Bitcoin Drops 1.11% as Multi-Chain Growth Accelerates and New Regulatory Measures Emerge

- Bitcoin .ℏ integrates Hashport for cross-chain transfers, boosting liquidity and DeFi accessibility across Ethereum , Polygon, and BNB Chain. - U.S. proposes "Bitcoin for America Act" to allow tax payments in BTC, eliminating capital gains tax and positioning crypto as strategic national asset. - BTC price drops 1.11% amid $3.79B ETF outflows, with technical indicators like death cross signaling extended bearish momentum. - Whale activity shows leveraged long positions at $84,400, contrasting short-term

Bitcoin Enhances Cross-Chain Reach Through Hashport Collaboration

Bitcoin.ℏ (BTC.ℏ) has revealed a significant partnership with Hashport, a leading interoperability platform, to facilitate effortless cross-chain operations. This alliance enables

Pursuing Global Digital Value Without Borders

This alliance mirrors the industry’s broader shift toward interoperability, connecting previously siloed blockchains. For BTC.ℏ, which prioritizes sustainability and microtransactions, this integration shifts it from a single-chain token to a globally usable digital asset. Developers on various networks can now incorporate BTC.ℏ into their applications, broadening its utility beyond

Regulatory Update: U.S. Considers Bitcoin for Tax Payments

In a noteworthy policy shift, the U.S. House has introduced the “Bitcoin for America Act,” which would permit citizens to pay federal taxes using Bitcoin. The bill connects tax payments directly to the Strategic Bitcoin Reserve, established by President Trump in 2025. By removing capital gains tax on BTC payments, the legislation aims to simplify crypto tax rules and encourage wider adoption. Supporters believe this move positions Bitcoin as a vital national asset, providing a hedge against inflation and long-term economic advantages. This initiative underscores Bitcoin’s expanding role beyond investment, indicating its deeper integration into government functions.

Institutional and Market Sentiment at Odds

Despite these positive changes, Bitcoin’s value continues to fall. As of November 22, 2025, BTC declined by 1.11% in 24 hours to $84,016.77, with an 8.71% drop over the past week and a 23.2% decrease for the month. A key factor in this downturn is the record withdrawals from U.S. spot Bitcoin ETFs. BlackRock’s IBIT ETF alone saw $355.5 million in net outflows on November 21, according to Farside Investors. Total ETF outflows reached $3.79 billion in November, the highest ever, highlighting institutional caution amid economic uncertainty and volatile markets.

Technical Analysis Points to Bearish Trend

Large Holders and Institutional Moves

Blockchain data also highlights notable activity from major investors. A new whale deposited 1.7 million

Summary: A Defining Period for Bitcoin

Bitcoin’s latest developments illustrate a complex mix of technological progress, regulatory changes, and shifting market sentiment. The Hashport integration and the proposed U.S. tax legislation both reflect increasing institutional and strategic interest in Bitcoin. However, these advancements must be balanced against the prevailing bearish market trend. As the cryptocurrency sector evolves, the adaptability and scalability of projects like BTC.ℏ will be crucial for future success. For now, Bitcoin’s price direction remains uncertain, with technical and on-chain data indicating a potentially prolonged bearish phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

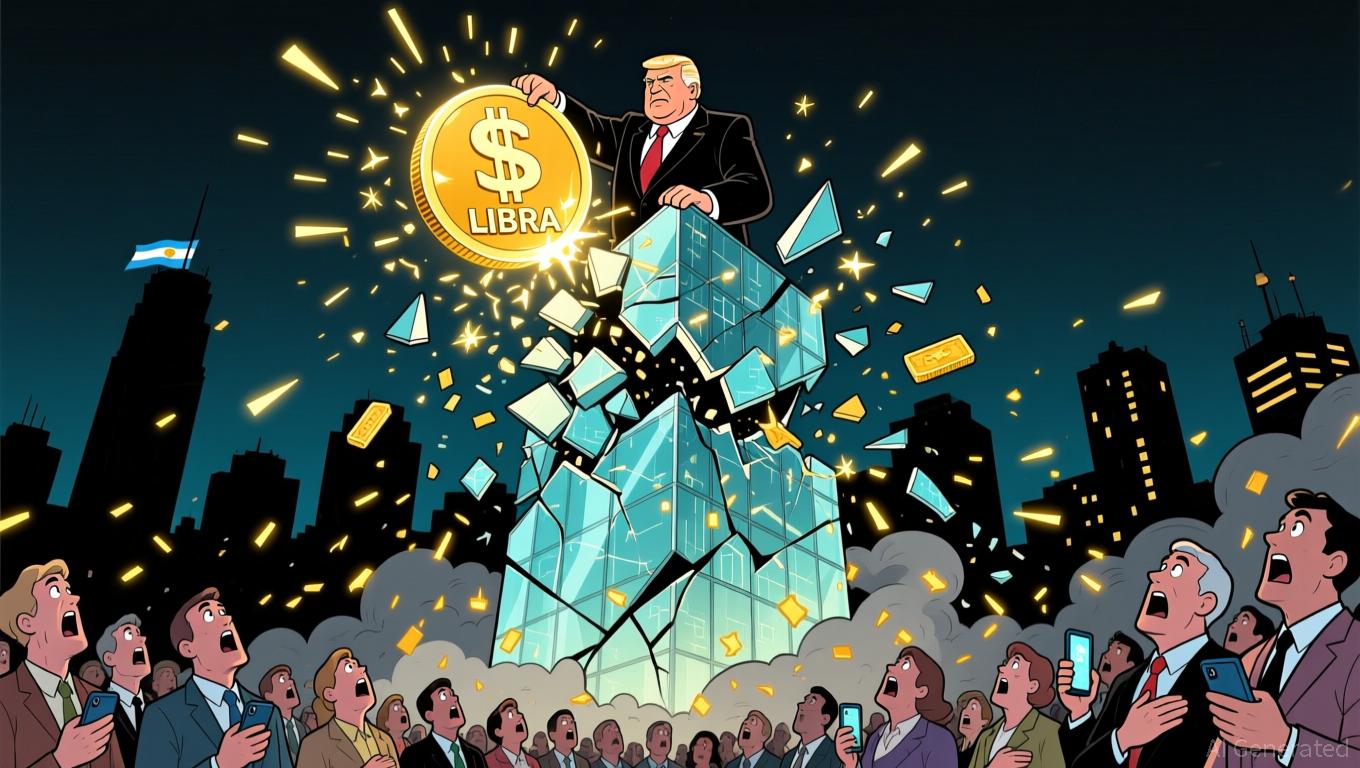

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate

Bitcoin Updates: U.S. Crypto Mining Companies Face Espionage Concerns and Growth Challenges During Bitmain Investigation

- U.S. authorities investigate Bitmain's ASICs for potential espionage risks, impacting miners reliant on its 80% market-dominant hardware . - American Bitcoin's Trump-linked purchase of 16,299 Bitmain miners raises conflict concerns amid strained U.S.-China supply chains. - Canaan Inc. reports record $30.6M Bitcoin mining revenue and 31% North American hardware sales growth despite industry challenges. - SOLAI pivots to infrastructure-as-a-service, earning $2.9M in data center fees as self-mining revenue

Fed's Split Between Doves and Hawks Fuels Crypto's Unsteady Surge

- NY Fed's John Williams hinted at potential December rate cut, sparking crypto market surge as traders priced in 60% cut probability. - Dallas Fed's Lorie Logan warned against premature cuts, highlighting FOMC divisions revealed in October meeting minutes. - BofA's Hartnett linked crypto's 35-45% declines to liquidity risks, noting $2.2B in record fund outflows as caution grows. - Former Fed adviser El-Erian cautioned against overreacting to dovish signals, citing delayed inflation data and hawkish resist

Solana News Today: Solana Faces Key Price Challenge: Can Strong Fundamentals Ignite a Bull Rally?

- Solana shows reversal signals via wallet growth and partnerships expanding real-world crypto utility. - Mastercard's Solflare debit card and 21shares' Solana ETF highlight institutional adoption amid 83% developer growth. - Latin American expansion through MiniPay's local payment integration boosts Solana's low-cost settlement appeal. - Price remains pressured near $125-$130 support, with mixed forecasts predicting 10-30% rebounds by 2025-2026. - Fear & Greed Index at 11 (Extreme Fear) contrasts RSI neut