Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Grayscale just secured the green light from the New York Stock Exchange to list two new ETFs tied to Dogecoin and XRP . Both products begin trading Monday, marking another step in the rapid expansion of crypto ETFs in the United States. Here’s what’s going on and why it matters.

What Exactly Did the NYSE Approve?

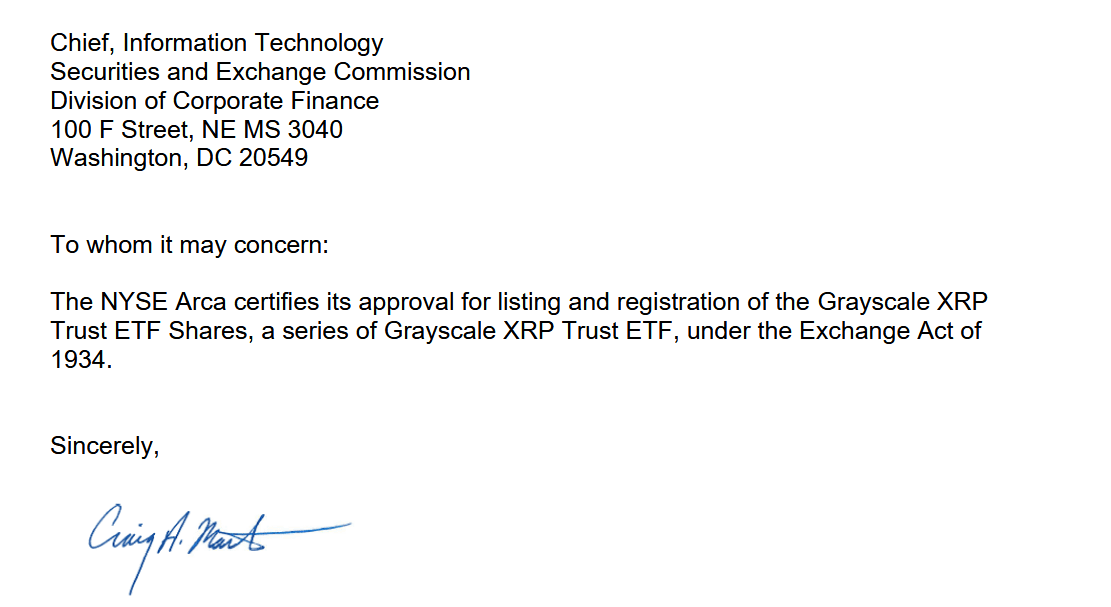

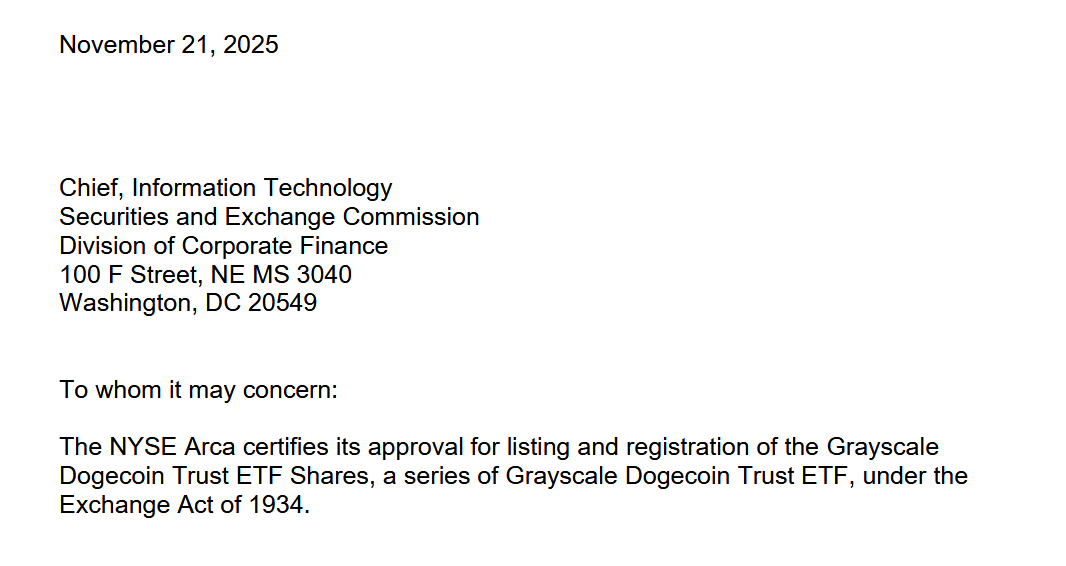

NYSE Arca certified the listing and registration of the Grayscale XRP Trust ETF Shares and the Grayscale Dogecoin Trust ETF Shares. This certification is the final administrative step that allows both products to debut on the open market.

These ETFs are not brand-new funds. They’re conversions of existing private-placement products that Grayscale has offered for years. Once they switch over into ETFs, they become easier to access for retail investors and institutions that prefer exchange-listed, regulated instruments.

Why These Two ETFs Are a Big Deal

Dogecoin isn’t just a meme coin anymore. It’s the original and largest memecoin by market value, with a community that behaves more like a movement than a fanbase. XRP, meanwhile, is one of the most established altcoins, sitting among the top assets by market cap and enjoying worldwide liquidity.

Adding both coins to Grayscale’s ETF lineup strengthens its already broad shelf, which includes bitcoin, Ethereum, Solana, and Dogecoin products. For the market, this signals something bigger: U.S. crypto ETFs are expanding beyond the usual majors and moving into a diversified multi-asset era.

Part of a Much Larger ETF Wave

These approvals didn’t happen in isolation. Over the past year, the U.S. has seen a consistent push toward altcoin-based ETFs. Litecoin, HBAR, SOL, and XRP ETFs have all appeared recently. Many of these launched during the government shutdown, when the SEC issued special guidance explaining how firms could go public without waiting for direct approval. The funds still had to meet strict listing standards, which the SEC signed off on in September.

That opened the door for Grayscale to move quickly with its own trust conversions.

Dogecoin ETF: Grayscale Joins a Small but Growing Club

Grayscale’s Dogecoin ETF will be only the second DOGE ETF to hit the U.S. market. The first was launched by REX Shares and Osprey Funds in September. Their DOGE product took a different regulatory route, listing under the Investment Company Act of 1940. That makes it more similar to an actively managed mutual fund structure, whereas Grayscale’s ETF conversion follows the traditional exchange-listed path.

The takeaway: the DOGE ETF space is small, experimental, and growing. Adding Grayscale’s scale and brand power could accelerate adoption.

Why Monday’s Launch Matters for Crypto Investors

Every time a new XRP ETF or any ETF goes live, liquidity deepens. Price discovery improves. More traditional capital flows into crypto without investors needing to self-custody or touch an exchange. With Dogecoin and XRP getting ETFs, two coins with massive communities and high global turnover suddenly get a new pipeline of institutional money.

This isn’t just another pair of products. It’s a sign that altcoin ETFs are steadily becoming a mainstream asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rising Incidents of Air Rage Spark Appeals for Polite Travel, While Detractors Highlight Deeper Systemic Issues

- U.S. Transportation Secretary Sean Duffy launched a campaign urging travelers to restore civility in air travel, citing a 400% rise in in-flight outbursts since 2019. - The initiative promotes courteous behavior, such as assisting passengers and showing gratitude to crew, amid FAA data showing 13,800 unruly incidents since 2021. - Critics blame airlines for cramped seating and poor service, arguing civility efforts should address systemic issues like overcrowding and pricing rather than passenger attire.

Bitcoin Updates: Investors Flee Bitcoin, Boosting Gold and Income-Producing Tokens

- Bitcoin faces record outflows and institutional skepticism as ETFs lose $3B in November, with BlackRock’s trust seeing its largest single-day redemption. - Gold surges 55% annually, outpacing Bitcoin’s flat performance, while Harvard reallocates $218M to gold ETFs and Harvard’s endowment shifts toward physical assets. - XRP Tundra attracts Bitcoin investors with yield-generating features like 20% APY Cryo Vaults, offering diversification through dual-token governance and Solana integration. - Market fear

PENGU's Price Decline: An Analysis of Small-Cap Cryptocurrency Fluctuations During Shifting Market Sentiment

- PENGU's 2025 price plunge reflects systemic risks in small-cap crypto, driven by Bitcoin/Ethereum collapses and liquidity crises. - DAT sector's 60%+ declines (e.g., MSTR) and $19B October crypto liquidation highlight cascading market pressures impacting PENGU. - Low-volume tokens like PENGU face amplified volatility due to lack of fundamentals, regulatory clarity, or institutional support. - Broader flight from speculative crypto assets underscores small-cap tokens' role as macroeconomic anxiety proxies

Is Strategy Stock the Preferred Hedge Against Crypto Losses? Tom Lee Thinks So