Mining Bitcoin : The United States Suspect Bitmain of Espionage

The Chinese giant Bitmain, world leader in ASIC chips for Bitcoin mining, is the subject of a federal investigation in the United States. Suspected of posing national security risks, this case could disrupt the BTC mining ecosystem and Sino-American relations.

In Brief

- Bitmain, Chinese leader in Bitcoin mining chips, is under American investigation for risks of espionage and sabotage.

- Bitmain denies any wrongdoing and claims to comply with American laws, but its equipment could threaten national security.

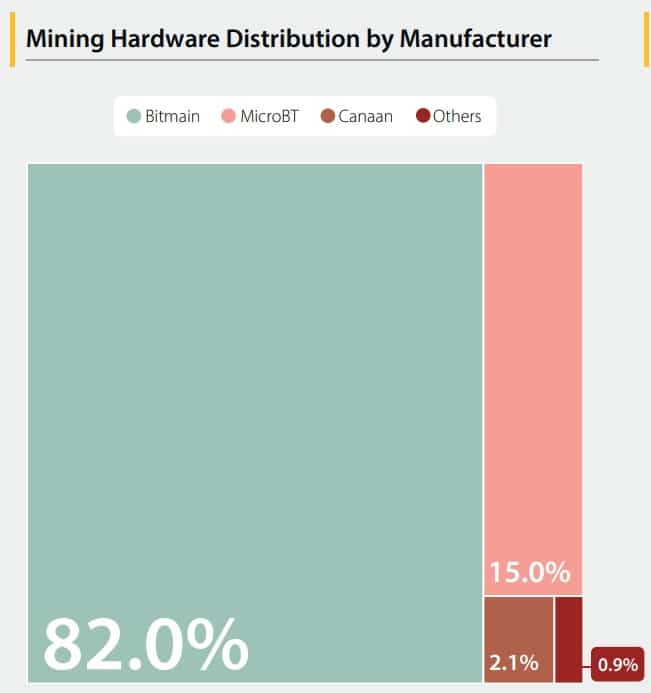

- A restriction on Chinese ASICs would have major repercussions on the mining market, dominated 97% by Bitmain and MicroBT.

Bitmain: an American Investigation for National Security Risks

American authorities, through the Department of Homeland Security, launched an investigation called “Operation Red Sunset” to assess whether Bitmain’s machines could be remotely exploited. Indeed, anonymous officials fear that its Bitcoin mining equipment could be used for espionage or sabotage purposes, notably on the power grid.

Bitmain reacted by categorically denying any remote control capability, affirming strict compliance with American laws and ignorance of the investigation’s existence. This situation takes place in a tense context where in November 2024, U.S. customs had blocked shipments of thousands of Bitmain ASICs before releasing them in March 2025.

Mining Bitcoin: Bitmain and MicroBT Control 97% of the ASIC Market

With more than 80% market share, Bitmain dominates the ASIC chip industry! A sector where Chinese manufacturers, including MicroBT, control 97% of global sales. This hegemony poses a major challenge for American bitcoin mining companies, heavily dependent on these technologies.

American Bitcoin, a company supported by members of the Trump family, illustrates this dependence. In 2025, it acquired 16,000 Bitmain machines, benefiting from “unusually generous” financing conditions, according to The Guardian. These machines, essential for the expansion of its operations, highlight the economic stakes of this investigation.

A restriction on Chinese ASICs could thus paralyze part of the American industry, already weakened by trade tensions between Washington and Beijing.

Will Bitcoin Mining Survive in the United States Without Bitmain?

If the investigation into the security risks of ASICs produced by Bitmain results in a suspension of activities on American soil, the bitcoin mining industry will face an existential challenge. With 97% of the ASIC market controlled by Chinese companies, alternatives are rare and costly. American miners could turn to emerging manufacturers, such as those based in South Korea. However, they struggle to compete in terms of performance and cost.

Some actors, like American Bitcoin, have already anticipated this risk by securing privileged supply agreements. However, for the majority of miners, a Bitmain ban would mean higher operational costs and reduced competitiveness against less affected foreign competitors.

In this scenario, bitcoin mining in the United States could refocus on regions where energy is abundant and cheap, such as Texas, while exploring alternative technologies.

The investigation into Bitmain reveals the tensions between technological innovation, national security, and geopolitical rivalries. While bitcoin mining relies heavily on Chinese equipment, upcoming American decisions could have a lasting impact on the industry. What is your opinion on reconciling technological sovereignty and dependence on foreign players in blockchain ?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Ethereum ETFs Recover as Investors Weigh Immediate Fluctuations Against Future Improvements

- Ethereum spot ETFs recorded a $55.7M net inflow, led by FETH's 60% share, reflecting institutional confidence in post-upgrade fundamentals. - ETH/BTC ratio hit 0.052 (7-month low) as Bitcoin dominance rose to 53.2%, with Ethereum trading below key EMAs amid bearish technical indicators. - Upcoming Dencun upgrade (EIP-4844) and $7.4B+ real-world asset tokenization drive long-term optimism despite short-term volatility and higher ETF fees. - Staking infrastructure grows (Lido's 8.95M ETH, MAVAN network) wh

Bitcoin Updates: The Crypto Market Splits—Bitcoin ETFs See Outflows While Altcoin Enthusiasts Seek Returns and New Developments

- Bitcoin ETFs lost $3B in November, with BlackRock’s IBIT seeing $523M outflow as prices fell below $90K. - Bitwise’s Solana and XRP ETFs gained $580M and $420M inflows, offering staking rewards and cross-border payment exposure. - Institutional investors repositioned capital, shorting 53% of Bitcoin while Ethereum retained 55% long positions. - Analysts highlight altcoin ETFs’ yield advantages, but warn of Bitcoin’s liquidity risks and XRP’s weak derivatives market. - Market divergence reflects crypto-na

LUNA Falls 1.68% Over the Past Day as It Suffers an 83.05% Yearly Decline

- LUNA fell 1.68% in 24 hours, with 83.05% annual decline and 24.73% monthly losses. - Prolonged bearish momentum and lack of positive catalysts intensify selling pressure on the token. - Analysts warn of continued underperformance without structural improvements or macroeconomic shifts.

Objective Metrics Signal More Upside Ahead: 5 Best Altcoins Traders Are Watching Closely