XRP Whale Selling Hits $480 Million In 48 Hours As Price Falls Below $2

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders. This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook. XRP Whales Switch Their Stance Whales

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders.

This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook.

XRP Whales Switch Their Stance

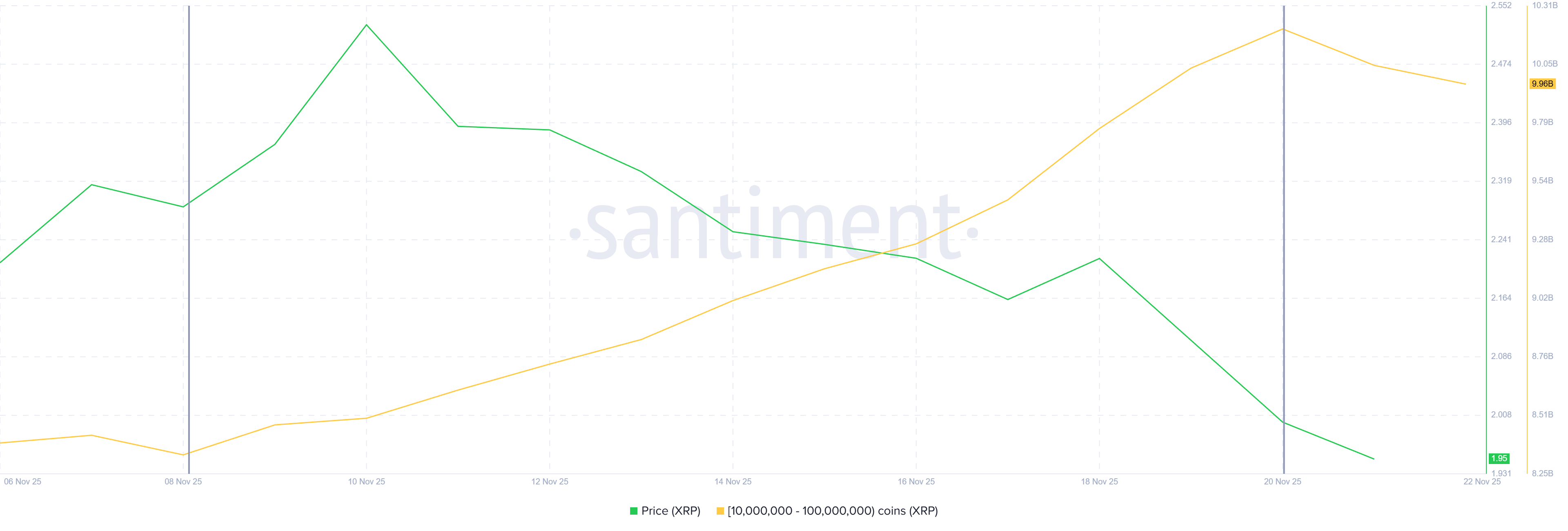

Whales have moved decisively from accumulation to heavy selling. Addresses holding between 10 million and 100 million XRP have dumped more than 250 million tokens in the past 48 hours alone, worth over $480 million.

This selling wave follows more than 20 consecutive days of accumulation by the same group of holders.

Such an abrupt shift signals a loss of conviction among large investors who had previously supported XRP’s rise. Their exit removes a crucial source of market strength and may prolong XRP’s decline. Without renewed confidence from whales, recovery momentum could weaken further and keep prices under pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source:

Santiment

XRP Whale Holding. Source:

Santiment

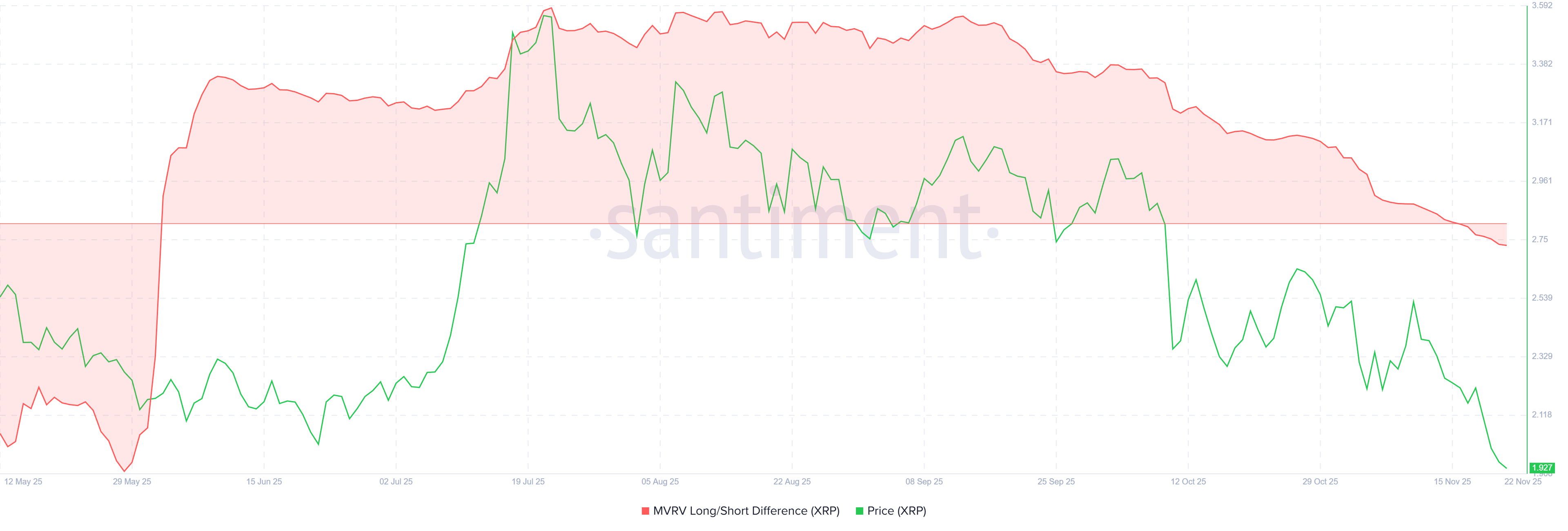

Macro indicators also highlight growing fragility. The MVRV Long/Short Difference has slipped below zero for the first time in five months, indicating that long-term holders have lost profitability. This shift pushes profit opportunity toward short-term holders, who tend to sell quickly once prices rise.

If XRP’s price rebounds even modestly, short-term holders may capitalize on their gains by selling, which could suppress upward movement. This dynamic often keeps volatility elevated and limits breakout potential.

XRP MVRV Long/Short Difference. Source:

Santiment

XRP MVRV Long/Short Difference. Source:

Santiment

XRP Price May Need Support

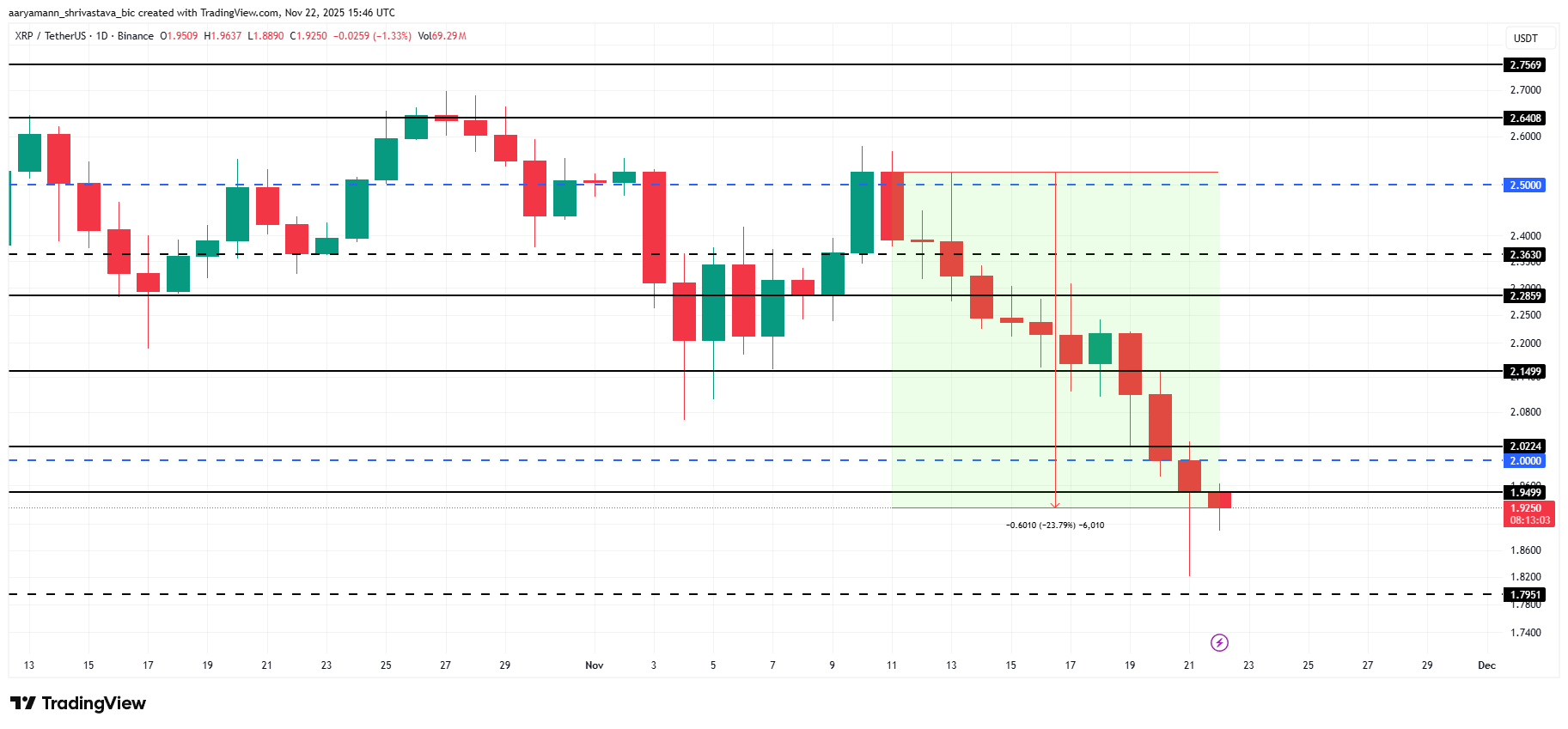

XRP has fallen 23% over the past 11 days and trades at $1.92, sitting just under the $1.94 resistance level. The drop below $2.00 marks a significant psychological break and reinforces the current bearish sentiment across the market.

If whale selling accelerates and macro indicators worsen, XRP could fall further toward $1.79 or even lower. Such a move would deepen losses and extend the current downtrend as market sentiment weakens.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if investor support stabilizes or broader market conditions improve, XRP may be able to reclaim $2.00 as support.

A successful recovery could lift the price toward $2.14 and higher, helping reverse recent losses and invalidating the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea Implements Comprehensive Crypto AML Enforcement: Exchanges Subject to Standardized Sanctions

- South Korea's FIU is imposing uniform penalties on major crypto exchanges like Upbit and Bithumb for AML/KYC violations, starting with a 35.2 billion won fine on Dunamu. - A "first-in, first-out" enforcement timeline extends into 2026, with Korbit and GOPAX facing imminent sanctions while Bithumb's case delays due to order book inspections. - The crackdown reflects South Korea's global regulatory leadership, aligning with stricter AML compliance and a delayed 2027 crypto tax regime that heightens market

XRP News Today: XRP Faces a Pivotal Moment—ETF Excitement Clashes with Technical Skepticism

- XRP's price debate intensifies as spot ETFs attract $410M inflows but fail to push the token above $100, with analysts divided on their long-term impact. - Prominent analyst Moon argues $10+ targets require more than ETF demand, contrasting bullish claims about XRP's utility-driven $1,000 potential. - Ripple's $500M Swell 2025 funding and 11 approved XRP ETFs signal institutional confidence, though historical post-Swell declines persist. - Technical indicators show mixed signals: $2 support retests and p

Bitcoin News Update: Major Whale Places $87 Million 3x Leveraged Bet Opposing BTC Surge Amid Divided Market

- A Hyperliquid whale opened a $87.58M 3x BTC short, contrasting with bullish market trends and other traders' strategies. - Another 20x $131M short faces liquidation risk if BTC surpasses $111,770, while $343.89M in 24-hour liquidations highlight short-position vulnerability. - Technical indicators (RSI 66, 15/1 buy/sell signals) and institutional BTC purchases support upward momentum despite liquidity risks on Hyperliquid. - Diverging whale strategies and macro factors like Fed policy underscore crypto's

Ethereum News Update: Major Institutions View Ethereum as a Key Asset, Outpacing ETF Investments

- 68 publicly traded firms now hold 12.7 million ETH, surpassing all Ethereum spot ETFs' 11.3 million holdings as of July 2024. - Firms like Coinbase and Gemini lead corporate accumulation, while banks like Fidelity expand crypto custody services for institutional clients. - Analysts cite regulatory clarity and improved risk frameworks as drivers, with 72% of institutional investors boosting crypto allocations in 2024. - Critics warn of market manipulation risks as corporate holdings now control 54% of ins