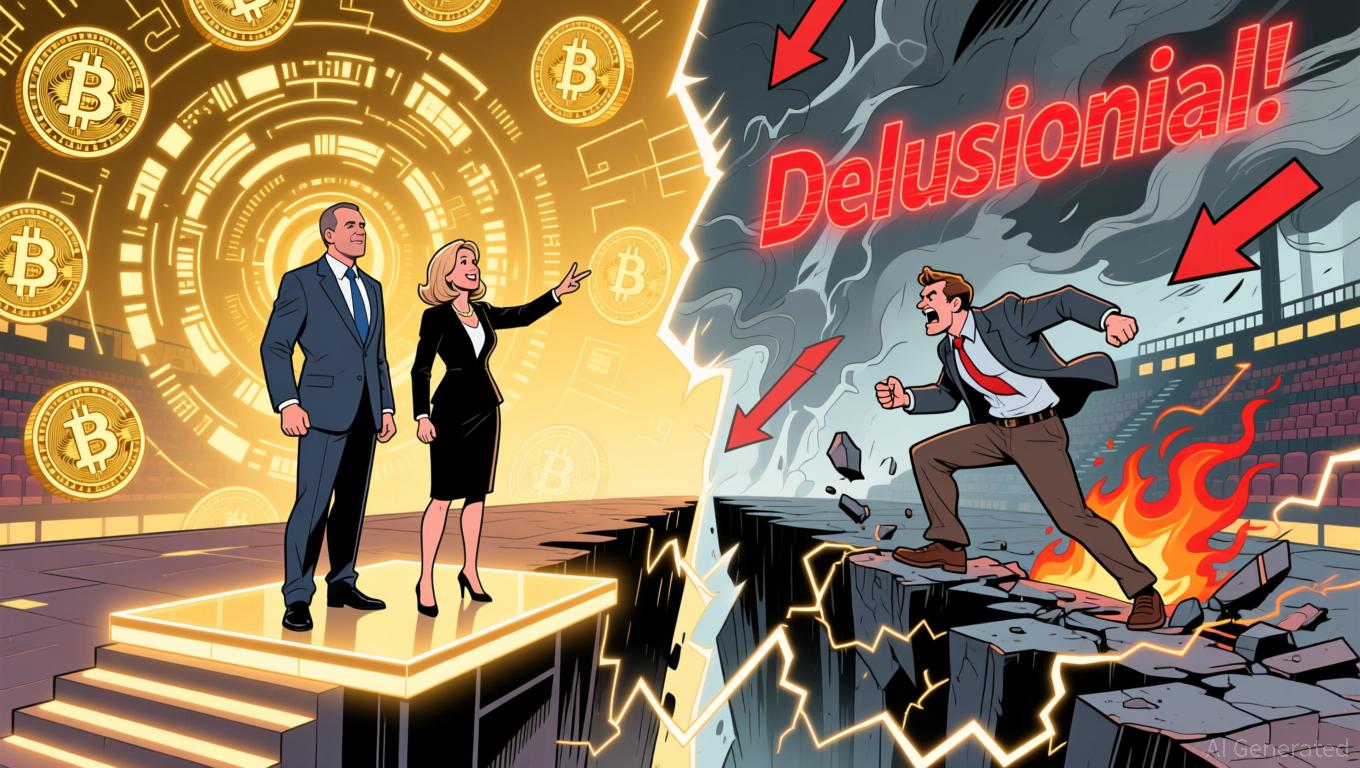

Bitcoin Updates: Crypto Enthusiasts and Conventional Experts Debate $1 Million Bitcoin Projection

Jim Cramer, who has long been critical of Bitcoin's lofty price targets, has intensified his doubts, ridiculing optimistic forecasts that claim the cryptocurrency could be valued at $1 million per coin by 2030. The CNBC anchor singled out Michael Saylor, the CEO of MicroStrategy, whose persistent support for Bitcoin's future has made him a central figure in crypto discussions. "The usual crypto bulls are gearing up for another round of hype, throwing out numbers like $1 million per

Saylor, a prominent Bitcoin advocate, has stuck to his viewpoint despite recent market swings. At the Money20/20 event in October,

This ongoing debate highlights the growing divide between staunch crypto supporters and traditional finance experts. Saylor and his supporters point to Bitcoin’s limited supply and increasing institutional interest as positive factors, while skeptics like Cramer argue that such predictions overlook broader economic challenges. "They always have to justify their stance," Cramer remarked,

At the same time, blockchain data shows Bitcoin’s lasting impact. A strategy linked to the asset

As the discussion continues, the $1 million Bitcoin prediction remains unverified—a goal that,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX's Tactical Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX's 2025 upgrade introduces ASTER token collateral for leveraged trading, enhancing capital efficiency and reducing reliance on stablecoins. - The upgrade offers 5% fee discounts for ASTER collateral users, creating a flywheel effect that boosts token scarcity and protocol revenue. - By integrating risk management tools and multi-chain support, Aster differentiates itself from GMX and Uniswap V3 through active trading incentives and reduced impermanent loss risks. - CZ's $2M ASTER purchase trigge

Toncoin’s Updated Tokenomics: How Changes in Supply Could Attract Institutional Investors and Transform Cryptocurrency Valuations

- Toncoin's 2025 tokenomics reforms aim to align supply dynamics with institutional infrastructure, boosting real-world utility through staking and burn mechanisms. - Strategic treasury operations and protocol upgrades like Jetton 2.0 seek to stabilize supply while enhancing cross-border payment efficiency and DeFi integration. - Institutional partnerships with Tether , Bitget, and Crypto.com highlight TON's growing appeal as a scalable platform with predictable yield generation for large investors. - TON

Bitcoin Updates: ETF Outflows Push Bitcoin to Lowest Point in Seven Months Amid Market Turmoil

- Bitcoin fell below $83,400, its lowest in seven months, as U.S. spot ETFs saw $3.79B in November outflows, led by BlackRock’s $2.47B loss. - Record $903M single-day ETF redemptions accelerated crypto and equity market selloffs, with Nvidia and crypto stocks dropping sharply. - Ethereum ETFs lost $1.79B, while altcoin funds like Bitwise’s XRP gained $105M, reflecting shifting investor preferences amid liquidity concerns. - Analysts attribute the selloff to macroeconomic uncertainty and delayed Fed rate cu

Dogecoin News Today: Grayscale DOGE ETF Debut May Trigger a Wave of Institutional Interest This November

- Grayscale's DOGE ETF launches Nov 24, aiming to boost institutional adoption of the meme coin amid SEC approval. - BlockDAG's $436M+ presale outpaces ADA/BCH, leveraging hybrid PoW-DAG tech and 3.5M miners to attract 312K holders. - Ethereum faces $2,850 support pressure after FG Nexus sells 11,000 ETH, triggering $170M in 24-hour liquidations. - DOGE hovers near $0.15 support with mixed technical signals, while ETF optimism contrasts with ongoing distribution trends.