accounts for about 10% of the protocol’s daily volume, averaging $15 million per day.

NEAR’s Price Remains Stuck in the 2025 Accumulation Range

Despite these developments, NEAR’s price remains trapped in its 2025 accumulation zone. TradingView data shows NEAR moving between $1.90 and $3.10 since the beginning of the year.

NEAR Price Performance. Source:

TradingView.

NEAR Price Performance. Source:

TradingView.

Analyst Vespamatic attributed this stagnation to Bitcoin’s price decline. This pressure could cause altcoins to drop even further, even when their fundamentals remain strong.

“NEAR has a risk of falling to $0.6, especially if Bitcoin falls to $84,000. In a bear market, almost 99% of altcoins can be destroyed, even though they have strong fundamentals,” Vespamatic predicted.

However, analysts also noted that NEAR’s current price near $1.9 aligns with the year’s strongest support. Combined with recent positive catalysts, this level may set the stage for a potential price rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Altcoin ETFs See Growth While Bitcoin and Ethereum Funds Face $4.2B Outflows in 2025

- Coinbase acquires Vector DEX to expand Solana integration, aiming to become an "everything exchange" with faster trading execution. - Altcoin ETFs (Solana, XRP) attract $632M in inflows, contrasting $4.2B outflows from Bitcoin/Ethereum ETFs amid macroeconomic uncertainty. - Institutional infrastructure advances include GSR's unified trading platform and GoPlus' $5B+ token security API usage, addressing volatility risks. - Market shifts toward diversified assets and institutional-grade tools persist as re

Bitcoin Updates: American Bitcoin Holders Pull Back While Asian Markets Strengthen Amid Changing Crypto Liquidity

- Coinbase's Bitcoin premium index hit -0.0499% on Nov 19, its widest negative level since Q1 2025, reflecting U.S. selling pressure and institutional profit-taking. - U.S. Bitcoin ETFs saw $2.47B in redemptions (63% of total outflows) as prices fell to 7-month lows, contrasting with rising Asian liquidity in spot markets. - Asian markets absorbed BTC inflows while U.S. capital retreated, signaling geographic liquidity reallocation rather than structural demand decline. - Macroeconomic factors including fa

2025's Business Landscape: Strategic Shifts Across Industries Transform Market Dynamics

- 2025's corporate landscape saw GSK transfer £17.995/share treasury stock to employee trusts, reflecting firms using share reserves for talent retention amid tight labor markets. - Formula 1's U.S. sponsorship boom (125 companies in 2025 vs. 44 in 2017) highlighted tech/AI partnerships as innovation-driven sponsorships reshaped the sport's commercial strategy. - Coinbase's acquisition of Solana-based DEX Vector (its 9th 2025 deal) aligned with $1T+ Solana DEX volume growth, signaling crypto exchanges' pus

Solana News Update: Solana ETFs Draw $421 Million Despite Price Drop, Bucking Overall Market Decline

- 21Shares launched a Solana ETF (TSOL) in the U.S., joining Fidelity and Bitwise in driving $421M in inflows despite SOL's 30% price drop. - Institutional interest grows as ETFs highlight Solana's real-world use cases in DeFi and gaming, though technical indicators show bearish momentum. - Regulatory clarity and staking innovations may sustain long-term adoption, but SOL faces critical resistance at $140 amid macroeconomic uncertainties.