PENGU USDT Sell Alert: Increasing Concerns for Those Holding Stablecoins?

- PENGU USDT's sell signal highlights structural vulnerabilities and liquidity risks amid opaque collateral and algorithmic design. - Weak technical indicators, on-chain outflows, and DeFi interdependencies amplify concerns about its peg stability and systemic contagion risks. - Regulatory shifts favoring asset-backed stablecoins under GENIUS Act and MiCA accelerate market migration away from PENGU USDT's non-compliant model. - Market share erosion and volatility patterns suggest PENGU USDT faces obsolesce

Technical and On-Chain Warning Signs

PENGU USDT’s price movement in late 2025 has been notably turbulent. Although the token surged 12.8% in early November 2025 alongside Bitcoin’s 4.3% rebound, it

The token’s liquidity problems are worsened by its algorithmic framework. In contrast to asset-backed stablecoins like

Collateral Opacity and Liquidity Concerns

PENGU USDT’s main vulnerability is its unclear collateral structure. Unlike conventional stablecoins that reveal their reserve assets (such as cash or government bonds),

Additionally, PENGU’s dependence on high-yield rewards creates a fragile sense of stability. While these incentives draw in temporary liquidity, they also expose the token to the volatility of DeFi platforms, some of which are prone to smart contract vulnerabilities.

Regulatory and Market Dynamics

Regulatory developments are hastening the decline of algorithmic stablecoins like PENGU USDT.

Broader economic conditions are also influential.

Wider Market Consequences

The sell signal for PENGU USDT is part of a larger movement toward risk aversion in the stablecoin industry. As traders move away from opaque models, capital is shifting into regulated, asset-backed stablecoins, transforming the competitive landscape. This migration could set off a chain reaction,

Conclusion

The warning sign for PENGU USDT serves as a reminder to stablecoin investors. Its liquidity issues, lack of transparent collateral, and regulatory disadvantages make it an increasing risk in a market that is moving toward greater openness and compliance. While short-term price increases are possible, the token’s long-term prospects depend on adopting reforms like overcollateralization and real-time risk monitoring to meet new regulatory expectations. For now, investors should prioritize asset-backed stablecoins and keep a close eye on PENGU USDT’s on-chain activity, as its difficulties may signal broader instability within the stablecoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

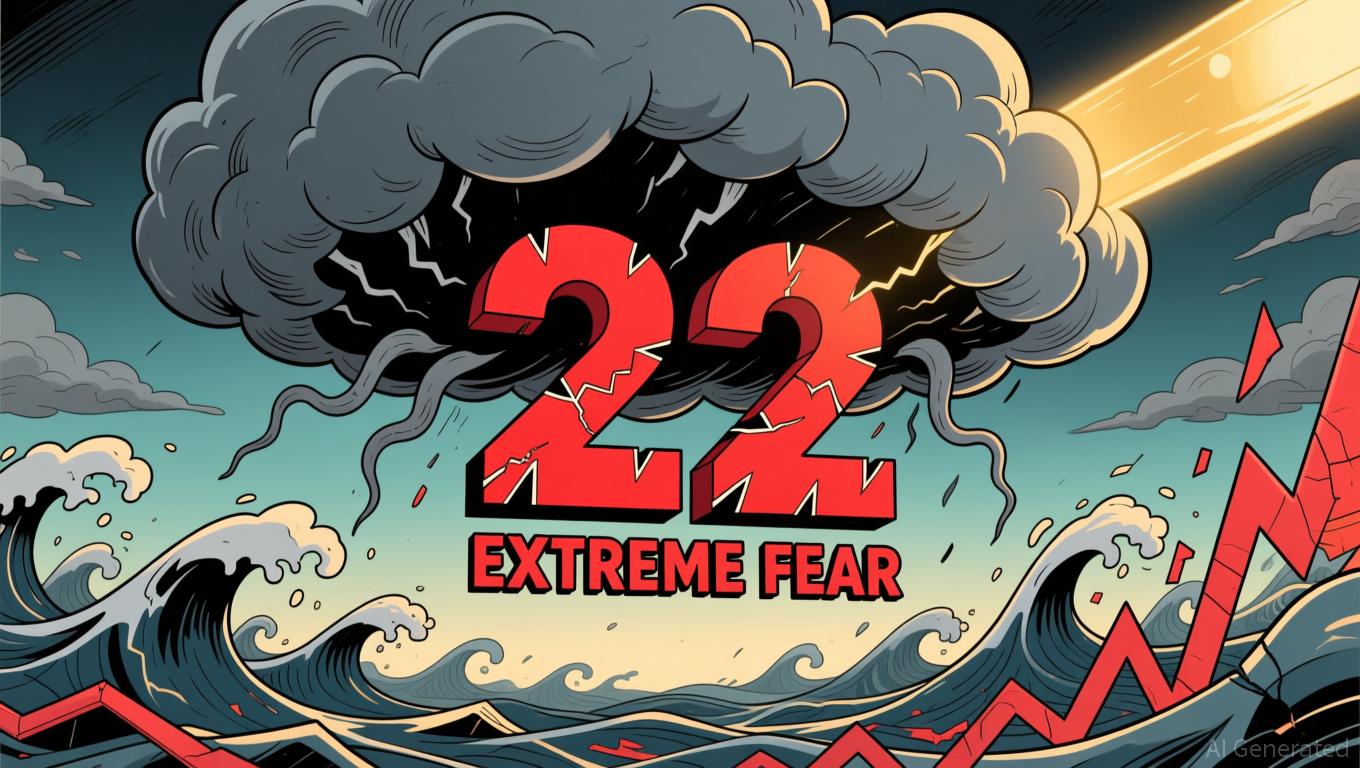

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou