How the Synthetix Trading Competition Became a Lesson in Contract Risk Education

Author: Eric, Foresight News

Original Title: Synthetix Held a Perpetual Contract Trading Competition, but the Effect Was Surprisingly Discouraging...

The "DeFi veteran" Synthetix, which returned from OP Mainnet to Ethereum mainnet, launched a perpetual contract trading competition exactly one month ago today. This DeFi protocol, which launched on Ethereum as early as 2018, has come full circle and returned to the mainnet. After exploring stablecoins and synthetic assets, it has now chosen to focus on order book perp DEX.

However, as Synthetix itself said, they do have quite a bit of experience with perp DEX, having operated on OP Mainnet for two or three years. But as they themselves admitted, these years were somewhat wasted, and this return to Ethereum mainnet is, in a sense, a fresh start.

But that's not the main point. The key is that to commemorate this new beginning and promote their new platform, Synthetix organized a perpetual contract trading competition. The competition ran from October 20 to November 20 local time, which just ended according to Beijing time.

Judging from the results, the outcome was disastrous. I don't know if the promotional effect was achieved, but in terms of discouraging people from trading perps, this competition was truly educational...

Do Nothing, Get 100,000 for Free

How disastrous was it? According to the Leaderboard provided by Synthetix, out of the 98 participants in this competition, only 12 didn't lose money, and two of those didn't make a single trade. 68 people lost more than 90%, and 27 were completely wiped out.

Let's briefly talk about the basic rules of this competition. Synthetix planned to invite 100 people to participate in the first season, with 50 people invited directly. The directly invited participants were well-known trading bloggers on X or senior executives from well-known industry companies, including James Wynn (who made 100 millions in 70 days and then lost it all), Wintermute CEO Evgeny Gaevoy, Synthetix founder Kain and Bodhi Ventures (founded by Kain and Jordan), as well as Chinese community figures like Feng Wuxiang and Zhuifeng Lab. Even zoomer, who specializes in reporting important Web3 news, joined in the fun.

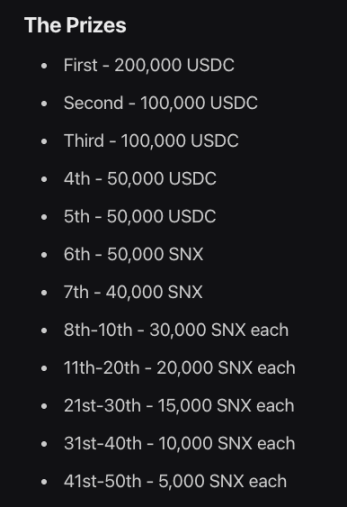

The other 50 spots were given to those who pre-deposited sUSD and sUSDe or held Kwenta points, resulting in a final participant count of 98. The prize structure was extremely unbalanced: first place received $1 million, while second to tenth place only received up to 25,000 SNX (worth about $15,000 at the end of the competition) and a Patrons NFT that entitles them to an Infinex token airdrop.

Each participant started with a margin of 50,000 USDT, and on November 5, another 50,000 USDT was added for each contestant. In addition, starting November 1, Synthetix allowed the community to vote to airdrop 10,000 USDT to one contestant whose margin fell below 1,000 USDT. Of course, this USDT could only be used on the platform and could not be withdrawn.

As for leverage, there were basically no restrictions, and the trading pairs focused on selected popular markets, including BTC, ETH, XRP, BNB, SOL, DOGE, SUI, and ENA, among other mainstream crypto assets. With such rules, most participants had only one goal: to win first place.

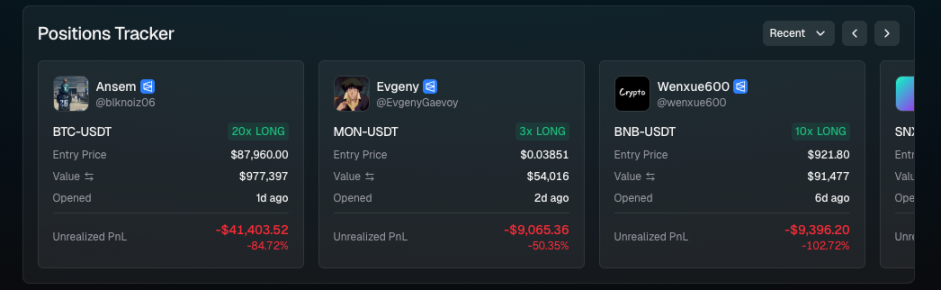

While many participants were cautiously testing the waters in the early stages, Feng Wuxiang surged ahead by using high leverage to go long, gaining what seemed like an insurmountable lead.

But the ending... After 132 trades totaling over $70 millions, Feng Wuxiang was liquidated a few days ago when Bitcoin fell below 90,000. This is truly the best example of "You can beat the market 100 times, but the market only needs to beat you once." Feng Wuxiang himself also commented on X, saying that everyone in this competition was aiming for the championship, and without high leverage, it was hard to achieve a high ROI. However, he also reminded that in real trading, one should choose low leverage and hedge properly.

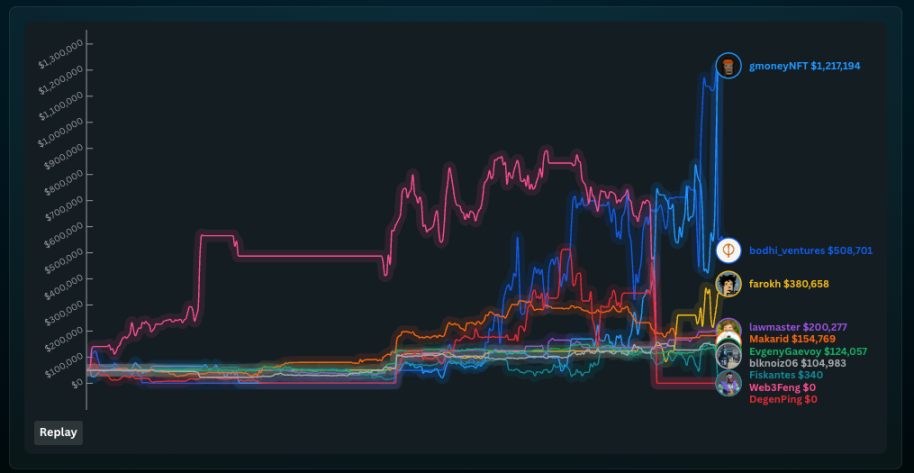

This competition was ultimately won by Gmoney, who has nearly 320,000 followers on X. Gmoney's "claim to fame" was buying CryptoPunk #8219 for 140 ETH (about $176,000 at the time) in January 2021, setting a record high price. This NFT is still his X profile picture.

In fact, until last night, the leader was still Bodhi Ventures, led by Synthetix insiders, with a lead of several hundred thousand dollars. But the "former champion's" long strategy and Gmoney's short strategy swapped their rankings in another round of market moves last night, making this timely drop a decisive blow before the competition ended.

In the end, the top ten were the only ones who stayed above water, and our old friend James almost made it into the top ten without doing anything. In the Polymarket prediction market for who would win the competition, out of 59 listed contestants, 6 made a profit, 2 didn't trade, and among the remaining 51, only 1 lost less than 20%, and only 11 lost less than 90%.

The top ten turned $1 million in principal into $2.184 million, with the champion alone earning $1.117 million. According to the rules, the total amount of demo funds Synthetix distributed this time should have been 10 millions USDT, but in the end, only $4,020,154 was left by these 98 people, with a total loss of nearly $6 millions. If this had been real money, Synthetix would probably be heartbroken. And if you, the reader, had acted as the counterparty to all the contestants throughout the competition and had enough capital, you could have made $6 millions in a month—just thinking about it is exciting.

Perhaps, as Feng Wuxiang said, the fight for the sole championship made everyone go crazy, and frequent high-leverage operations caused many to lose everything even after the additional 50,000 USDT margin was added. For such results, I feel the educational value in teaching people to avoid gambling far outweighs the platform's promotional value. Most of these so-called "top" traders, carefully selected, ended up nearly wiped out—let alone ordinary people.

Looking back at this competition from a god's-eye view, the start coincided with the beginning of a sustained market decline. Although there was some rebound at first, it almost immediately continued downward. During the competition, Bitcoin's price dropped 30% from its highest to lowest point. It's not hard to guess that those who were wiped out or nearly wiped out were stubbornly going long.

Human greed and obsession know no race, gender, or age. Readers, please remember: what you saw in this competition in others is exactly yourself.

Second Season "Discouragement Competition" Starts Next Month

After the first season ended, the second season of this "discouragement competition" will start on December 1. The total number of participants will be expanded to 1,000, consisting of 200 top traders and 800 community members. Directly invited participants need to share their views on the competition on X as a ticket, while community participants will be selected from the top 800 users who pre-deposit sUSD with Synthetix, with a minimum deposit of 10,000 sUSD.

Perhaps learning from the wild results of the first season, the prize distribution in the second season is much more balanced.

If you want to challenge yourself, you can use the "fun tokens" provided by the organizers to give it a try. If the brutal outcome of the first round was due to the prize distribution, then we have reason to look forward to the results of the second season—to see whether it was the lure of the grand prize that triggered greed, or if human nature is just like this.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hydration will soon launch perpetual contracts and will launch the Rains APP in Q2 2026!

WLFI reserve firm ALT5 Sigma to be investigated for violating SEC disclosure requirements.

One In Three Young Investors Moves To Crypto-Friendly Advisors